It finally happened. This year, Warren Buffett and Berkshire Hathaway (NYSE: BRK.B) (NYSE: BRK.A) began selling significant portions of its monster Apple stake. According to its latest 13-F filing with the Securities and Exchange Commission (SEC), Berkshire Hathaway reduced its Apple investment by approximately half in the second quarter. That stock was worth around $80 billion based on Apple’s current share price.

Berkshire Hathaway now has an estimated $300 billion in cash and equivalents on its balance sheet, a number that has been growing every quarter for quite a while now.

A lot of the proceeds of that Apple stock sale are now sitting in cash and U.S. Treasuries as Buffett waits for the next big opportunity that appeals to him. However, the conglomerate did make a few stock buys in the second quarter. Here are two interesting stocks Berkshire Hathaway bought this summer that you should consider for your portfolio.

Occidental Petroleum: Betting on U.S. oil and natural gas

One of Buffett’s favorite companies — and a stock he seems to buy more of every quarter at this point — is Occidental Petroleum (NYSE: OXY). It is one of the largest U.S. oil and natural gas companies, and last quarter, it posted its highest production in four years (as measured in barrels of oil equivalent per day) from its various operations.

This led to $1.3 billion in free-cash-flow generation in the quarter. To further reinvest for growth, the company just bought CrownRock for $12 billion, a deal that added new acreage for production in the Midland basin. The new assets will help boost free-cash-flow generation and should help Occidental Petroleum consolidate its position in the United States.

Buffett now owns an estimated 27% of Occidental Petroleum’s stock, which is a big bet on continued U.S. demand for natural gas. This might prove a particularly prescient move as additional electricity demand growth builds from the artificial intelligence (AI) and cloud computing markets. However, right now, natural gas prices are falling. While that will be an issue for Occidental Petroleum in the short run (and helps explain why the stock is down 21% from its 52-week high), this could provide a buying opportunity for investors who are focused on the long term.

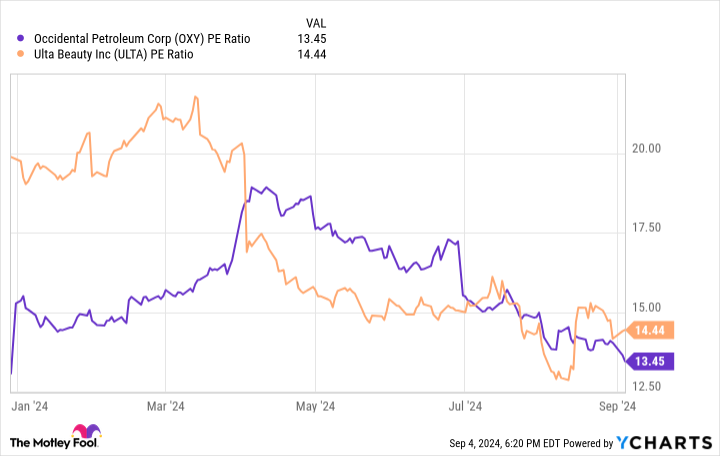

Occidental Petroleum currently trades at a price-to-earnings ratio (P/E) of 13.4, even with natural gas prices low. If you are like Buffett and a believer in the durability of natural gas demand, now could be a great time to add Occidental Petroleum shares to your portfolio.

Ulta Beauty: A bargain beauty retailer?

Ulta Beauty (NASDAQ: ULTA) is a new position for Buffett. Berkshire Hathaway added the stock to its portfolio in the second quarter after shares fell by more than 40% from their recent high.

Ulta Beauty is struggling as it comes off of a beauty-supplies boom related to the COVID-19 pandemic. Comparable sales declined by 1.2% in the second quarter compared to growth of 8% in the prior-year period. Customers are spending less on beauty products and visiting Ulta stores less frequently. And given that the chain has close to 1,500 stores in operation, investors are likely worried that it’s reaching market saturation.

Taking a longer view, it is clear that Ulta Beauty has been adept at growing its earnings. Operating income is up 295% in the last 10 years while shares outstanding are down 26.8%. The company consistently repurchases stock to reduce its outstanding shares, which is good news for the remaining shareholders.

Buffett and his team at Berkshire Hathaway likely think that Ulta Beauty is a quality retailer that is facing short-term trouble. It currently trades at a low P/E ratio of 14.4 and is buying back a ton of stock. For those confident in the Ulta Beauty brand, now could be a great time to follow Buffett and take a position in the company.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, and Ulta Beauty. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

Warren Buffett Trimmed His Apple Stake. Here’s What He Bought Instead. was originally published by The Motley Fool