With the S&P 500 and Nasdaq Composite up over 20% year to date, investors may be feeling like the stock market is overvalued. And while certain pockets of the market are more expensive than in past years, that doesn’t mean there aren’t opportunities if you know where to look. In fact, now is the perfect time to filter out the noise, zoom out, and focus on companies you would be comfortable holding for decades to come.

Here’s why Visa (NYSE: V), Kinder Morgan (NYSE: KMI), and PPG Industries (NYSE: PPG) stand out as worthwhile dividend stocks to buy in October.

The recent sell-off in Visa stock is a buying opportunity

Daniel Foelber (Visa): After hitting an all-time high in mid-September, Visa has been under pressure from the U.S. Department of Justice for monopolizing debit markets. The DOJ filed a civil antitrust lawsuit against Visa, citing that “more than 60% of debit transactions in the United States run on Visa’s debit network, allowing it to charge over $7 billion in fees each year for processing those transactions.”

Although civil lawsuits are nothing to brush off completely, it’s worth understanding that they don’t always significantly impact a company’s value. In March, the DOJ sued Apple and the stock proceeded to suffer a 4.8% decline, its largest in seven months at the time. Since then, Apple is up around 40%, has reached a new all-time high, and is now — once again — the most valuable company in the world.

Visa’s fee structure for credit and debit cards is based on the volume of transactions and the amount per transaction. This business model has allowed Visa to steadily grow its business even during challenging periods, such as high inflation and pressure on consumer spending.

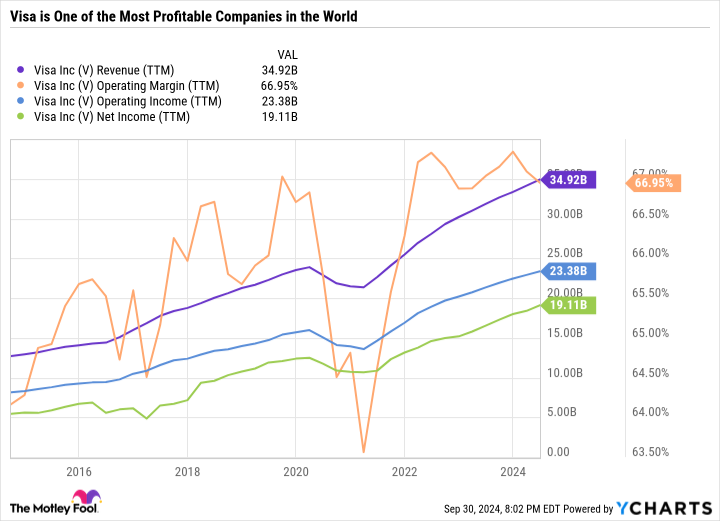

If there is one metric that explains why Visa has grown to become one of the most valuable financial companies in the world (with a market cap of over $535 billion), it’s the company’s operating margin. Visa sports a staggering 67% operating margin, meaning two-thirds of every dollar it earns in sales is converted to operating income. The following chart showcases Visa’s incredible profitability — with the company converting 55% of every dollar in sales into net income.

Visa’s global reach has pressured merchants to accept its cards even if it means they pocket less money per transaction. The company’s network effects have allowed its expansion to be virtually unstoppable. However, Visa’s profitability is heavily dependent on its fee structure.

Visa’s margins are so high that they could come down, and the stock would still be a great value. Visa has a forward price-to-earnings ratio of just 27.7 — which is reasonable for a reliable dividend-growth stock. Over the last five years, it has increased its dividend by 73.3% and reduced its outstanding share count by 11.1% thanks to stock repurchases. Even after returning capital to shareholders through dividends and buybacks, Visa still has plenty of dry powder left over to reinvest in the business.

Visa may yield just 0.8%, but the low yield is more due to its outperforming stock price than a lack of dividend raises. Add it all up, and Visa is a great buy now, even if its margins come down.

Kinder Morgan’s robust backlog suggests the company has plenty of growth ahead

Scott Levine (Kinder Morgan): A leading pipeline stock, Kinder Morgan has demonstrated a sincere commitment to returning capital to its investors, and the company will likely continue to do so in the years to come. Add to this the fact that the company has a robust backlog of projects to support future distribution raises, and it’s apparent that Kinder Morgan — along with its 5.6% forward-yielding dividend — is a great opportunity for investors to scoop up today.

