All eyes will be on Federal Reserve Chairman Jay Powell when he announces what the Fed is planning to do with interest rates during its Sept. 17 and 18 meeting. It’s a foregone conclusion that there will be at least some rate cut, but nobody knows how much. As a result, some consumers may hold off on purchases until after rates start to fall, something that could massively benefit a few companies.

One stock that could go parabolic if the Fed cuts rates is Upstart (NASDAQ: UPST). Upstart’s software is an alternative to FICO scores and is used primarily in personal and auto loans, two areas that haven’t seen as much demand since interest rates rose.

Upstart uses AI to assess creditworthiness

Upstart’s alternative lending model assesses borrowers differently than a credit score. It uses alternative factors that aren’t normally used in FICO scores to better assess a borrower’s creditworthiness. It also uses artificial intelligence (AI) to do this, which can help remove bias from approving loans. The results are pretty stark: Upstart has 53% fewer defaults than a traditional model at the same approval rates.

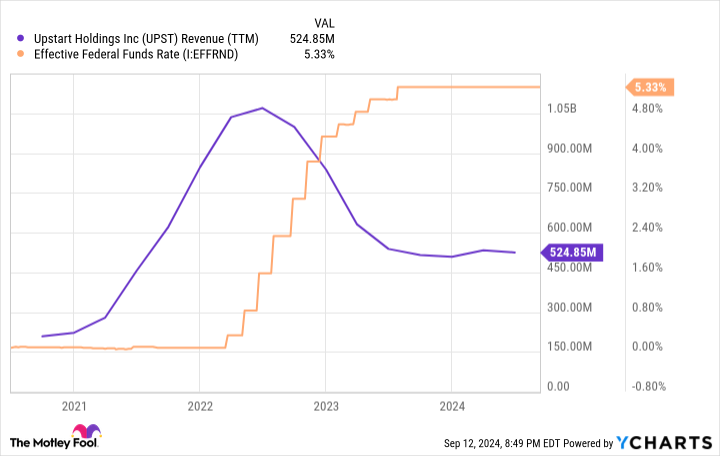

Upstart has a fantastic model, but the problem is that it isn’t in control of its own destiny. Because its business is tethered to the interest rate environment, it can boom and bust alongside those rates. Just a few years ago, it had a $1 billion annual revenue run rate. Now, the figure sits at about half of that amount.

But those low revenue quarters are pretty much the inverse of the effective federal funds rate, so this raises the question: Can Upstart return to prominence if the Fed cuts rates?

Upstart’s business hasn’t done well with higher rates

The problem with Upstart is that its business needs booms to survive. As mentioned above, Upstart’s lending expertise is focused on the personal and auto loan space. These rates are often significantly higher than the federal funds rate due to the increased risk of these loans that the lender takes on. As a result, when rates are as high as they are now, there is little demand. However, if the Fed decreases rates, consumers may be more likely to take on some loans if they can get a lower rate than previously.

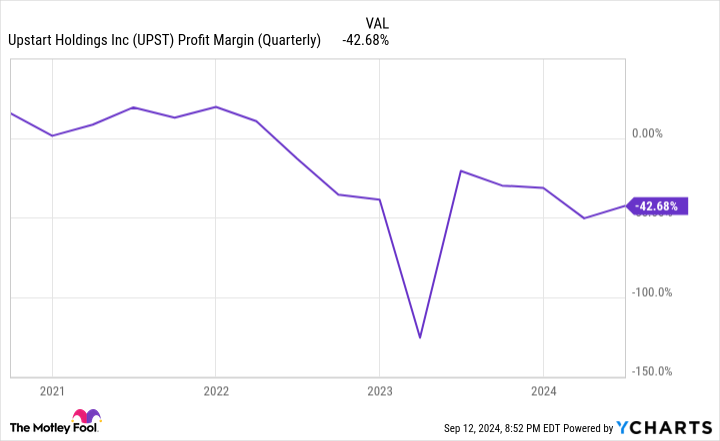

Unfortunately, Upstart has become deeply unprofitable since its business took a nose dive thanks to high interest rates.

Although the company’s revenue has stayed fairly steady, it has done little to become more efficient and cut its losses. This is a big warning flag for me, as it shows that it must have these low interest rate periods in order to survive.

That is a mark of a company that isn’t built for the long term. If Upstart were marginally profitable in bad times but massively profitable in good times, I’d reconsider, but this isn’t the case.

Still, this doesn’t mean the stock won’t see significant gains as the Fed cuts rates. There is likely pent-up demand for personal and auto loans, as consumers may have been avoiding taking on loans due to higher rates than in recent times. As a result, Upstart’s business will likely take off, and the stock could follow suit.

Unless management makes some changes from the past boom, Upstart could struggle again years down the road. The stock could be bought here if it changes for the better. But if it sticks with its old ways (which it has done over the past few quarters), it could repeat its problems a few years from now.

Should you invest $1,000 in Upstart right now?

Before you buy stock in Upstart, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Upstart wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Keithen Drury has positions in Upstart. The Motley Fool has positions in and recommends Upstart. The Motley Fool has a disclosure policy.

1 Stock Down 91% That Could Go Parabolic if the Fed Cuts Rates was originally published by The Motley Fool