Drivers are poised to benefit from lower prices at the pump as the world’s biggest oil exporting nation prepares to ramp up output.

Brent crude dropped more than 2pc to less than $72 per barrel on Thursday after reports suggested Saudi Arabia was ready to scrap its $100 price target for crude in preparation for increasing output.

It extends oil’s fall from more than $90 per barrel in the spring, with drivers already seeing an improvement when filling up their car compared to earlier in the year.

Saudi Arabia’s plans, which were reported by the Financial Times, indicate that the country will ramp up production even if it means a prolonged period of lower returns.

A litre of petrol has dropped to just over £1.35 on average, according to figures from the Department for Energy Security and Net Zero, down from £1.55 a year ago and a peak of more than £1.90 in 2022.

Diesel costs £1.40 on average, down from £1.60 last September and the high of almost £2 in the wake of Vladimir Putin’s invasion of Ukraine.

Simon Williams, at the RAC, said the further fall in oil prices means drivers can expect more cuts to fuel costs at the pump in the coming weeks.

He added: “A relatively low oil price, caused by lower demand globally, and a relatively strong pound are the two factors that are contributing to pump prices falling. We believe there is scope for pump prices to come down further in the next few weeks to reflect the lower wholesale costs retailers are paying when they buy fresh fuel stocks.”

However, experts warned prices were at risk of rising again with the Conservative government’s temporary 5p cut to fuel duty poised to expire in the spring.

Edmund King, president of the AA, urged Rachel Reeves, the Chancellor, not to use lower prices as an “excuse” to launch a tax raid on drivers in next month’s Budget.

“Although prices are lower now and have fallen, we do not want this to be an excuse for the Treasury to hike fuel duty,” he said.

“Fuel prices fluctuate erratically due to world events. It is good for drivers at the moment, but it is not guaranteed to last. The Treasury can use it as an excuse, then who knows, two weeks later the global price may increase again and it is a double hit to drivers.”

Lower petrol prices will also play into global politics, as the cost of living is a major factor in the US election campaign. The Democrats have been blamed by Republicans for high inflation in recent years, and so potentially stand to benefit from lower fuel prices in the States.

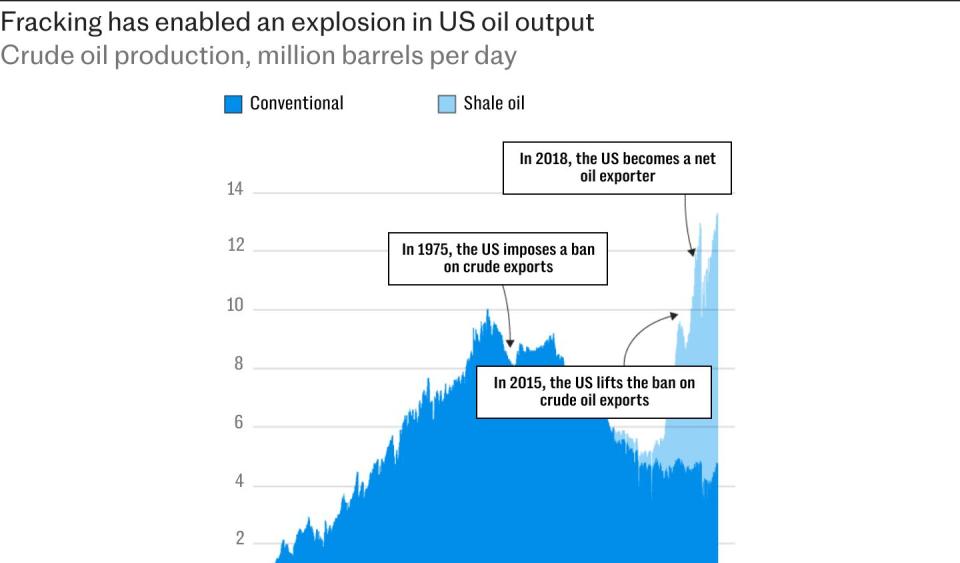

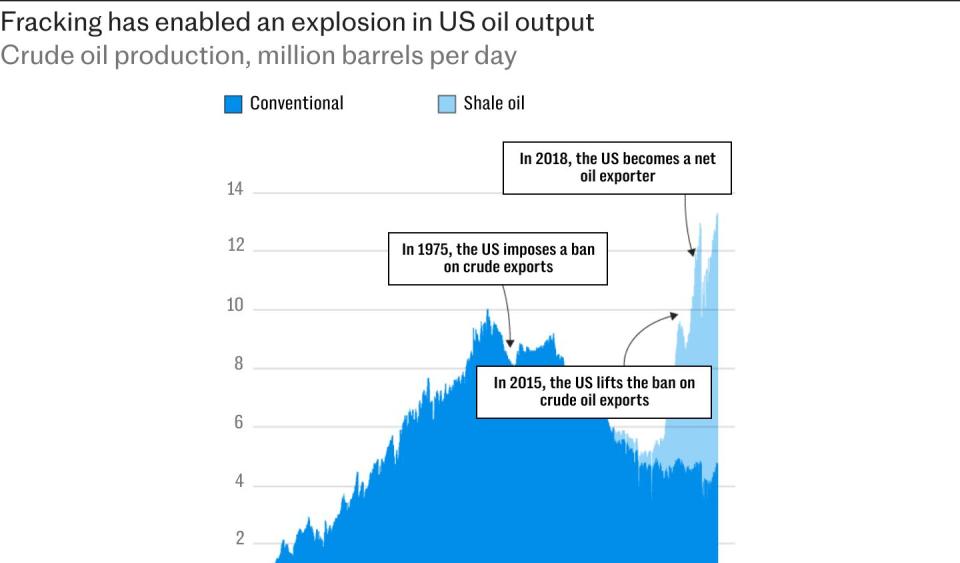

However, the US is also now a net energy exporter thanks to the fracking boom, so lower prices risk harming some parts of the American oil and gas industry.

The decline in the price of Brent was accelerated by separate news from Libya that its rival factions have agreed a process to appoint a new central bank governor, opening the way for restoring exports.

Fears that Saudi Arabia’s plans will trigger a dramatic fall in the price of Brent wiped nearly £11bn from the value of Britain’s biggest oil giants on Thursday. BP and Shell plunged to the bottom of the FTSE 100, down 4.8pc and 4.7pc respectively.

Ashley Kelty, director and research analyst for oil and gas at Panmure Liberum investment bank, said: “Crude prices gave up some of the recent gains on news that a deal had been reached in Libya which could see production resumed.

“There are also longer term worries over the state of the Chinese recovery and subsequent impact on demand growth. The new package of stimulus measures in China have failed to impress investors with some analysts arguing that this was a mere sticking plaster and would not help to resolve underlying structural issues in the economy.

“In Libya agreement over the selection of a new central bank governor could see both ‘governments’ resume oil production and exports which will see up to 1m barrels per day added to global supplies.”