Opera (NASDAQ: OPRA) may not be a household name among technology investors. The company is a bit-part player in the global web browser, search engine, and advertising markets, which are dominated by the big players. But the stock’s recent action on the market following its latest quarterly report should warrant attention from investors looking to add a growth stock to their portfolios.

The company released second-quarter (ended June 30) 2024 results on Aug. 22. The stock shot up a remarkable 14% in a single session thanks to its better-than-expected numbers and improved full-year guidance. Let’s take a closer look at Opera’s quarterly results and why buying this tech stock looks like a no-brainer right now.

Opera’s solid results point toward improved monetization

Opera’s Q2 revenue increased 17% year over year to $109.7 million, besting the consensus estimate of $108.5 million. Additionally, the company enjoyed much stronger bottom-line growth as its earnings shot up 47% year over year to $0.22 per share, driven by an improvement in its margin profile. More specifically, Opera’s net income margin increased by 4 percentage points year over year to 18%.

The margin gains can be attributed to a 25% increase in Opera’s annualized average revenue per user (ARPU) to $1.46, which points toward better monetization of the company’s web browsers, as well as the strength in its advertising and search businesses. More specifically, Opera’s advertising revenue was up 20% from the same quarter last year to $64.6 million. Its search revenue, on the other hand, increased by 15% to $45 million.

The good part is that Opera has built a big user base that it can monetize and use to sustain healthy levels of growth in the long run. The company ended the previous quarter with 298 million monthly active users (MAUs). Of them, 78 million were using Opera’s browsers on personal computers (PCs) while the rest were on mobile.

Opera makes money from these users by offering ads on its browsers. Advertisers and brands can display ads on Opera’s browser homepage, and they can even opt to position their ads in the form of speed dials for which they need to pay a premium. So, the increase in the ARPU indicates that Opera is landing more high-value customers.

Meanwhile, the company is generating revenue from search through revenue-sharing agreements with brands. For example, if someone is looking to book hotels, Opera’s search bar will provide users with suggestions for booking sites, allowing it to generate revenue if users go to those sites through its recommendations.

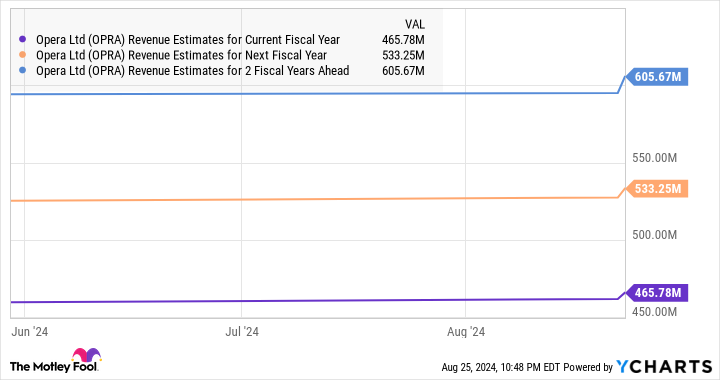

Considering that Opera has already built a huge user base, it is easy to see why the company is witnessing stronger spending on its platform by advertisers, thereby leading to an improvement in the ARPU and margins. As a result, the company has increased its full-year revenue forecast to a range of $464 million at the midpoint of its guidance, which would be a 17% increase over last year.

It was earlier anticipating a 16% increase in revenue when it released its first-quarter results in April. It is also worth noting that Opera’s original 2024 revenue guidance (issued in February this year) called for a 15% year-over-year increase in revenue, which means that the company has raised its guidance for two consecutive quarters.

A similar scenario could unfold in the future as well if it continues to drive greater monetization, which is probably why analysts have also raised their growth expectations.

A no-brainer reason to buy the stock

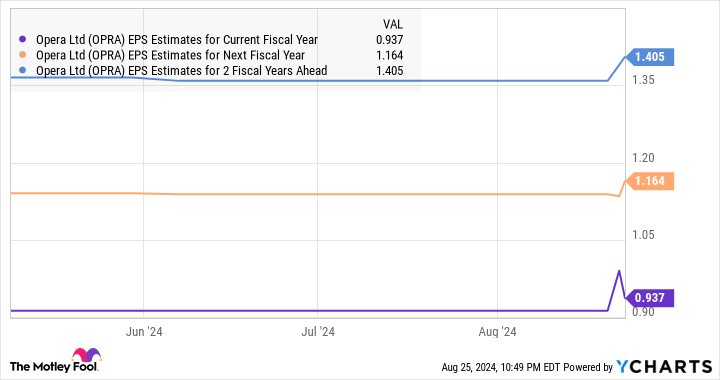

Opera’s revenue growth is expected to pick up in 2024 and beyond. This growth is set to filter down to the bottom line as well, which won’t be surprising considering the company’s margin improvements.

The chart above indicates that Opera’s earnings could increase at 20%-plus rates for the next couple of years. With Opera stock currently trading at 9 times trailing earnings, buying it looks like a no-brainer considering the healthy earnings growth it is likely to deliver.

So, investors looking to add a potential growth stock to their portfolios — especially one trading at an attractive valuation — would do well to buy Opera as its improving financial performance could be rewarded with more upside on the market. The stock carries a one-year median price target of $23 as per analysts covering it, which points toward 42% gains from current levels. It could indeed deliver such a solid upside.

Should you invest $1,000 in Opera right now?

Before you buy stock in Opera, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Opera wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $786,169!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

This Incredibly Cheap Tech Stock Is Skyrocketing, and It Is Likely to Soar Further was originally published by The Motley Fool