The race among the top S&P 500 ETFs is intensifying, with the Vanguard S&P 500 ETF (VOO) and the iShares Core S&P 500 ETF (IVV) likely to surpass the longtime assets leader, the SPDR S&P 500 ETF Trust (SPY) over the next year, according to an X post from Bloomberg ETF Senior Analyst Eric Balchunas.

VOO will likely rank first in AUM because it is growing at a faster rate than IVV, Balchunas added.

“My take $IVV and $VOO both pass $SPY around the same time but $VOO ultimately pulls away long term bc it takes in more cash and has the MF [mutual fund] migration tailwind that $IVV doesn’t,” Balchunas wrote.

The potential shift comes as investors pile into index-focused funds, part of a larger surge in demand for exchange-traded funds. A number of issuers have converted mutual funds into ETFs, which are more tax efficient and transparent.

“[Mutual fund] migration is moving from mutual funds to ETFs. For example, investors in the Vanguard [500 Index Fund Admiral Shares] VFIAX can convert their mutual fund shares to VOO ETF shares at no cost,” said Kent Thune, etf.com research lead. “These conversions give Vanguard the edge in the AUM race.”

S&P 500 ETFs: A Fierce Competition

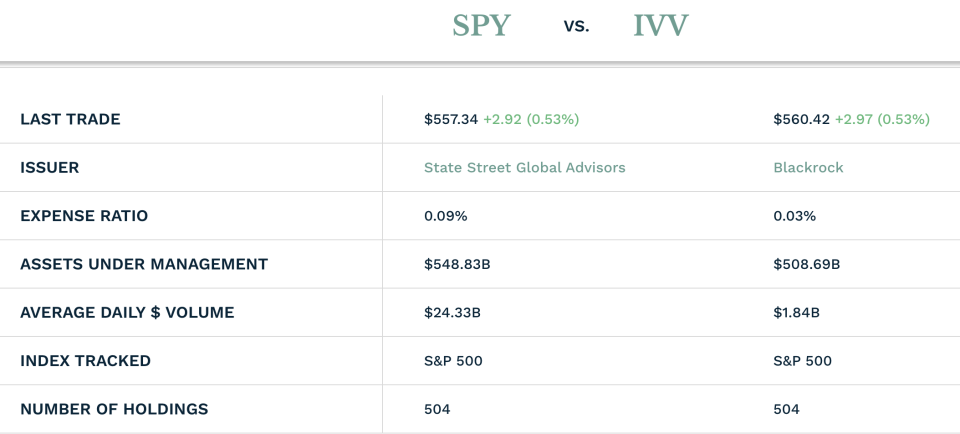

One key factor driving the popularity of VOO and IVV is their lower expense ratios. Both charge just 0.03% annually, compared to SPY’s 0.09%.

Performance among the ETFs is similar year-to-date, with all three returning slightly over 16%, according to etf.com data.

While SPY maintains the highest trading volume with a daily average of $24.3 billion, IVV and VOO are gaining traction. VOO’s daily average volume is $2.3 billion, surpassing IVV’s 1.9 billion.

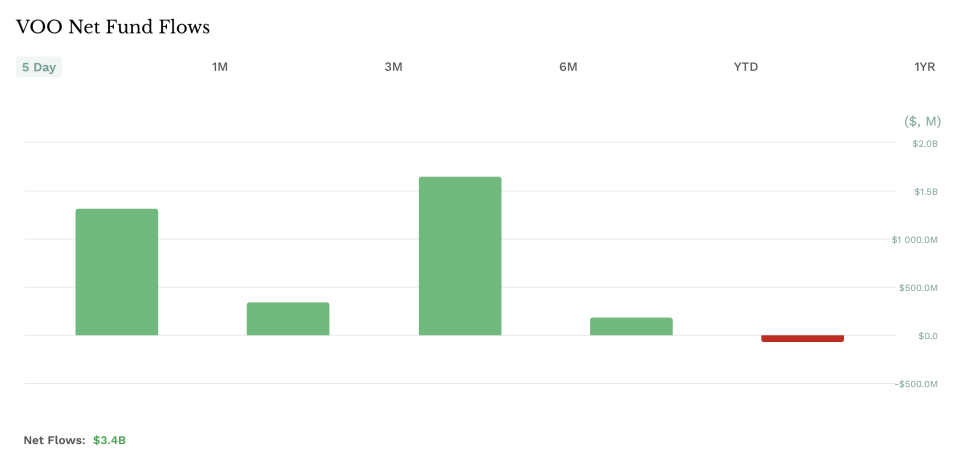

Over the past five days, VOO and SPY inflows have reached $3.4 billion $3.1 billion, respectively, while IVV attracted $1.4 billion.

This trend extends to longer time frames as well. Year-to-date, VOO has attracted $63.9 billion in inflows, compared to IVV’s $45 billion, while SPY has experienced outflows of $19.2 billion.

“VOO and IVV are gaining more assets from the retail investor side while SPY gets more from the institutional side,” Thune said. “I see retail investors chasing the recent past performance of the tech-led S&P 500, while institutional investors are paring back their positions to capture gains and restructure portfolios to reduce risk.”

SPY’s higher liquidity continues to make it a favorite among institutional investors and traders. However, the consistent inflows and lower fees of VOO and IVV are steadily eroding SPY’s market share.