With booming adoption of artificial intelligence, many key semiconductor companies have seen their stock prices soar, after which several announced stock splits this year.

But there are two critically important companies in the background of all semiconductor production that may fly under many investors’ radar. This duopoly controls the software platforms virtually all chip companies use to design and test their semiconductors.

Having experienced a nice run over the past few years, these two stocks have also seen their share prices climb to the point where a stock split may be on the horizon.

Synopsys and Cadence Design Systems: Using AI to make AI

Synopsys (NASDAQ: SNPS) and Cadence Design Systems (NASDAQ: CDNS) are the two leaders in electronic design automation software, each with about 35% of the EDA market, with the rest occupied by smaller point solution players. With such a concentrated market, virtually all major chipmakers use one or both of these companies’ tools to design, prototype, and test chip designs. In addition, both Synopsys and Cadence also sell semiconductor IP design blocks, which are standardized portions of chips that they also license to chip designers.

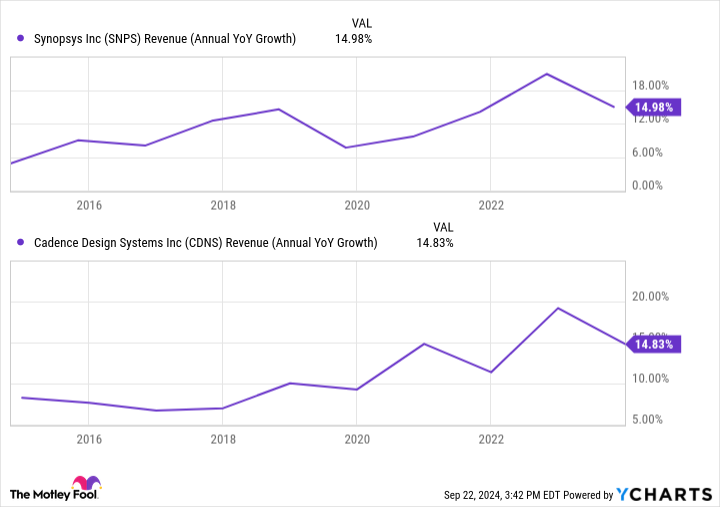

Both companies have strong tailwinds at their backs, which has led to an acceleration in revenue growth over the past decade.

Usually, it’s more difficult for companies to increase their growth rates as they get larger, due to the law of large numbers. But Synopsys and Cadence are benefiting from big secular tailwinds. These include:

-

More semiconductors are going into more devices than ever before, and the amount of chip content per device is only increasing. The AI revolution is only accelerating this trend.

-

More companies are developing chips than ever before. Cloud hyper-scalers are now designing their own custom designs, in addition to traditional merchant chipmakers.

-

Large chipmakers continue to develop more chips for more markets. Think of Qualcomm, traditionally concentrated in the phone market, coming out with its first PC processor this year.

-

Chipmaking designs have become more complicated at leading-edge nodes, increasing the need for new architectures, such as chiplets, backside power, and gate-all-around transistors.

Increased complexity is also good for these two stocks, as they can help chipmakers accelerate and test complex designs through their collective expertise. Both Synopsys and Cadence are now using more AI themselves within their software platforms in order to help customers design and produce new chips. One can think this as “AI helping chipmakers make better AI chips,” leading to a sort of virtuous circle as the AI wars heat up in earnest.

