The last five years have been incredible for Nvidia (NASDAQ: NVDA) investors as shares of the semiconductor specialist have taken off in stunning fashion thanks to the terrific growth in its revenue and earnings, and a couple of solid catalysts in the form of video gaming and artificial intelligence (AI).

An investment of just $100 in shares of Nvidia five years ago is now worth a whopping $2,850. The stock’s gains of 2,750% during this period have crushed the S&P 500 index’s jump of 93% in the past five years. But now, Nvidia is the world’s third-largest company with a market capitalization of just over $2.9 trillion. Expecting the stock to jump another 25 times to 30 times from current levels over the next five years doesn’t seem logical as its market cap would then be worth a whopping $80 trillion.

The global economy, for comparison, was worth an estimated $105 trillion last year. However, it is worth noting that Nvidia still has solid-growth drivers in the bag that could allow it to sustain healthy levels of growth over the next five years.

In this article, we will take a closer look at those catalysts and check how much upside this semiconductor stock could deliver over the next five years.

Nvidia’s latest results indicate its AI-fueled growth is here to stay

Nvidia released fiscal 2025 second-quarter results (for the three months ended July 28) on Aug. 28. Its numbers turned out to be better than expected, with revenue jumping 122% year over year to $30 billion and non-GAAP earnings per share increasing by an impressive 152% from the same quarter last year to $0.68 per share.

Wall Street analysts would have settled for $0.65 per share in earnings on $28.7 billion in revenue from the company. This is not where the good news ended as Nvidia is expecting its fiscal Q3 revenue to land at $32.5 billion, ahead of the $31.7 billion consensus estimate. That would translate into year-over-year growth of 80%.

Still, the stock has been slipping despite reporting such phenomenal growth and delivering stronger-than-expected guidance. This slight pullback, however, is an opportunity for investors to buy the stock as a closer look at its latest quarterly results indicate that it is witnessing solid growth across all of its businesses.

The data-center segment, which grew a whopping 154% year over year and clocked record revenue of $26.3 billion, is benefiting big time from the robust demand for Nvidia’s graphics processing units (GPUs), which are being deployed to train and deploy AI models. What’s worth noting here is that customers have continued to purchase Nvidia’s Hopper architecture-based GPUs even though the company is set to begin the production ramp of its next-generation Blackwell chips in the next quarter.

As pointed out by CFO Colette Kress on the latest earnings conference call:

Blackwell production ramp is scheduled to begin in the fourth quarter and continue into fiscal year ’26. In Q4, we expect to get several billion dollars in Blackwell revenue. Hopper shipments are expected to increase in the second half of fiscal 2025.

Hopper supply and availability have improved. Demand for Blackwell platforms is well above supply, and we expect this to continue into next year.

More importantly, Nvidia believes that the next-generation AI models are likely to require 10 to 20 times more computing power, suggesting that the demand for its data-center GPUs could keep growing in the long run. According to one estimate, the AI chip market could generate $311 billion in annual revenue in 2029 as compared to this year’s estimate of $123 billion.

Nvidia generated almost $49 billion in data-center revenue in the first half of its current fiscal year, indicating that it could end fiscal 2025 (which coincides with 11 months of calendar 2024) with almost $100 billion in revenue from this segment. Based on the $123 billion estimate of the overall AI chip market, Nvidia’s share of this market could stand at around 80% by the end of this year.

Even if Nvidia’s AI chip share falls over the next five years to even 70% thanks to the emerging competition, it could still generate $217 billion in annual data-center revenue after five years (based on the $311 billion size of the overall market). In simpler words, Nvidia’s data-center revenue may double over the next five years.

Throw in the fact that the company’s other businesses are also delivering healthy growth, it won’t be surprising to see Nvidia becoming a bigger company over the next five years. For instance, the company’s revenue from the gaming and AI personal computer (PC) segment was up 18% year over year to $2.6 billion.

