The U.S. stock market has shown remarkable resilience, with the S&P 500 and Nasdaq Composite wrapping up their best week of 2024 amid investor optimism about potential interest rate cuts by the Federal Reserve. As major indexes recover from early-September losses, analysts are identifying stocks that may be undervalued despite the broader market rally. In such a dynamic environment, finding undervalued stocks can offer significant opportunities for investors looking to capitalize on potential growth at attractive prices.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

|

Name |

Current Price |

Fair Value (Est) |

Discount (Est) |

|

Kaspi.kz (NasdaqGS:KSPI) |

$123.95 |

$241.40 |

48.7% |

|

Phibro Animal Health (NasdaqGM:PAHC) |

$21.99 |

$42.63 |

48.4% |

|

EQT (NYSE:EQT) |

$33.19 |

$65.85 |

49.6% |

|

Heartland Financial USA (NasdaqGS:HTLF) |

$56.59 |

$111.54 |

49.3% |

|

Progress Software (NasdaqGS:PRGS) |

$57.99 |

$114.81 |

49.5% |

|

ChromaDex (NasdaqCM:CDXC) |

$3.55 |

$7.10 |

50% |

|

EVERTEC (NYSE:EVTC) |

$33.38 |

$65.96 |

49.4% |

|

Vertex Pharmaceuticals (NasdaqGS:VRTX) |

$485.37 |

$961.23 |

49.5% |

|

Alnylam Pharmaceuticals (NasdaqGS:ALNY) |

$265.27 |

$514.78 |

48.5% |

|

Bilibili (NasdaqGS:BILI) |

$14.83 |

$28.74 |

48.4% |

Let’s uncover some gems from our specialized screener.

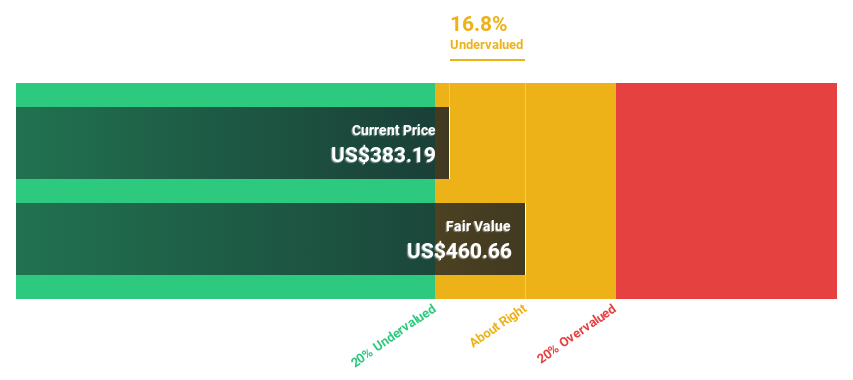

Overview: CrowdStrike Holdings, Inc. provides cybersecurity solutions in the United States and internationally, with a market cap of approximately $63.52 billion.

Operations: CrowdStrike’s revenue from Security Software & Services amounts to $3.52 billion.

Estimated Discount To Fair Value: 37.1%

CrowdStrike Holdings is trading at 37.1% below its estimated fair value of US$412.03, making it highly undervalued based on discounted cash flows. Despite recent legal issues and insider selling, the company has shown robust earnings growth, becoming profitable this year with a net income of US$47.01 million for Q2 2024 compared to US$8.47 million a year ago. Earnings are forecast to grow significantly faster than the market at 35.84% annually over the next three years, supported by strategic partnerships and product innovations like Falcon Go for SMBs and Falcon Complete Next-Gen MDR for enterprise security.

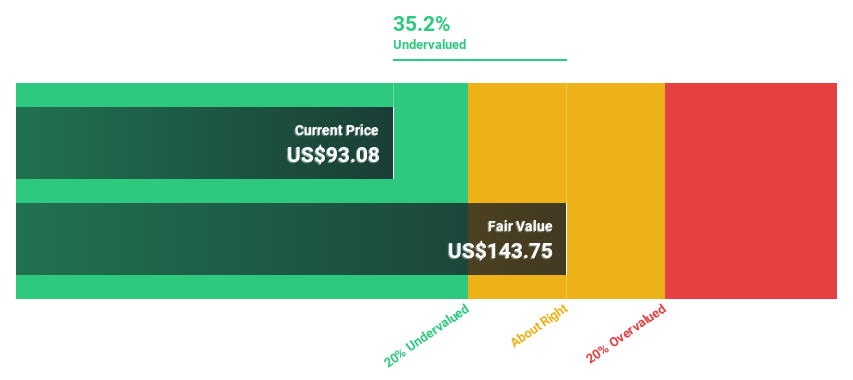

Overview: Micron Technology, Inc. designs, develops, manufactures, and sells memory and storage products worldwide with a market cap of approximately $101.15 billion.

Operations: Micron Technology’s revenue segments include the Mobile Business Unit ($5.69 billion), Storage Business Unit ($3.65 billion), Embedded Business Unit ($4.30 billion), and Compute and Networking Business Unit ($7.70 billion).

Estimated Discount To Fair Value: 33.8%

Micron Technology is trading at 33.8% below its estimated fair value of US$137.80, making it highly undervalued based on discounted cash flows. Recent product innovations, including the PCIe Gen6 SSD and G9 TLC NAND, underscore its leadership in AI and data center storage solutions. Despite a challenging past year, Micron’s revenue grew to US$17.36 billion for the first nine months of 2024 from US$11.53 billion a year ago, with earnings forecasted to grow significantly over the next three years.

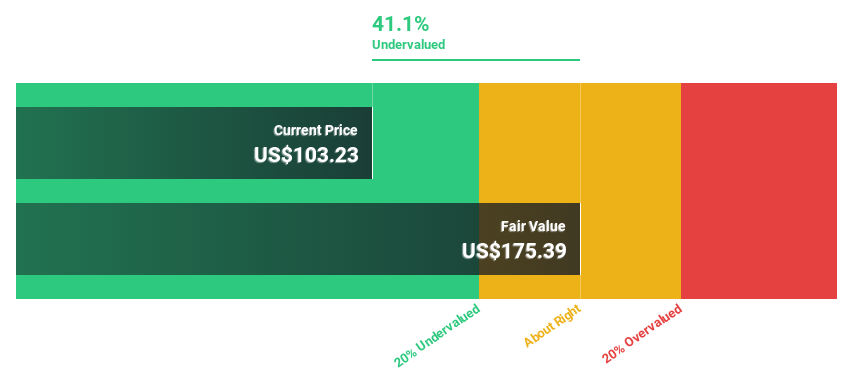

Overview: 3M Company offers diversified technology services both in the United States and globally, with a market cap of $73.16 billion.

Operations: The company’s revenue segments include Consumer ($4.94 billion), Safety and Industrial ($10.90 billion), and Transportation and Electronics ($8.51 billion).

Estimated Discount To Fair Value: 37.8%

3M is trading at US$133.18, significantly below its estimated fair value of US$214.18, indicating it is undervalued based on discounted cash flows. Despite a forecasted revenue decline of 5.6% per year over the next three years, earnings are projected to grow by 21.48% annually, outpacing the broader market’s growth rate of 15.3%. However, the company faces challenges such as high debt levels and large one-off items impacting financial results.

Next Steps

-

Discover the full array of 186 Undervalued US Stocks Based On Cash Flows right here.

-

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio’s performance.

-

Streamline your investment strategy with Simply Wall St’s app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:CRWD NasdaqGS:MU and NYSE:MMM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com