For much of the past decade, tech goliath Apple (NASDAQ: AAPL) has sat atop Wall Street’s pedestal as its largest and most-influential business. It became the first public company to reach a $1 trillion market cap in August 2018, and was the first to top $3 trillion in June 2023.

While a key investment that’s the envy of pretty much every other public company has played a vital role in its ascent, this mammoth investment isn’t able to fix what’s currently Apple’s biggest problem.

Apple’s $700 billion investment has been a godsend for its shareholders

Berkshire Hathaway CEO Warren Buffett made Apple his company’s top holding for a good reason. Namely, its veritable sea of catalysts and competitive advantages.

For instance, it’s one of the world’s strongest and most easily recognized brands. Kantar’s annual “BrandZ Most Valuable Global Brands Report” for 2024 listed Apple as the top brand for a third consecutive year. It was the only company to receive a brand value north of $1 trillion, and was commended for having products that justify a premium price.

Apple’s iPhone is also unmistakably dominant in the U.S. Since introducing a 5G-capable version of the iPhone during the fourth quarter of 2020, it’s maintained a 50% or greater share of the domestic smartphone market and has seen its share of global shipments surge from 12% in 2020 to 16% by 2023. There’s historically been plenty of excitement surrounding Apple’s annual iPhone update/reveal.

Investors buy Apple stock for its innovative capacity, too, which includes innovations that extend beyond the physical products that initially endeared the company to consumers. CEO Tim Cook is spearheading a multiyear endeavor that has his company focused on growing its Services segment. Subscription services should bolster the company’s operating margin over the long run, keep customers loyal to its ecosystem of products and services, and minimize the revenue ebbs-and-flows associated with iPhone replacement cycles.

But the unmistakable investment that’s played the biggest role in Apple’s success is the roughly $700 billion it’s apportioned to share repurchases since the start of 2013. Here’s a breakdown of Apple’s buyback activity over the last 11 years:

Collectively, Apple has repurchased $700.61 billion worth of its common stock since the beginning of 2013 and has reduced its outstanding share count by 42.24% since peaking.

Aside from incrementally increasing the ownership stake of shareholders and promoting a long-term mindset, buying back stock is having a positive impact on earnings per share (EPS). Businesses with steady or growing net income and a declining share count tend to enjoy an EPS boost, which ultimately makes their stock more fundamentally attractive to value-focused investors, like Warren Buffett.

If Apple hadn’t spent a cent on share repurchases over the last 11 years, its trailing-12-month EPS, which is currently north of $6.50, would be just $3.87. These buybacks have been that vital to the success of its stock.

Unfortunately, Apple’s $700 billion investment can’t fix its biggest problem.

Apple’s growth engine has stalled — and that’s a big problem

While buying back copious amounts of stock has, at times, helped Apple maintain some semblance of value in the eye of investors, the company’s growth engine has completely stalled out over the last few years. This is a massive problem that buybacks simply won’t fix.

Despite record Services revenue in the fiscal third quarter (ended June 29) and double-digit sales growth from this segment through the first nine months of the current fiscal year, Apple’s physical product segments are struggling.

-

iPhone, which is Apple’s top segment by revenue (52.3% of net sales), has endured a sales slump of roughly 1% from the comparable period last year. Consumers haven’t been impressed with the lack of major changes Apple has made to its newest models, and they continue to wait on artificial intelligence (AI) to be incorporated into next-gen iPhone models.

-

Though Mac sales are up about 2% year-over-year, they fell by a double-digit percentage last year. The return to the office for working Americans following the COVID-19 pandemic has put a serious damper on demand for personal computers/laptops.

-

Sales of iPad are down nearly 10% through the first nine months of fiscal 2024 to $19.7 billion.

-

Apple’s Wearables, Home and Accessories segment, which includes Apple Watch, has navigated a greater-than 8% sales slump, thus far, in fiscal 2024.

Even with Services now accounting for 24% of net sales and growing by double digits, Apple’s revenue is up by (drum roll) just 1% from the comparable period last year.

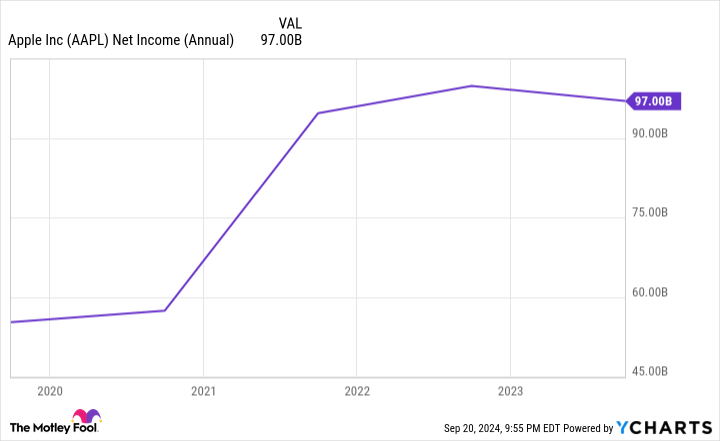

Although Services will lead to a higher operating margin over time, it alone hasn’t been packing enough punch to meaningfully grow Apple’s net income. Here’s a breakdown of Apple’s net income through the first nine months of its last four fiscal years:

-

Through Q3 2021: $74.129 billion

-

Through Q3 2022: $79.082 billion

-

Through Q3 2023: $74.039 billion

-

Through Q3 2024: $79 billion (on the nose)

Apple’s net income has gone nowhere in two years and is up by just 6.6% over the last three years. However, this operating weakness has been well-masked by the company’s ramped-up buyback program. All the while, Apple’s stock has gained 61% since the end of its fiscal third quarter in 2022, despite a nominal decline in its net income.

What makes this lack of growth even more egregious is that it occurred during a period of historically high inflation in the U.S. A record-breaking increase in U.S. money supply sent the prevailing rate of inflation soaring at a pace not witnessed since the early 1980s. Even with an exceptionally strong brand and pricing power in its sails, Apple’s revenue and profit growth have completely stalled.

This is a particularly big problem for Apple because it’s currently valued at 31 times forecast earnings for the upcoming year. This represents a 17% premium to its average forward-year price-to-earnings multiple over the trailing-five-year period.

In other words, Apple is historically pricey at a time when its operating performance is misfiring. No amount of share repurchases fixes this.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Apple’s Mammoth $700 Billion Investment Since 2013 Can’t Fix Its Biggest Problem was originally published by The Motley Fool