AT&T (NYSE: T) has quietly emerged as an impressive turnaround story. Compared to a challenging last couple of years pressured by disappointing earnings and soft trends from the wireless business, the latest results have presented an improving outlook. The stock is up 34% over the past year, currently trading at a multi-year high.

Oftentimes into a sharp rally, investors may wonder how much more upside shares can offer or whether it’s too late to jump in. Could AT&T stock be a good addition to your portfolio now? Let’s explore several reasons to stay bullish on this high-yield telecom leader.

A strong first half to 2024

It’s been just over two years since AT&T completed one of the largest restructuring efforts in its history, spinning off the WarnerMedia group back in 2022. The deal marked a turning point for the company, moving away from investments in entertainment to refocus efforts on its telecom strengths.

It appears the new strategy is paying off, with stronger underlying profitability the big theme for AT&T this year. In the second quarter, adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) increased by 2.6%, while free cash flow of $4.6 billion was up $0.4 million compared to last year.

Even as the secular decline of the company’s wireline segment remains a drag on the top line, the core-mobility group and consumer-wireline segment are seeing a resurgence of momentum. AT&T is benefiting from a resilient macroeconomic backdrop on the demand side and the impact of gradual pricing increases implemented in recent years.

In terms of guidance, management is targeting an increase to full-year wireless revenue in the 3% range, capturing steady subscriber gains and higher average revenue per user (ARPU). The company also expects 2024 broadband revenue above 7%, with AT&T fiber a key growth driver.

An ongoing transition away from legacy cable toward the more advanced broadband infrastructure has created a category of “converged customers” subscribing to both fiber and wireless service. AT&T sees a large opportunity in bundling its various services as a tailwind for higher profitability into 2025 and beyond.

Why I’m bullish on AT&T

My takeaway when looking at AT&T today as an investment opportunity is that the company has successfully regained its fundamental footing. Maybe the biggest improvement AT&T has undergone is through its strengthening balance sheet. Long plagued by a heavy burden of liabilities, AT&T is managing to deleverage with a decline in net debt supported by positive free cash flow.

That dynamic is great news for investors eyeing AT&T’s 5.4% dividend yield amid growing confidence that the $0.2775 per-share quarterly rate is sustainable. With indications that the Federal Reserve may cut interest rates later this year, AT&T’s industry leadership and high-yield profile will appear even more attractive.

One of the unique aspects of the telecom industry and wireless business is its defensive positioning. For most people, a smartphone with mobile service and internet has become a utility-like necessity. This means that even in a scenario where economic conditions deteriorate, AT&T should continue to generate high-quality cash flows with stability to earnings. That could make the stock a winner even in a volatile stock market environment.

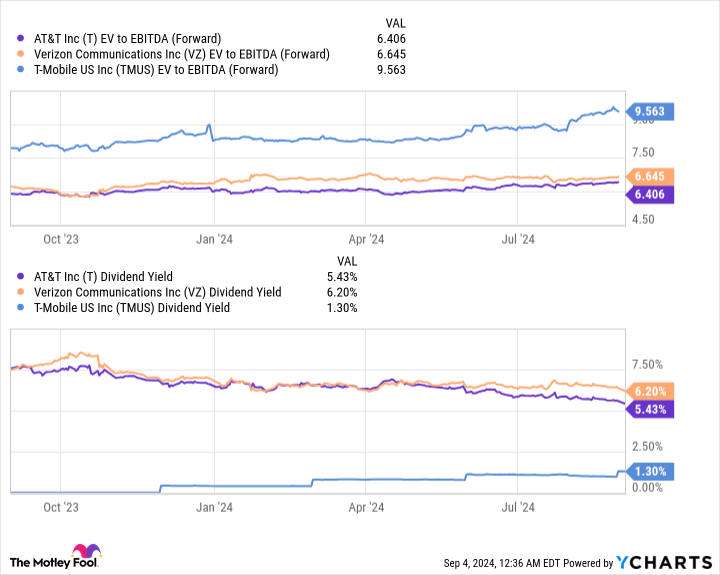

I also like AT&T stock for its compelling valuation trading around 6.4 times management’s 2024 adjusted EBITDA guidance as an enterprise value to forward EBITDA ratio. Notably, this level represents a discount compared to Verizon Communications trading at a 6.6 multiple on the same metric or T-Mobile US at 9.6. In my view, AT&T offers good value with a bullish case that it could see some expansion of its earnings premium as a catalyst for the stock.

T EV to EBITDA (Forward) data by YCharts.

My prediction for AT&T stock

I believe AT&T stock deserves more attention and can work for investors within a diversified portfolio. While it likely won’t be a straight line higher, there’s a good chance that shares can rally from here while investors are being compensated with a solid dividend yield. The company’s ability to keep executing its strategy should reward shareholders over the long run.

Should you invest $1,000 in AT&T right now?

Before you buy stock in AT&T, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AT&T wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Dan Victor has no position in any of the stocks mentioned. The Motley Fool recommends T-Mobile US and Verizon Communications. The Motley Fool has a disclosure policy.

Is AT&T Stock a Buy Now? was originally published by The Motley Fool