Gaming has been Nvidia’s bread and butter over the years, but now it contributes less than 10% to its top line. However, investors would do well to look at the bigger picture as the demand for AI PCs is set to boom over the next five years, paving the way for Nvidia to generate substantial revenue from the gaming and PC segment.

Meanwhile, the company’s professional-visualization revenue increased 45% year over year to $427 million thanks to the growing demand for the company’s digital-twin solutions. As Kress remarked on the latest earnings call:

The world’s largest electronics manufacturer, Foxconn, is using NVIDIA Omniverse to power digital twins of the physical plants that produce NVIDIA Blackwell systems. And several large global enterprises, including Mercedes-Benz, signed multiyear contracts for NVIDIA Omniverse Cloud to build industrial digital twins of factories.

Again, this is another lucrative growth opportunity for Nvidia as the digital-twin market could generate $131 billion in revenue in 2029 as compared to $26 billion this year, according to Mordor Intelligence. In all, there are multiple reasons why Nvidia could turn out to be a solid investment over the next five years.

How much upside can investors expect?

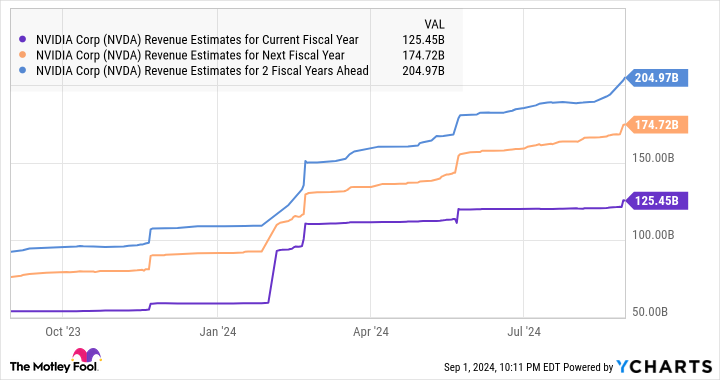

Nvidia’s healthy prospects are the reason why analysts have ramped up their revenue-growth expectations for the company’s current fiscal year and beyond.

NVDA Revenue Estimates for Current Fiscal Year data by YCharts.

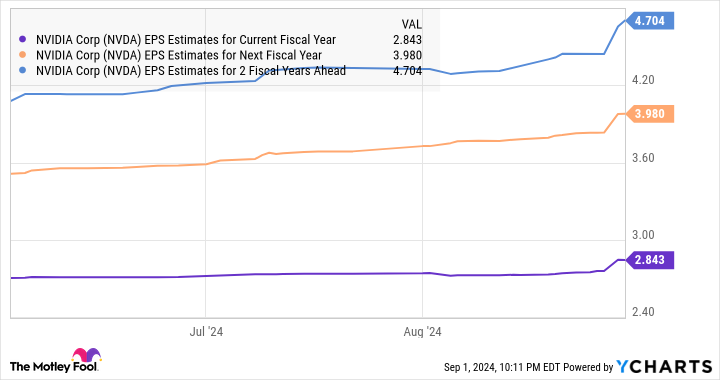

Similarly, its bottom-line growth expectations have also seen a bump.

NVDA EPS Estimates for Current Fiscal Year data by YCharts.

The good part is that Nvidia is expected to clock annual-earnings growth of 52% for the next five years. Based on the company’s fiscal 2025 earnings-per-share estimate of $2.84, its bottom line could jump to $23 per share after five years. The stock currently has a forward-earnings multiple of 45. However, even if it trades at a discounted 29 times forward earnings after five years, in line with the Nasdaq-100 index’s forward-earnings multiple (using the index as a proxy for tech stocks), its stock price could hit $667.

That would be a jump of over 5 times from current levels, suggesting that this AI stock could continue to make investors richer in the next five years.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $656,938!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Where Will Nvidia Stock Be in 5 Years? was originally published by The Motley Fool