If you’re in the U.S. and using natural gas, there’s a pretty good chance you have Kinder Morgan to thank. The company claims about 40% of the natural gas produced in the U.S. makes its way through its pipelines. In addition, it operates 139 terminals where renewable fuels, petroleum, and other products are stored. With these assets, the company often inks long-term contracts with customers. This provides management with excellent foresight into future cash flows, giving it clarity on how to plan for capital expenditures such as dividends and growth projects. For example, Kinder Morgan has a backlog of projects valued at $5.2 billion.

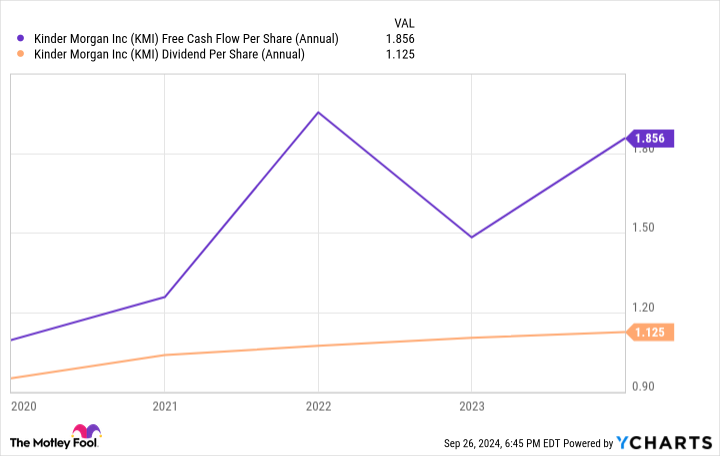

While the company is generous in returning capital to shareholders, management isn’t simultaneously jeopardizing its financial health. For instance, over the past five years, Kinder Morgan has generated ample free cash flow to cover the dividend.

Kinder Morgan’s stock may not seem like a screaming buy. It is valued at 8.9 times operating cash flow, which is a premium to its five-year average cash-flow multiple of 7.4. But for those who plan on holding the stock for decades to come, its slightly rich valuation should be less of a concern.

PPG has plenty of potential to improve its dividends in future years

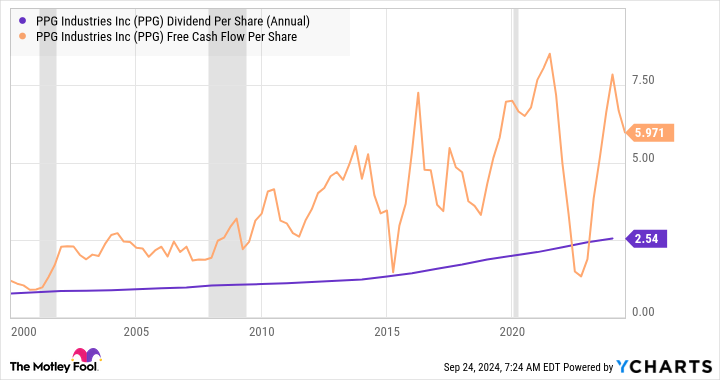

Lee Samaha (PPG Industries): Investing in the paint industry may seem as interesting as watching paint dry, but investors shouldn’t be too quick to dismiss it. It’s an industry characterized by a relatively high return on equity (RoE). PPG’s average RoE has been 22.7% over the last decade. As the chart below demonstrates, PPG has an excellent track record of generating the free cash flow per share necessary to cover its dividend payments easily.

Moreover, there’s reason to believe PPG can meaningfully improve its earnings, cash flow, and dividends in the coming years. For example, it has heavy exposure to interest rate-sensitive sectors such as architectural paints and automotive (original equipment manufacturing). They should improve in a lower interest rate environment. In addition, PPG is the leading player in the aerospace coatings market and stands to benefit from a multiyear ramp in airplane production and the growth of commercial air traffic.

PPG’s market position is solid as the second-largest global paint and coatings company operating in a consolidating industry. As long as there’s a need for physical products, there’ll be a need for coatings. As such, PPG is an excellent option for dividend investors.

Should you invest $1,000 in Visa right now?

Before you buy stock in Visa, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Visa wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $728,325!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Daniel Foelber has no position in any of the stocks mentioned. Lee Samaha has no position in any of the stocks mentioned. Scott Levine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Kinder Morgan, and Visa. The Motley Fool has a disclosure policy.

3 Top Dividend Stocks to Buy in October and Hold for Decades to Come was originally published by The Motley Fool