For investors, dividend-paying stocks offer an immediate return, and those with consistent, rising payouts have performed even better, with less volatility than the benchmark S&P 500. One explanation could be that annual dividend increases compel management to maintain disciplined capital allocation while also signaling strong confidence to investors in the company’s future growth.

Let’s dive into two dividend-paying stocks, priced at a combined $500, that appear undervalued and either recently began paying dividends or have a strong history of increasing them.

1. Alphabet

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) is down approximately 5% over the past month as the tech giant faces increasing calls for regulation in its search and advertising business. Additionally, investors fear Alphabet may be behind in the artificial intelligence (AI) arms race against competitor Microsoft, which owns a significant stake in Open AI, the company behind ChatGPT.

While long-term trepidation may be holding down the stock price, Alphabet’s business is generating more revenue and profit than ever before. Through the first half of 2024, the company generated $165.3 billion in net sales and $47.3 billion in net income, representing a year-over-year increase of 14.5% and 41.5%, respectively.

Alphabet’s balance sheet shows that as of its most recently reported quarter, the company held $88.9 billion in net cash. The excess cash likely gave management confidence to initiate its first-ever dividend earlier this year. The company currently pays a quarterly dividend of $0.20 per share, equating to an annual yield of 0.53%.

Notably, Alphabet’s payout ratio — the percentage of a company’s income paid out as dividends — is incredibly low at 2.8%, meaning management will have plenty of room to raise its dividend in the future.

Management also returns capital to shareholders through share repurchases, which increase investors’ ownership stakes without requiring additional purchases. In the first half of 2024, Alphabet spent $31.4 billion on share buybacks, lowering its outstanding shares by 1.2%. Given that Alphabet’s outstanding share count has decreased 10.9% over the past five years, and it announced a new $70 billion share repurchase in April, it looks as if management will continue to prioritize this capital allocation method for its shareholders for the foreseeable future.

Returning to the perceived threat to Alphabet’s business, management understands the significance of AI and is pouring cash into the transformative technology. CEO Sundar Pichai underscored Alphabet’s investments into AI on the company’s most recent earnings call, adding, “The one way I think about it is when you go through a curve like this, the risk of underinvesting is dramatically greater than the risk of overinvesting for us here.”

The company poured $25.2 billion in capital expenditures for the first half of 2024, most of which it earmarked for its AI development. For comparison, Alphabet spent $13.2 billion capital expenditures in the first half of 2023.

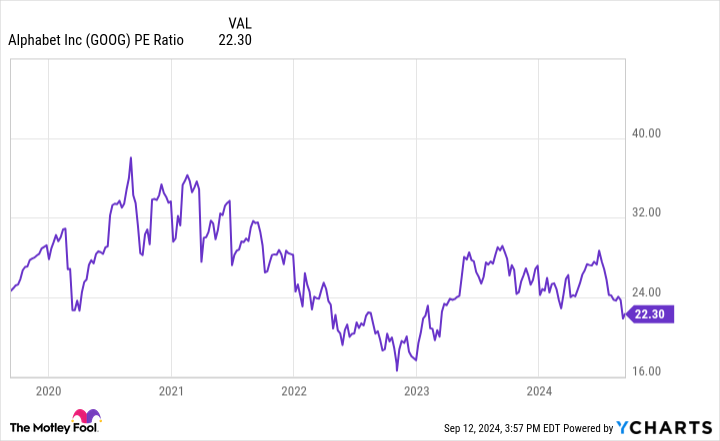

Even if it is considered behind in the AI boom, Alphabet remains a market leader in ads and search and owns valuable properties like YouTube. Based on the price-to-earnings (P/E) ratio, which compares a company’s earnings over the past 12 months to its stock price, Alphabet appears undervalued. That’s because the stock currently trades at roughly 22.3 times earnings, well below its five-year P/E ratio average of 26.8.

2. Caterpillar

Caterpillar (NYSE: CAT) stock has been stagnant of late, generating a total return of only 1.5% over the past six months. Still, the world’s largest construction equipment manufacturer is a dividend stalwart, paying a quarterly dividend since 1989 and raising it for 31 consecutive years. Today, Caterpillar pays a quarterly dividend of $1.41 per share, representing an annual dividend yield of roughly 1.7%. Additionally, with a payout ratio of 23.7%, investors can reasonably expect management to continue its impressive dividend hike streak in the coming years.

Similar to Alphabet, Caterpillar repurchases its stock hand over fist. Management lowered its outstanding shares by 2.9% in 2024 and 12.3% over the past five years.

Caterpillar’s management regularly states its plans to use “substantially all” of its free cash flow from machinery, energy, and transportation (ME&T) on dividends and share repurchases. For 2024, it projected that metric to be within the range of $7.5 billion to $10 billion. While an impressive outlook on the surface, Caterpillar generated $10 billion in ME&T free cash flow in 2023, which is perhaps why some investors are timid about the stock.

Yet, there is a reason behind the stagnation: Higher sustained interest rates are weighing on global demand for construction projections. As of its most recently reported quarter, Caterpillar generated $16.7 billion in net sales, and its backlog stood at $28.6 billion, representing a decrease of 4% and 7% year over year, respectively.

The good news is that interest rates are on track to ease in the coming months, which management believes will help some areas of its business, like building warehouses or other rate-sensitive projects. In the long term, Caterpillar will benefit from U.S. government-related infrastructure projects and demand for new housing in North America. Specifically, Caterpillar continues to receive a windfall from the $1.2 trillion Infrastructure Investment and Jobs Act signed into law in 2021 and the fact that America has underbuilt an estimated 4.5 million homes since the Great Recession.

Similar to Alphabet, Caterpillar also trades at a depressed valuation when compared to historical averages. Today, the construction-focused company trades at 15.5 times earnings, below its five-year P/E ratio median of 16.9.

CAT PE Ratio data by YCharts

Should you buy these dividend stocks?

Whether it’s the start of a dividend journey or 30-plus years into it, these two stocks are well positioned to continue to reward shareholders with a rising dividend. Again, according to research, this is a key factor in a stock outperforming the market over the long term. Couple that history with what appears to be fair valuations, and Alphabet and Caterpillar are two stocks to buy for any portfolio.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Collin Brantmeyer has positions in Alphabet, Caterpillar, and Microsoft. The Motley Fool has positions in and recommends Alphabet and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The Smartest Dividend Stocks to Buy With $500 Right Now was originally published by The Motley Fool