Though shares of Zoom Video Communications (NASDAQ: ZM) are down 3% in 2024, a closer look at the recent stock price action suggests that they are back in the good books of investors.

The company, which is known for its communications platform and workplace collaboration tools, released its fiscal 2025 second-quarter results (for the three months ended July 31) on Aug. 21. Zoom stock has shot up remarkably since then, clocking 17% gains thanks to the big earnings beat it delivered and better-than-expected guidance.

The videoconferencing provider is integrating artificial intelligence (AI) tools into its offerings and tapping the lucrative contact center market to accelerate its anemic growth. But will the company’s efforts be enough to help drive stronger growth in its revenue and earnings and send its stock higher in the future? Let’s find out.

Zoom’s growth may not be outstanding, but the finer details point toward better times

Zoom’s fiscal Q2 revenue increased 2.4% year over year to $1.16 billion, which was slightly lower than the $1.17 billion consensus estimate. The company’s non-GAAP (adjusted) earnings increased to $1.39 per share from $1.34 per share in the same quarter last year, easily beating the $1.23 per share consensus estimate.

There’s not much to write home about Zoom’s numbers, but there were certain silver linings that point toward a potential improvement in the pace of its growth. For instance, Zoom’s AI Companion feature seems to be gaining traction among customers.

Launched in September 2023, AI Companion is a generative AI assistant that can perform a wide range of functions such as composing responses to chats, catching up with the developments in a meeting in case someone joins late, summarizing meetings, generating analysis of phone calls, and research for important information, among other things.

It is worth noting that AI Companion is in its first stage of rollout, and the company plans to add more capabilities going forward. More importantly, the solution is witnessing solid traction among customers as AI Companion has been used by 1.2 million accounts in its first 11 months. Additionally, AI Companion is helping Zoom win more business in the contact center space, as CEO Eric Yuan pointed out on the August earnings conference call:

We are seeing increased adoption of our advanced Contact Center packages, as customers seek to utilize our AI capabilities to enhance agent performance. Of our top 10 Contact Center wins, all represented displacements of major Contact Center vendors and 40% were migrations of our first-generation cloud-based solutions.

The company ended the previous quarter with 1,100 contact center customers, which was an increase of more than 100% from the prior-year period. Even better, Zoom’s online average monthly churn fell to 2.9% in fiscal Q2 from 3.2% in the same quarter last year. This was Zoom’s lowest-ever churn rate and indicates that fewer customers are leaving the company’s platform.

At the same time, the number of customers who contributed more than $100,000 in revenue to Zoom in the trailing 12 months increased 7% year over year. In all, this combination of lower churn, improved spending, and the growing adoption of Zoom’s AI platform make it clear why the company’s remaining performance obligations (RPO) increased 8% year over year last quarter to $3.78 billion.

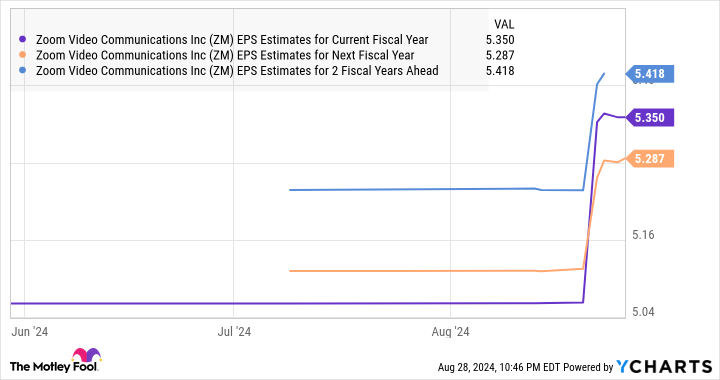

The RPO refers to the total value of a company’s future contracts that are yet to be fulfilled. So, the faster increment in this metric when compared to the actual growth in its revenue suggests that Zoom’s growth could pick up the pace in the future. This probably explains why analysts have raised their earnings expectations from Zoom.

The valuation makes the stock worth buying

Though Zoom stock has shot up lately, it continues to trade at an attractive valuation. Its trailing price-to-earnings (P/E) ratio stands at 25, while the forward P/E ratio of 13 points toward a nice jump in its bottom line. For comparison, the Nasdaq-100 index sports an average earnings multiple of 32 and a forward P/E ratio of 30.

Of course, Zoom’s growth may not be very solid right now, but we have seen that there are signs that it could deliver stronger-than-expected growth thanks to an improved revenue pipeline and its focus on driving improved customer spending through AI tools. That’s why investors looking to add an AI stock that’s trading at a cheap valuation may want to take a closer look at Zoom before it soars further.

Should you invest $1,000 in Zoom Video Communications right now?

Before you buy stock in Zoom Video Communications, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Zoom Video Communications wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Zoom Video Communications. The Motley Fool has a disclosure policy.

This Incredibly Cheap Artificial Intelligence (AI) Stock Soared 17% Since Aug. 21. Is It Still Worth Buying Hand Over Fist? was originally published by The Motley Fool