Big data software stock Palantir (NYSE: PLTR) is having a moment today. Revenue is accelerating, profitability has flipped to the positive — somewhat of a rarity for a software stock — and the artificial intelligence revolution appears to be reinvigorating demand in its platforms.

Founded in 2003, Palantir began assisting the U.S. military and intelligence agencies during the War on Terror. But the company appears to be making a transition to become more of a commercially focused company now. That’s good news for shareholders, as the commercial market is far bigger.

The commercial business has been kick-started

Last quarter, Palantir showed a marked acceleration in its commercial business. Commercial revenue was up 33% to $307 million, making up 45.3% of revenue. That’s gaining fast on the traditional government segment, which held its own with a fine 23% growth to $371 million. Both segments accelerated relative to last year, enabling the company to more than double its growth rate relative to the year-ago quarter, from 13% growth in Q2 2023 to 27% total growth in Q2 2024.

That’s a rather stunning pickup in the growth rate, which typically gets harder, not easier, as a company gets bigger. But under the hood, things look even rosier in the forward outlook for commercial revenue, especially the dynamic U.S. market.

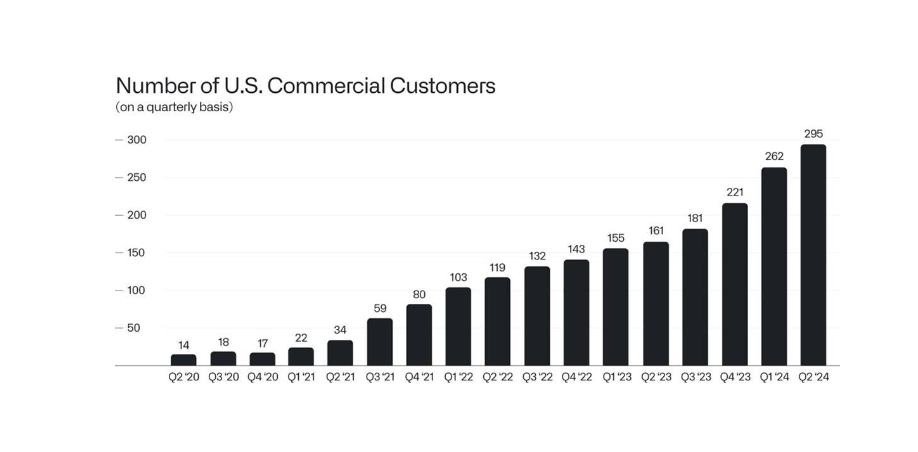

In Q2, U.S. commercial revenue grew 55% but would have been up 70% if not for discounted initial low-revenue deployments with “strategic” customers. The overall U.S. commercial customer count was up 83% to 295 commercial customers, with total customers up 41% year over year. Finally, U.S. commercial remaining deal value (RDV), which totals all the remaining value of outstanding contracts, was up a whopping 103% relative to the prior year.

Of note, the U.S. now accounts for just over 50% of total commercial revenue.

Acceleration coinciding with the unveiling of the AI Palantir (AIP) platform

In his letter to shareholders, CEO Alex Karp included this graphic about customer adoption:

As you can see, there appears to be a big acceleration in customer adoption starting around one year ago — exactly when Palantir launched its AIP platform. AIP is Palantir’s artificial intelligence software that helps companies harness the power of large language models (LLMs) and employ them within real-world contexts for businesses to generate tangible outcomes. CEO Alex Karp said that AIP is disrupting or “deprecating” enterprises’ back-end application development processes, akin to the way cloud computing disrupted traditional enterprise tech infrastructure.

From the looks of the chart above, it appears Karp and Palantir are onto something with AIP. In his letter to shareholders, Karp highlighted the ability of AIP to harness the power of large language models toward actual business outcomes, saying that using LLMs without the full context of the business and AIP won’t work:

Models with trillions of parameters may be able to flawlessly mimic Goethe, but without more, add little value to the enterprise. They have been born into this world without any sense of its contours or logic, or indeed a conception of truth or basic facts, let alone the collective knowledge of and insight into the operations of an organization with half a million employees…They are wild animals, whose power and capabilities must be tamed and harnessed. And we are now seeing what is possible once they are.

AIP is also leading to new vertical products

But the growth doesn’t stop there. Karp and his team also noted Palantir would be coming out with a new software platform called Warp Speed, built on top of AIP. Warp Speed will be a back-end platform specifically designed for modern industrial manufacturing businesses. “The American manufacturing operating system” is what Karp called it, built from Palantir’s past experience in the military and heavy industrial industries.

From the call with analysts, it appears Warp Speed will tie all the elements of manufacturing together, from the enterprise resource planning (ERP) system, to the Manufacturing Execution System (MES), to the Production Lifecycle Management system (PLM), to the Programmable Logic Controller (PLCs) for factory automation, to the workers on the factory floor.

With Warp Speed, Palantir is adapting AI for specific vertical industries in a way that has the potential to disrupt legacy enterprise software businesses — and those markets are quite large.

Peering into the decade ahead

The defense segment is still an important one for Palantir, and somewhat defines its corporate brand. However, it’s highly likely that the commercial segment will soon become its largest. Ten years out, it stands to dwarf the defense business, which is somewhat limited in its potential size.

Palantir made about $2.5 billion in revenue over the past 12 months, but is also profitable on a generally accepted accounting principles (GAAP) basis. Still, at 33 times sales, the stock is also extremely expensive.

But, given the much larger private sector relative to the U.S. and allied defense industries, Palantir’s accelerated commercial traction appears to have brightened its long-term growth prospects. If the commercial segment keeps growing as it is, Palantir could make a sizable dent in several enterprise software segments. For instance, in the context of Warp Speed, the ERP software market alone was $71 billion in 2023 but is projected to grow at a 14.4% rate through 2032, reaching $238 billion by that time, according to Fortune Business Insights.

Therefore, should Palantir stay on the cutting edge of AI-powered enterprise software with AIP, Warp Speed, and other future potential offerings, it may very well have a lot of runway in front of it, potentially justifying its current valuation.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $730,103!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Billy Duberstein and/or his clients have no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.

Where Will Palantir Be in 10 Years? was originally published by The Motley Fool