After bouncing back from the early August dip, the stock market opened September with another round of losses. In volatile times, investors need a clear signal, something to suggest a particular stock is ready to climb.

Insider buying is one of the clearest signs available. The insiders are corporate officers, company officials responsible to both Boards of Directors and stockholders of all stripes for ensuring profits and returns – and their positions give them access to the inner workings of their companies. The key point to remember: insiders may sell shares in their own companies for any number of reasons, but they only buy when they believe the stock is on track to gain. And when the insiders start spending millions on their shares, investors should take notice.

To keep things fair, financial regulatory authorities require that insiders publish their trades – and we can use the Insiders’ Hot Stocks tool, from TipRanks, to follow the trends of the insiders’ trades. The data aggregated by the tool points out the stocks that the insiders like, and we can follow those shares, dipping into the details to find out just what makes them so compelling.

Bill.com Holdings (BILL)

The first stock on our radar, Bill.com, is a cloud software provider focused on the small- and medium-sized business niche, where it offers customers solutions for the accounting and paperwork requirements of the business world. With Bill.com’s platform, small business managers can automate, digitize, and simplify the back-office financial issues and processes that come up, whether they occur every day or once a year. The company’s platform lets its users find greater efficiency in their billing, payment processing, and invoicing activities.

Small and medium businesses are always looking for efficient solutions to smooth out their paperwork, and Bill.com, which lets them put all of this into one place, has leveraged that fact into a successful business model of its own. The company has created a one-stop-shop for its customers, small entrepreneurs looking to save costs on some of their world’s most time-consuming requirements. Some of the platform’s features include allowing the creation and payment of bills for accounts receivable and payable, and management of expenses and budgets.

In the last reported quarter, covering fiscal 4Q24 (June quarter), Bill.com had a top line of $343.7 million for the quarter, gaining over 16% year-over-year and beating the forecast by almost $15.7 million. The company’s bottom line, 57 cents per share by non-GAAP measures, was 10 cents per share better than had been anticipated. And, looking forward, the company’s fiscal Q1 revenue guidance, in the range of $346 million to $351 million, was well ahead of the $336.95 million consensus.

The guide wasn’t an all-out success, however, as for FY25, revenue is expected in the range between $1.41 to $1.45 billion, at the midpoint below consensus at $1.44 billion, while non-GAAP EPS is expected to come in between $1.36 to $1.61, some distance below the Street’s $2.21 estimate.

Meanwhile, shares have been drifting lower this year, and evidently those in the know have been thinking the time is right for loading up. When we turn to the insider trades on BILL, we find several recent informative buys of more than $1 million each. John Rettig, CFO, picked up 21,124 shares for $1.04 million; Brian Jacobs, of the company Board, bought 25,000 shares for $1.338 million; and Rene Lacerte, CEO and Board member, spent an impressive $2.095 million on 42,248 shares of BILL. Currently, Jacobs and Rettig’s holdings are worth $12.25 million and $7.7 million, respectively; Lacerte’s holding is valued at almost $146 million.

This stock is covered by analyst Joseph Vafi, from Canaccord Genuity. Vafi is rated among the upper 3% of his peers by TipRanks, and he sees Bill.com as a good option under current conditions. He writes, “Against a macro backdrop that remains tough, Bill’s fintech value proposition for SMB’s continues to resonate. At a high level, we note that even though Bill’s SMB target market is more economically sensitive than large enterprises, most of the company’s KPIs and financial metrics are still sector wide standouts. We attribute this continued relative outperformance to what remains a still relative greenfield in SMB FPA/payments combined, strong channel partnerships and what is a great service set of service offerings.”

Vafi goes on to put a Buy rating on the shares, while his $100 price target suggests a one-year gain of 87.5%. (To watch Vafi’s track record, click here)

