There’s a major fault line running through the U.S. oil and gas sector, and I’m not talking about geology here. Simply put, Devon Energy (NYSE: DVN), Vitesse Energy (NYSE: VTS), and Chord Energy (NASDAQ: CHRD) are trading on lowly valuations and colossal dividend yields because investors are pricing in Bakken oil field assets at a discount to other assets such as in the Permian Basin. However, all three stocks now trade on attractive valuations and are worth picking up.

The top five oil-producing regions in the U.S.

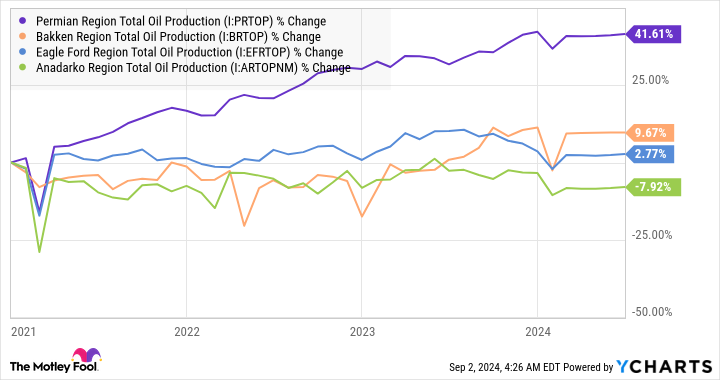

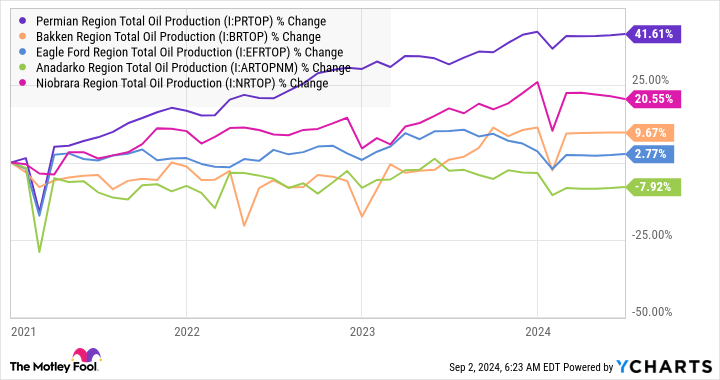

Here’s a look at the top five oil-producing regions in the U.S. to get a sense of why investors favor the Permian over other assets.

|

Region |

Location |

Oil Production in June 2024 (thousands of barrels per day) |

|---|---|---|

|

Permian |

Texas and New Mexico |

6,187 |

|

Bakken |

North Dakota and Montana |

1,313 |

|

Eagle Ford |

Texas |

1,106 |

|

Niobrara |

Northeast Colorado and Southeast Wyoming |

697 |

|

Anadarko |

Texas and Oklahoma |

383 |

Data: U.S. Energy Information Administration.

Not only is the Permian region the most important in terms of production, but it has also increased production the most in recent years. This stands in contrast to the mediocre growth in production in the Bakken.

The maturing nature of the Bakken oil field is recognized in the North Dakota Energy Report 2023: “The Bakken formation is now considered “mature” by the industry — meaning that many of the operators in the state are dedicated to producing their acreage on a consistent and steady pace but that radical growth in production is less likely.

Devon Energy, Vitesse Energy, and Chord Energy

It’s not hard to see that investors may take a glass-half-empty viewpoint of these stocks. While Vitesse Energy is up 18% this year, it still trades on an 8.1% dividend yield, and stocks don’t trade on such yields unless the market is concerned about something.

Similarly, Devon Energy and Chord Energy also trade on attractive yields, and part of that reason probably comes down to significant deals both companies have done to add assets in the Bakken oil field. All three have announced deals in the Bakken this year. It’s part of a current trend in the industry whereby oil and gas companies are using cash flows gushing from a relatively high price of oil to acquire assets at a time when the market continues to accord energy companies lowly valuations.

It’s not hard to see what all three have in common this year.

|

Company |

Market Cap |

Deal Announced in 2024 |

|

|---|---|---|---|

|

Vitesse Energy |

$763 million |

Agreed to acquire $40 million worth of assets in the Williston Basin (Bakken). |

|

|

Chord Energy |

$9.2 billion |

Combined with Williston Basin-focused Enerplus in an $11 billion enterprise deal, Chord shareholders own 67% of the new company, and Enerplus shareholders hold 33%. |

|

|

Devon Energy |

$28 billion |

Acquiring Grayson Mills’ Williston Basin assets for $5 billion, consisting of $3.25 billion in cash and $1.75 billion in shares. |

|

Data source: Company presentations.

All three stocks look like a great value, and it appears that the market is being overly pessimistic here.

Vitesse Energy

Vitesse Energy is an unusual oil and gas company that doesn’t fully own or operate assets. Instead, it uses a proprietary technology system and management’s experience to invest in interest in wells operated by larger companies, primarily in the Bakken. These include Chord Energy and Grayson Mill.

In addition, it uses hedging to protect against a fall in the price of oil. The strategy provides diversification across 7,000 producing wells, and Vitesse is almost an ETF on Bakken.

Chord Energy

Chord Energy now expects $1.2 billion in adjusted free cash flow (FCF) in 2024, and management believes it has a “footprint of 10 years of low breakeven locations delivering peer-leading oil-weighted production” in the Williston Basin. Given that the $1.2 billion in FCF represents more than 13% of its market cap, the stock looks capable of delivering its entire market cap and more in FCF within a decade.

Devon Energy

It’s a similar story at Devon Energy, where Wall Street expects the company will generate $10.9 billion in FCF over the next three years. Management expects the Grayson Mill deal will add 15% to FCF generation. With the current market cap at just $28 billion, it won’t take long for Devon to generate a significant part of its market cap in FCF, either.

All told, while the Bakken is maturing, and there’s no guarantee the price of oil will stay high, these three high-yield stocks look like an excellent value.

Should you invest $1,000 in Devon Energy right now?

Before you buy stock in Devon Energy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Devon Energy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $656,938!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chord Energy and Vitesse Energy. The Motley Fool has a disclosure policy.

3 Top High-Yield Oil Stocks to Buy in September was originally published by The Motley Fool