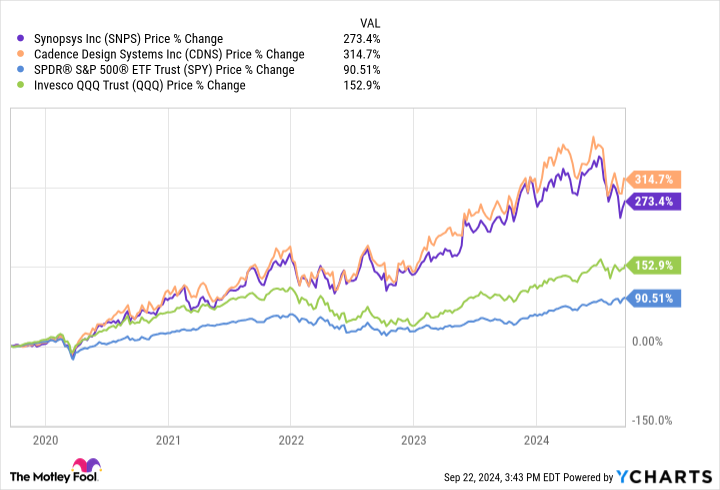

Synopsys and Cadence have had remarkable runs

As you can see, Synopsys and Cadence have each handily outperformed not only the S&P 500 but also the Nasdaq 100 over the past five years. Given the secular tailwinds just discussed and their revenue acceleration, that’s not surprising.

Nor is it surprising that Synopisis has seen its share price appreciate to $506 per share and Cadence levitate to $273 per share as of this writing. While those may not prompt the 10-for-1 stock split we’ve seen other AI-focused chip stocks execute this year, these stock prices are high enough for perhaps a 5-for-1 or 2-for-1 split soon, or something in-between.

Are these stocks too expensive to buy today?

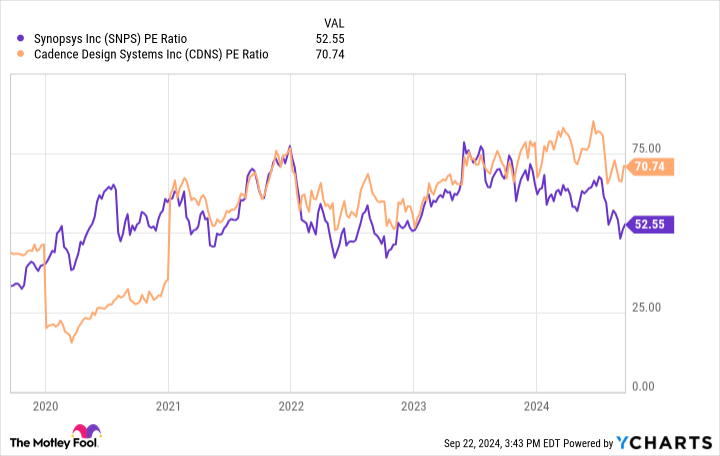

Synopsys and Cadence were never “cheap” in the sense that each had a high P/E multiple, owing to each company’s recurring software revenue and their strong oligopoly position in the growing semiconductor industry. However, their valuations have inflated to 71 times earnings for Cadence and 53 times for Synopsys.

That seems pretty expensive, but some Wall Street analysts think these prices are justified, given each company’s runway for growth. This is especially true as each has recently had a pullback, with Cadence down 15% and Synopsys down 18% from their respective highs.

In August, Baird analyst Joe Vruwink upgraded Synopsys, with a $663 price target. Justifying the move, Vruwink said he believes Synopsys can maintain at least a mid-teens growth rate over the coming years, which would enable a significant margin expansion as well. This is more optimistic than consensus, which appears to only assume a high-single-digit or low-double digit growth rate looking forward.

Some investors have grown skeptical of the sustainability of the chip industry’s recent run. However, investors tend to always fear the next downturn in the economically sensitive chip industry. Yet zooming out, the semiconductor sector has actually been the highest-performing in the market over the last 10 years.

Synopsys and Cadence are long-term compounders

Looking over the long-term for these two stocks, one needs to ask just a few important questions. Do you think AI will lead to outsized growth for chips, not only in data centers but edge devices like PCs, smartphones, and autos? Are these chips getting more complex? And will more companies, start-ups and mature tech firms alike, begin to design custom chips?

If the answer to all these questions is yes, these two well-positioned stock-split candidates are still long-term buys on any market or sectorwide pullback.

Should you invest $1,000 in Synopsys right now?

Before you buy stock in Synopsys, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Synopsys wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $712,454!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Billy Duberstein and/or his clients no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Cadence Design Systems, Qualcomm, and Synopsys. The Motley Fool has a disclosure policy.

Stock Split Watch: Two Artificial Intelligence (AI) Stocks That Look Ready to Split was originally published by The Motley Fool