C3.ai (NYSE: AI) has been accelerating its growth in recent quarters, which has been a positive sign, and says that it is taking advantage of new opportunities in artificial intelligence (AI). But one area that is still a cause for concern for investors is the bottom line. The software provider continues to incur sizable losses, which could keep risk-averse investors away.

Investors shouldn’t be worried, though, according to CEO Thomas Siebel, who believes that profitability will come in the future as the company scales up its operations. In a recent interview with CNBC, he even said it was a “mathematical certainty” that the company will get there.

However, after looking at the company’s recent results, here’s why I’m not convinced it is much of a certainty at all.

Revenue has been rising, but losses haven’t decreased much

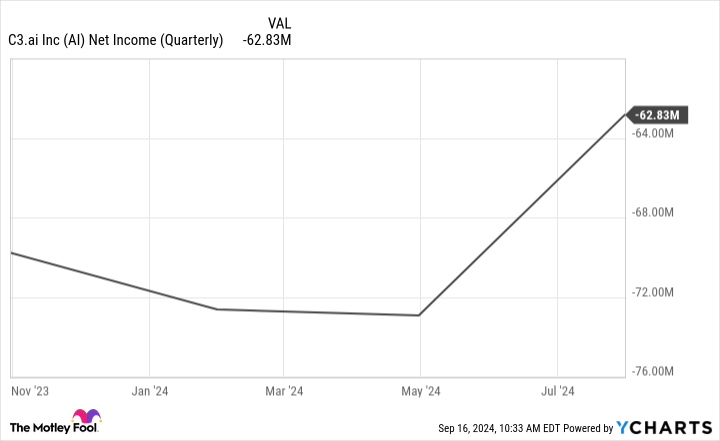

As a company gets bigger, investors expect that its bottom line will ultimately improve. In C3.ai’s case, however, the improvement has not been all that impressive. During the company’s most recent quarter, which ended on July 31, sales totaled $87.2 million and rose by 21% year over year. But despite the strong increase in revenue, the company’s net loss shrank by a modest 2%, from $64.4 million a year ago to $62.8 million this past quarter.

There are indeed positives. C3.ai continues to generate a high gross profit margin of 60%, and operating expenses rose by just 9% last quarter. But the scale isn’t significant enough to suggest that there is any certainty of profitability in the near future. The company has made strides in shrinking its losses, but it doesn’t necessarily mean that positive earnings numbers are on the horizon.

Why scaling up the business won’t guarantee profitability

By ramping up its business, C3.ai can continue to make incremental improvements on the bottom line. But there’s also a risk that it might need to spend more money than it expects to grow its operations.

Spending on AI could slow if there’s a recession or if companies struggle to see the benefit from such projects. Research company Gartner projects that companies will abandon at least 30% of generative AI projects by the end of next year.

That means C3.ai’s growth could slow since there would be less interest in its AI applications. And it might need to spend more money to attract customers. Both factors would lead to its bottom line worsening, not improving. At the very least, there isn’t any certainty that the business is going to be profitable in the near future.

C3.ai remains a risky investment

A CEO can often be a company’s best salesperson, touting its prospects. Investors need to take such optimism and excitement with a grain of salt, however.

C3.ai is growing, but there is by no means a guaranteed path to profitability at this point. Management is still providing guidance for the current fiscal year (ending in April 2025) indicating an operating loss of at least $95 million. And that’s an adjusted loss; its actual net loss will likely come in higher.

The stock has been struggling of late, falling 20% in just the past three months as investors appear to be concerned with the prospects for profitability. Sales growth alone might not be enough to convince the market that the stock is the real deal, and investors could be better off buying other AI stocks instead.

Should you invest $1,000 in C3.ai right now?

Before you buy stock in C3.ai, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and C3.ai wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $694,743!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool recommends C3.ai and Gartner. The Motley Fool has a disclosure policy.

C3.ai’s Chief Says It’s a “Mathematical Certainty” That the Company Will Be Profitable. But a Closer Look at the Numbers Says Something Else. was originally published by The Motley Fool