Some market prognosticators would argue that, as Nvidia (NASDAQ: NVDA) stock goes, so goes the artificial intelligence (AI) bull market. Wall Street rallied around Nvidia, thanks to its dominance in the AI chip market. It’s the flagship company representing the emergence of large language models and other AI technology, which is arguably the largest technological leap forward since the internet started developing in the late 1990s.

After soaring for most of the past two years, Nvidia’s stock price has reversed course. The stock is down about 22% from its June 2024 high. Buying the dip on winning stocks has been a successful investing strategy for years. And to be honest, it’s hard to imagine an AI future without Nvidia playing a significant role.

However, you may want to consider these risks before buying the stock today.

Nvidia looks cheap, but perhaps it’s for a reason

Nvidia’s AI-friendly GPU chips have become the go-to choice for technology companies building large data centers to run powerful AI models. Approximately $26.3 billion of Nvidia’s overall $30 billion in Q2 revenue was from its data center segment, so Nvidia has effectively become a pure play on AI chips. The good news is that data center revenue grew 154% year over year in Q2 and 16% from the prior quarter, a sign that chip demand remains strong.

Analysts now estimate Nvidia will earn $2.84 per share this year and $4 per share next year. Using next year’s estimates, that prices Nvidia at a forward price-to-earnings ratio (P/E) of 26. If Nvidia grows earnings by 40% annually over the long term, as analysts believe it will, it’s arguably a bargain now.

However, there’s an argument that Nvidia’s revenue, as impressive as it could wind up being, is risky enough that investors may want a tremendous margin of safety to buy the stock. A small handful of companies are propping up Nvidia’s sales. Specifically, four companies make up 40% of Nvidia’s total revenue. To make matters worse, all four of them — Microsoft, Meta Platforms, Alphabet, and Amazon — have worked on developing their own custom AI chips.

Margins could become a problem

These companies will not necessarily discontinue using Nvidia’s chips entirely (though anything is possible). But Nvidia has enjoyed remarkable pricing power since the AI rush began early last year. AI became a race where speed to market became the priority.

There are signs that the AI market is slowly evolving. Investors have openly questioned whether big technology companies see the returns needed to justify all this data center spending.

Market research has indicated that traffic to ChatGPT, once the fastest-growing app in history, has dropped in recent months. Amazon’s management noted in the company’s Q2 earnings call that its AI customers want better value.

Price didn’t matter when AI was new, but it’s starting to become a conversation. That could spell pricing pressure for Nvidia moving forward. The company may have to choose between sacrificing market share to competition or accepting lower margins to retain share.

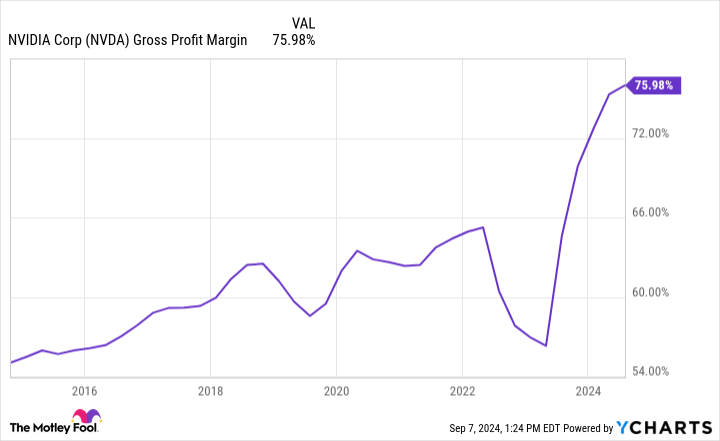

This year, Nvidia is guiding to gross margins in the mid-70s, so this is something to watch in 2025 and beyond. You can see that margins this high are well beyond anything before the pandemic:

It’s tempting to ignore such a long-term concern, but remember that Nvidia only looks cheap because everyone expects stellar sales and profits years into the future. Margins reverting to long-term averages would be disastrous for investors.

Should investors buy Nvidia stock today?

These concerns aren’t to dissuade you from owning Nvidia. They are raised to keep you aware of the risks. As impressive as Nvidia’s financials are today, they’ve been propped up by a few deep-pocketed customers throwing money at being the early AI winner. Nvidia could be the leading AI chip company 20 years from now, but sales and/or profit margins could also fizzle out and collapse the stock.

The tricky part is that both things could be true.

Long-term investors who would like to buy the stock on this dip should do so responsibly. Consider a dollar-cost averaging strategy to accumulate shares slowly. That way, volatility is more of an opportunity than a reason to stress. Nvidia could be a bumpy ride for the foreseeable future, even if it makes investors money in the long run.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Is Nvidia Stock a Buy Now? was originally published by The Motley Fool