Data analytics and warehousing company Snowflake (NYSE: SNOW) went public as one of the most hyped IPOs in modern history. But today? Investors have largely moved on. Snowflake is down a whopping 71% from its former peak, which admittedly came in 2020-2021 during a zero-percent interest rate-driven market bubble.

But Snowflake’s story doesn’t reflect a bad business, even if the stock’s price action points to that conclusion.

The good news is that Snowflake has now fallen far enough that it could completely change the stock’s long-term investment prospects. Here is why it’s finally time to buy Snowflake.

A tragedy: a story of valuation

Snowflake was a wildly popular IPO, which made it a successful one. After all, the purpose of an IPO is to raise money a company can use to grow the business. Snowflake arrived to a Wall Street frenzy; it seemed there wasn’t a price investors weren’t willing to pay for shares.

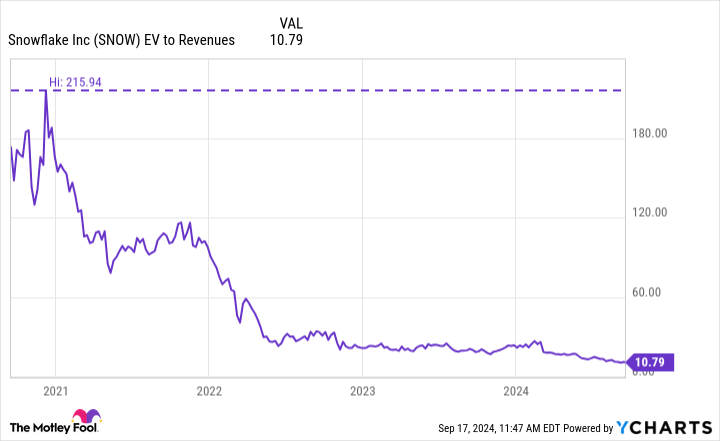

At its peak, investors paid an enterprise value (EV)-to-revenue ratio of nearly 216. That’s not a ratio of Snowflake’s profits — that’s revenue! For reference, the vaunted AI stock, Nvidia, which some have argued is in a bubble itself, hasn’t gone past 45 on that ratio during this AI craze. Investors can think of valuations like expectations; the reality is that Snowflake’s early valuation set the bar impossibly high. It seemingly doomed the stock from the start.

You can see above how Snowflake’s valuation has completely unwound over the past four years due to a combination of share price declines and revenue growth that have helped lower that valuation ratio. The good news is that Snowflake is a much better opportunity today, trading at an EV-to-revenue ratio of just 11. Snowflake’s current valuation isn’t even top-of-market today; it’s well below that of some other hot software stocks like CrowdStrike (17) and Palantir (31).

Tremendous long-term growth potential

Snowflake is a data software company. Its platform allows companies to securely store, organize, share, and query their data. Companies want a firm grasp of their data as they lean toward artificial intelligence (AI), which uses data to train and implement AI technologies. Snowflake’s product is cloud-neutral, which appeals to the many enterprises who don’t want to tie into one cloud or another.

While Snowflake’s revenue growth has slowed from a triple-digit rate to under 30% over the past few years, investors shouldn’t panic. Snowflake charges by usage, and rising rates created a challenging environment where customers were cutting back on their spending. The underlying growth numbers look healthy: Snowflake still boasts a 127% revenue retention rate among existing customers, and last quarter the company’s customer count grew 21% from a year ago. It doesn’t look like revenue growth should slow much further from its current pace.

Meanwhile, the long-term opportunity is tremendous. Management estimates that its addressable market was worth $153 billion last year and will rise to $342 billion by the end of 2028. The company’s trailing-12-month revenue is $3.2 billion, only about 1% of that long-term number. Snowflake has a direct competitor, a privately held company called Databricks, but there is plenty of opportunity to feed both companies over the coming years.

The pitch to buy shares today

Investing often boils down to the potential risks versus the rewards. Today, Snowflake’s business is larger than ever, and the stock’s valuation isn’t anywhere close to the top of the market anymore.

At this point, Snowflake’s financial losses are the most significant risk to investors. The company has lost over $1 billion over the past four quarters. For some, investing in a non-profitable business may not be for you. However, these are GAAP losses, and Snowflake is highly cash-flow positive. The company’s $815 million trailing-12-month free cash flow represents 25% of revenue. High stock-based compensation mainly explains the losses and is part of life for technology companies bidding for the best talent.

Eventually, the company must show it can overcome these expenses and turn GAAP profitable. For now, Snowflake is highly cash-flow positive and well funded with $3.2 billion in cash and zero debt, so the financial risk isn’t as bad as it looks at first glance. Snowflake has time, and so do investors.

Snowflake’s strong revenue retention and tremendous market opportunity give it enough potential for investors to consider the stock at a valuation that finally gives it a chance to shine.

Should you invest $1,000 in Snowflake right now?

Before you buy stock in Snowflake, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Snowflake wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $722,320!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CrowdStrike, Nvidia, Palantir Technologies, and Snowflake. The Motley Fool has a disclosure policy.

1 Growth Stock Down 71% to Buy Right Now was originally published by The Motley Fool