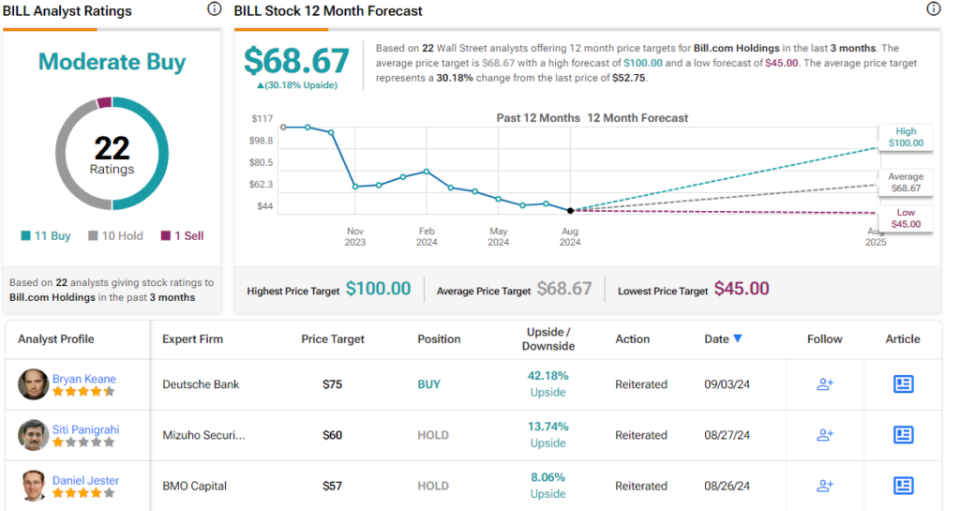

Overall, BILL shares get a Moderate Buy consensus rating from the Street, based on 22 recent recommendations that include 11 Buys, 10 Holds, and 1 Sell. The stock is priced at $52.75 and its average target price implies a gain of 30% on the one-year horizon. (See BILL stock forecast)

Butterfly Network (BFLY)

One of the greatest advances of medical technology was the development of medical imaging. Starting with the discovery of X-rays in 1895, and the application of that discovery to diagnostically important images of a patient’s hand one year later, medical imaging has grown to become a vital specialty in the health care profession, with a powerful impact on improved patient outcomes. Butterfly Network has taken upon itself the goal of ‘democratizing medical imaging,’ by making it accessible to everyone, no matter where in the world they are. The company has developed a groundbreaking technology, dubbed Ultrasound-on-Chip, that can integrate into hospital and clinic networks and transform the delivery of care – by allowing a single-probe, whole-body, ultrasound imaging solution at the point-of-care.

In short, this is portable ultrasound imaging tech at the next level, using handheld scanner technology and miniaturized components. Butterfly’s portable systems cost less than older ultrasound systems, are more accessible, and are easier to use. Ultrasound is a long-known niche within the medical imaging field, and large numbers of providers are experienced in interpreting the images, making it a good choice for a technology company that aims to expand the base of medical imaging users.

In 2Q24, revenues reached a record $21.5 million, a figure that was up more than 16% year-over-year and $1.9 million better than had been forecast. At the bottom-line, the 7-cent per share net loss came in 3 cents per share better than the estimates.

There is only one recent ‘informative buy’ insider purchase on BFLY shares, and it’s something of a doozy. Larry Robbins, of the Board of Directors, bought 1,676,869 shares of the stock – and paid just over $1.675 million for the shares. Robbins now holds company stock worth $15.85 million.

Joshua Jennings, in his coverage of Butterfly for TD Cowen, is impressed by the company’s product line, especially its new iQ3, which was launched earlier this year. Jennings sees the product as just one of several potential growth engines for Butterfly, and writes of the company, “Although the 3Q guide implies a slight deceleration from 2Q, we think the setup for BFLY in the back half of 2024 is intriguing as the company will have multiple growth channels (especially iQ3) which will continue to ramp through the remainder of the year and could provide upside to current guidance. Following its launch in February, BFLY’s iQ3 device is already seeing significant commercial demand from customers… We’re encouraged by the iQ3 commercial progress and will look for more updates on the launch in the quarters ahead.”

For Jennings, all of this adds up to a Buy rating for this stock. His price target, currently set at $3 per share, implies an impressive 12-month upside of 152%. (To watch Jennings’ track record, click here)

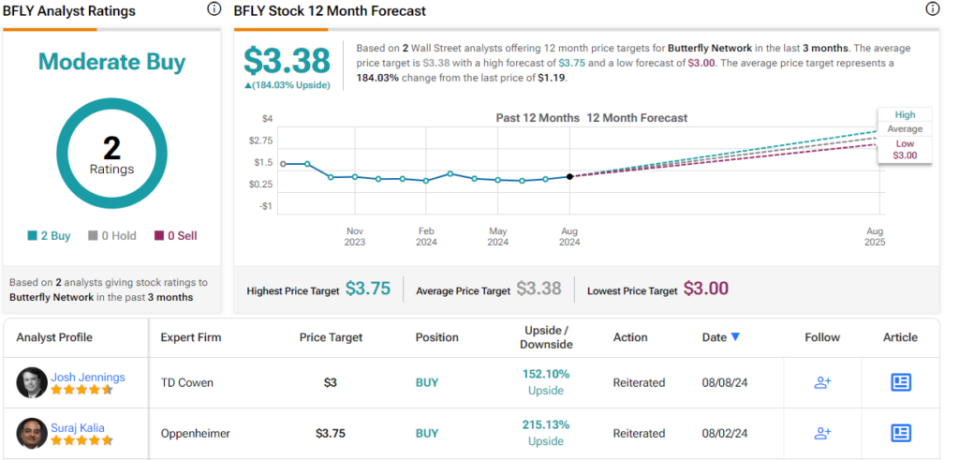

While there are only 2 recent reviews of this stock on file, they are both positive – giving the stock a Moderate Buy consensus rating. The shares are trading for $1.19, and the average target, at $3.38, is even more bullish than Jennings allows, suggesting a strong upside of 184% for the coming year. (See BFLY stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.