Dividend Kings are elite companies that have paid and raised their dividends for at least 50 consecutive years. As of May 21, 2024, there were just 53 qualified Dividend Kings. But that list could grow considerably by 2040 as companies that have increased their dividends consistently since the 1980s and early 1990s look to continue their streaks.

Caterpillar (NYSE: CAT), Chevron (NYSE: CVX), and ExxonMobil (NYSE: XOM) are three industry-leading behemoths that reward their shareholders with a blend of dividends, buybacks, and earnings growth. Here’s why all three dividend stocks are worth buying now.

Caterpillar’s earnings will fluctuate, but its dividend looks set for ongoing growth

Lee Samaha (Caterpillar): The construction, mining, and transportation equipment company has a proud record of paying dividends to its investors since 1933 and has raised its dividend for the last 30 years. Moreover, plenty of evidence suggests it can continue to do so for many years to come. For example, back at its investor day presentation in 2022, management set a target for free cash flow (FCF) of $4 billion to $8 billion through the cycle, only to raise it to $5 billion to $10 billion in early 2024.

Caterpillar’s management gives these ranges in recognition of its cyclical business. Its core end markets, like construction and transportation, fluctuate with the economy at large, and its mining machinery end market depends on capital spending conditions in the mining sector, which in turn is led by commodity prices.

While Caterpillar’s revenue, earnings, and cash flow are volatile, it’s important to note that the low point of the FCF range, $5 billion, easily covers the current dividend payout of some $2.6 billion.

In addition, Caterpillar continues to expand its less cyclical and higher-margin services revenue — on track to grow from $14 billion in 2016 to $28 billion in 2026. That’s one reason its margins are expanding, and the company is also doing a great job of delivering high-value products that are commanding pricing power, even in weak end markets.

The dividend cover and services growth are two things. Still, Caterpillar has long-term growth prospects from its machinery’s role in helping infrastructure development and mining metals crucial to the energy transition, including copper and lithium. As such, it looks likely that Caterpillar will join the elite group of Dividend Kings over time.

Set your calendars for Chevron’s coronation to occur in 2037

Scott Levine (Chevron): Consistent with falling energy prices — a common phenomenon for oil and gas stocks — Chevron stock hasn’t fared well in 2024. While the price of common oil benchmark West Texas Intermediate has fallen 1.1% in 2024, Chevron stock has moved nearly identically, dipping 1.2%.

Disconcerting as this may seem, enduring the stock’s declines that occur in step with sliding energy prices is table stakes for counting oneself as an energy investor. With shares now trading at 7.3 times operating cash flow, a discount to their five-year average cash-flow multiple of 8.3, now’s a great time for patient investors to gas up on Chevron stock and its 4.4% high-yield dividend.

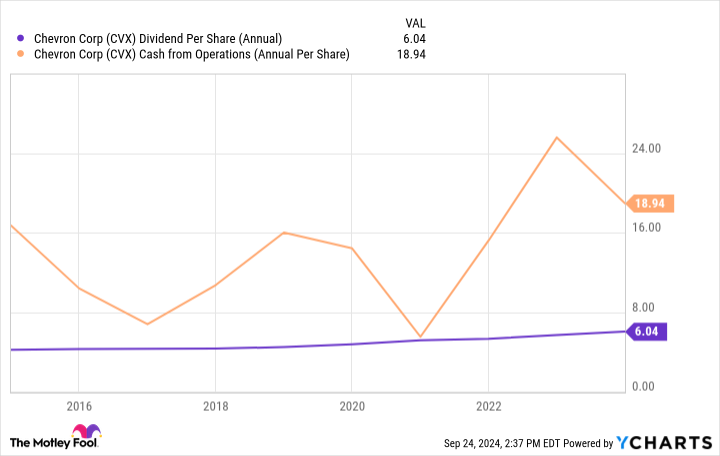

For 37 consecutive years, Chevron stock has hiked its dividend, illustrating just one reason why it’s one of the premier energy stocks for those looking to procure prodigious passive income. The company’s dividend increases are far from nominal. Over the past 10 years, Chevron has boosted its dividend at a 4.1% compound annual growth rate.

And it’s not as if management has put a tremendous financial strain on the company in order to placate shareholders. For the past decade, Chevron has generated ample operational cash flow from which it has been able to fuel its dividend payments.

Operating robust assets through all links of the energy value chain, Chevron is well positioned to continue generating strong free cash flow in the coming years — especially when its acquisition of Hess is completed.

In light of Chevron stock’s five-year average operating cash flow multiple of 8.3, the fact that it’s changing hands at 7.3 times operating cash flow today makes the oil supermajor’s stock look especially appealing.

ExxonMobil’s plan to support future dividend raises

Daniel Foelber (ExxonMobil): After raising its dividend in late 2023, ExxonMobil is on track for its 42nd consecutive year of higher dividends by year end 2024. If it keeps it up, ExxonMobil will become a Dividend King by 2032 — an impressive accomplishment given the volatility of the oil and gas industry.

Between 2013 and 2023, ExxonMobil grew its dividend by just 36.3% compared to 132.1% growth from 2003 to 2013 — so the pace of increases has noticeably slowed. However, ExxonMobil is taking action to ensure it can grow its business even in a low-carbon future.

According to its corporate plan, the company aims to increase annual earnings and cash flow by $14 billion from year end 2023 through 2027, thanks to structural cost savings, reinvestments in the core business, and low-carbon efforts. Higher cash flow supports dividend growth. But the look and feel of those cash flows is changing, as ExxonMobil expects its Low Carbon Solutions division to generate 15% returns from a portfolio of lithium, hydrogen, biofuels, and carbon capture and storage projects.

As for its oil and gas portfolio, ExxonMobil continues to bet big on the Permian Basin in west Texas and eastern New Mexico. Its acquisition of Pioneer Natural Resources, which was completed in May, boosted its production in the shale play. ExxonMobil’s upstream production was 3.78 million barrels per day (bpd) in first quarter 2024 and then jumped to 4.36 million bpd by second quarter 2024 as a result of the acquisition. However, its corporate plan calls for just 4.2 million bpd of production by 2027.

Investors should watch to see how ExxonMobil manages its production and if it chooses to sell off less appealing assets to make room for further development offshore in Guyana and the Permian. Ideally, ExxonMobil would be able to grow free cash flow from a variety of oil and gas and low-carbon assets. Further carbon capture and storage innovation could help justify production increases and offset emissions so ExxonMobil stays on track toward hitting its sustainability targets.

ExxonMobil’s payout ratio sits at just 45.7% — indicating it can easily afford its dividend based on trailing earnings. Earnings could come down if oil prices continue to tumble. But overall, ExxonMobil stands out as a balanced energy stock that can power a passive income portfolio with its 3.3% yield.

Should you invest $1,000 in Caterpillar right now?

Before you buy stock in Caterpillar, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Caterpillar wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $744,197!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Daniel Foelber has positions in Caterpillar. Lee Samaha has no position in any of the stocks mentioned. Scott Levine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron. The Motley Fool has a disclosure policy.

3 Stocks to Buy Now That Are on Their Way to Being Crowned Dividend Kings by 2045 (or Sooner) was originally published by The Motley Fool