Throughout history, there has almost never been a bad time to buy shares of Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B). The company, led by legendary investor Warren Buffett, has simply been one of the best investments of all time.

However, now valued at nearly $1 trillion, Berkshire isn’t the same company it used to be. The future is still very bright, but there are other similar options investors should strongly consider. Even Buffett agrees with this. Over the past 12 months, he’s plowed billions of dollars into a company with a lot of similarities to Berkshire.

Buffett is betting billions on this insurance company

At the core of Berkshire’s empire is a portfolio of insurance companies. These businesses have been the foundation of Buffett’s investment strategy for decades. The value of operating an insurance company is that you regularly have investable cash available. That’s because insurance providers collect cash whenever a policy premium is paid, but they only have to pay out that cash when a claim is filed. In the interim, they get to keep the capital free of interest. Industry experts call these interest-free capital “float.”

Float is available to insurance companies regardless of economic or market conditions. It gives the owner of that float the ability to invest capital when it’s in scarce supply. In other words, it gives Buffett a huge capital advantage when prices fall and outside capital dries up. Suffice it to say that Buffett understands the insurance industry incredibly well, and it’s been key to Berkshire’s long-term success. It should come as no surprise, then, that Berkshire has been plowing billions into one of the largest, highest-quality insurance operators in the world: Chubb Ltd (NYSE: CB).

What makes Chubb better than Berkshire?

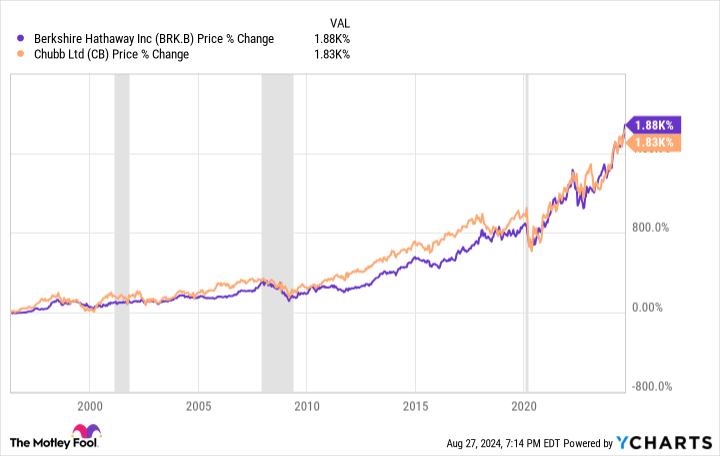

Over the long term, Chubb and Berkshire have posted very similar performances, although a recent surge in Berkshire’s value has pushed it over the top so far this year. Where Chubb truly shines, however, is during times of turmoil. From 2008 through 2009, for example — the worst years of the financial crisis — Chubb outperformed Berkshire by 12%.

It hasn’t been a perfect performance, however. Berkshire’s diversified business model allowed it to sail through the 2020 flash crash more easily. But over the last five years, Chubb has generated a beta of 0.67 versus Berkshire’s beta of 0.87. As a measurement of volatility, these numbers suggest that Chubb stock is likely a safer place to be if markets suddenly plunge.

Still, Berkshire and Chubb’s long-term performance and volatility are very similar, even if Chubb has proven a slightly superior option during bear markets. In reality, perhaps the best reason to buy Chubb over Berkshire right now is the valuation. Chubb stock trades at just 1.8 times book value, while the industry average for property and casualty insurers is above 2 times book value. The average return on equity for the industry is also around 10% — lower than Chubb’s latest result of 14.7%. The valuation becomes even more attractive when you consider Chubb is buying back huge sums of stock, an act that creates shareholder value but tends to depress accounting book value. More than $3 billion remains under its current share repurchase program.

Want proof that Chubb’s current valuation is too good to pass up? Right now, Berkshire’s cash hoard of $277 billion is at an all-time high. This comes at a time when Buffett continues to buy back Berkshire stock, which trades at a slight discount to Chubb on a price-to-book basis. Yet instead of buying back more Berkshire stock or keeping the capital as cash, Buffett opted to build a $7 billion stake in Chubb. Last quarter, Berkshire invested just $2.6 billion in share repurchases, suggesting that Buffett views Chubb as a superior investment right now.

Will Chubb be a far more superior investment in the years to come than Berkshire? Likely not. But Buffett is clearly a fan, and the company’s reasonable valuation, strong returns on equity, and long-term record of performance make it easy to understand why. If you’re a fan of Berkshire, strongly consider adding Chubb to your portfolio.

Should you invest $1,000 in Chubb right now?

Before you buy stock in Chubb, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chubb wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

Forget Berkshire Hathaway, Buy This Magnificent Insurance Stock Instead was originally published by The Motley Fool