Chipotle Mexican Grill (NYSE: CMG) has been in the headlines of late for the wrong reasons. The biggest attention-grabber was the departure of the company’s well-respected CEO. But a quick 20% price decline is another worrying bit of information that’s hard to ignore. If you are a long-term growth investor, however, here are three reasons to remain positive about Chipotle stock.

1. The drop in Chipotle’s shares isn’t unusual

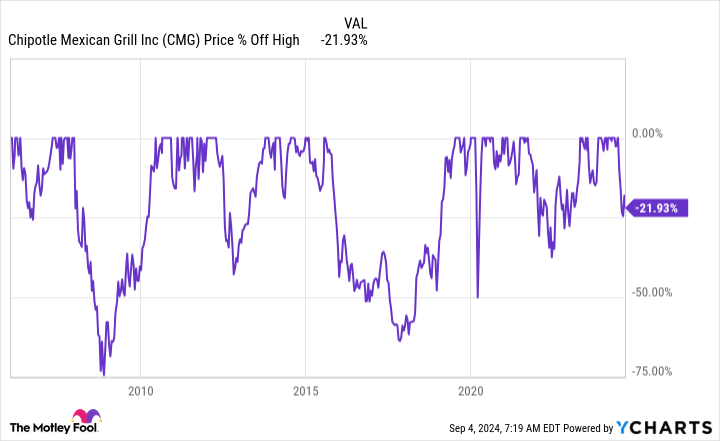

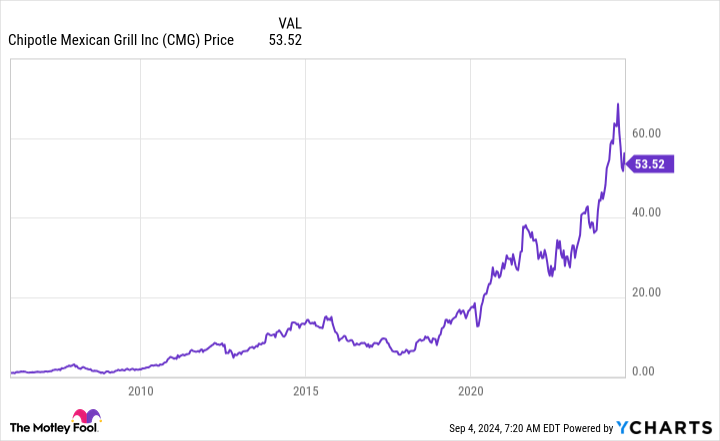

Growth stocks have a habit of lurching higher, pulling back to consolidate those gains, and then lurching higher again. It can be hard to stick around through the ups and downs, but for companies that have a long runway for growth ahead, it is often the best course of action. With that background, Chipotle’s current price retreat isn’t really odd for the company.

In fact, as the graph above highlights, this is the seventh pullback of 20% or more. Occasionally the stock has declined even further, reaching 50% a few times and even 75% once. And yet the current pullback has left the stock 20% or so below its all-time high, which also happens to be the 52-week high. So this has been a steady climb higher with quick downdrafts along the way. Or, in plain English, this is just how the stock moves.

Chipotle operates around 3,500 restaurants. Taco Bell, owned by Yum! Brands, has around 8,500 locations. That suggests that long-term, Chipotle could still double in size and not fully saturate its food niche.

2. Chipotle is operating from a position of strength

Having plenty of room for more stores is one thing, but the more important part of the story is that Chipotle isn’t doing badly right now. In fact, it is doing extremely well. In the second quarter of 2024, same-store sales soared 11.1%. That’s a huge number in the food sector, where low-single-digit same-store sales growth is considered good. Overall sales, helped by new store openings, increased 18.2% to $3 billion. Again, that’s a pretty robust number for a restaurant.

To be fair, Chipotle probably can’t continue to put up numbers like this forever. So reasonable investors should expect some pullback in performance. Still, it would be hard to suggest that Chipotle’s business is doing badly today. It is, in fact, executing at the top of its game even though the stock price would suggest the opposite.

3. Chipotle’s CEO is leaving behind an organization

That brings the story to the biggest negative headline of the year, Chipotle’s CEO abruptly jumping ship to Starbucks (NASDAQ: SBUX). Brian Niccol was well respected in the restaurant space and was credited with helping to put Chipotle on a more solid upward trajectory. So perhaps his departure is a negative.

Yet though he headed up a large business, he wasn’t the only person running it. He leaves a team of hand-selected leaders behind him and a business that is operating efficiently. The new CEO will have big shoes to fill, but this isn’t a turnaround situation or a company that needs a big refresh. The interim CEO, Scott Boatwright, was the company’s chief operating officer, so he knows the company well. And a high-level employee who recently announced his retirement has agreed to stick around a bit to help out. All in, Chipotle seems like it is still in good hands.

Should you keep an eye on the company because of the CEO’s departure? Yes! Should you fret that the end is nigh? Absolutely not.

Chipotle’s bumpy ride higher

Growth stocks often traverse a bumpy road that leads steadily higher over time. That’s the story behind Chipotle so far, and there’s no particular reason to believe its current stock-price pullback will be any different from previous pullbacks. The company is performing well and its operations are sound. Panicking just doesn’t seem warranted by the facts right now.

Should you invest $1,000 in Chipotle Mexican Grill right now?

Before you buy stock in Chipotle Mexican Grill, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chipotle Mexican Grill wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill and Starbucks. The Motley Fool recommends the following options: short September 2024 $52 puts on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

Chipotle’s Sell-Off: 3 Reasons Investors Shouldn’t Panic was originally published by The Motley Fool