The recent 50-basis-point rate cut by the Federal Reserve is a double-edged sword for investors. They probably like that it makes more projects economical, which should presumably increase profits and stock prices. Nonetheless, investors hoping to earn more from bank deposits and fixed income instruments will likely find they now earn less in interest.

Still, both of these phenomena work in the favor of dividend stocks. Not only will stock prices rise, but such stocks, which tend to yield lower average cash returns than fixed income investments, suddenly become more attractive income investments. These phenomena should work in the favor of higher-yielding stocks like Realty Income (NYSE: O), Innovative Industrial Properties (IIP) (NYSE: IIPR), and AT&T (NYSE: T).

Realty Income

Realty Income is a real estate investment trust (REIT) specializing in single-tenant properties rented on a net lease basis. Under these agreements, the tenant pays for maintenance, insurance, and property taxes.

These properties also happen to be attractive to many of the most prominent consumer businesses, with Walmart, Planet Fitness, and Wynn Resorts among many of their best-known clients.

Moreover, even in an environment of higher interest rates, Realty Income continued to develop properties. It added more than 2,000 properties last year by acquiring Spirit Realty, taking its total property count to around 15,500. This allowed it to grow profits and increase its monthly dividend throughout this time. At $3.16 per share annually, new shareholders earn a dividend yield of 5.1%.

Unfortunately, investors continued to punish the stock amid higher interest costs, and the stock still trades below its pre-pandemic highs.

However, the recent rate cut is about to offer significant relief on those high interest costs, which have weighed on profit growth. Now, with falling interest rates allowing the company to reduce that expense, it could give Realty Income the catalyst it needs to inspire a long-awaited recovery in the stock price.

Innovative Industrial Properties

IIP is an unusual REIT that serves a unique set of clients: medical cannabis growers. As a landlord, it is highly insulated from the volatility of the industry it serves. Still, since it provides the type of properties needed for its industry to succeed, it plays a critical role in the industry.

Nonetheless, over the last couple of years, the troubles in its industry caught up with it as clients began to miss rent payments. Fortunately, IIP proved itself adept enough to find new tenants or sell properties as a few clients could not pay.

Now, it seems to be on the road to recovery. The stock is up by more than 65% over the last year. That does not include the dividend, which has risen at least once per year since it began in 2017. Its $7.60 per share annual payout yields a return of 5.6%.

Additionally, its part of the industry could benefit if a proposed rescheduling of cannabis in the U.S. gains approval. The Schedule III designation makes FDA-approved cannabis products legal with a prescription, a move that could be hugely beneficial to IIP’s clients and, ultimately, the medical marijuana stock.

AT&T

At first glance, AT&T looks more like a dividend stock to avoid. Early in the decade, it admitted very costly missteps in buying DirecTV and the company then known as Time Warner. While it later spun those businesses off, the losses from these deals left a massive debt load. That prompted AT&T to walk away from a 35-year streak of annual dividend increases, slashing its payout by mroe than 45%.

However, its annual dividend of $1.11 per share yields its investors 5.2%. Investors who held this stock over the last 12 months gained an additional 40% on account of its rising stock price.

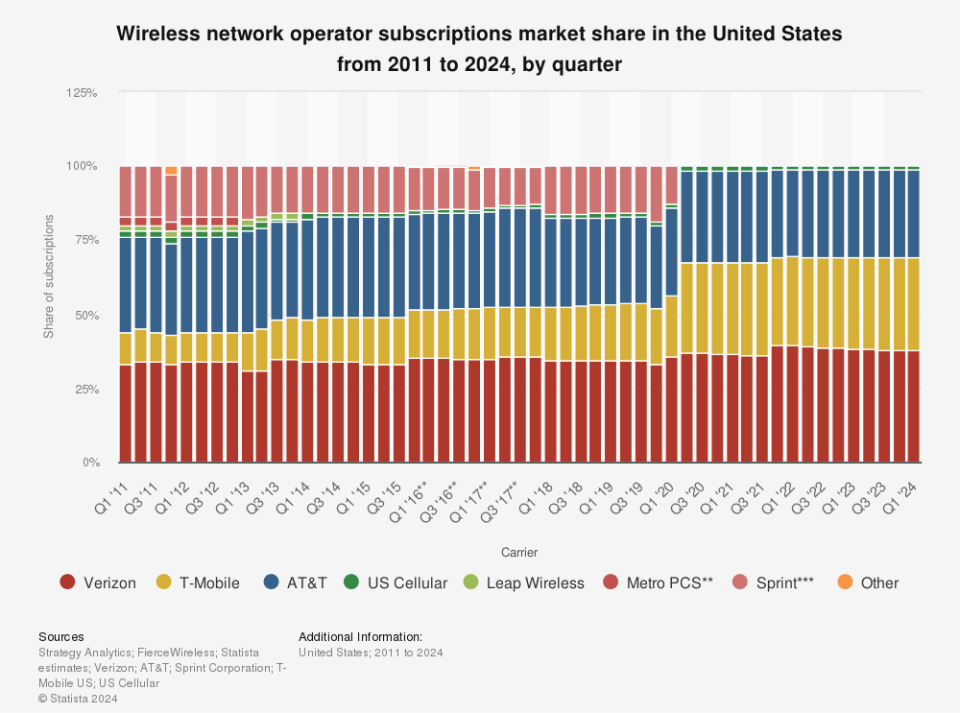

Why the turnaround? For one, AT&T holds a large market share amid intense competition from its two main peers, Verizon Communications and T-Mobile. Demand has also risen for higher-tier unlimited plans, helping it attract 419,000 postpaid phone net additions in the second quarter alone.

Additionally, with the 5G upgrade cycle running its course, AT&T has had to spend less on capital expenditures than it did in 2022, helping its profits to rise.

Finally, it is unlikely to need to cut its dividend. Its $19 billion in free cash flow over the last year helped it cover $8 billion in dividend costs during that time. Over the same period, total debt dropped by $12 billion to $131 billion. Hence, even as debt reduction strengthens its balance sheet, its improving business should benefit growth and income investors alike.

Should you invest $1,000 in Realty Income right now?

Before you buy stock in Realty Income, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $756,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Will Healy has positions in Innovative Industrial Properties. The Motley Fool has positions in and recommends Innovative Industrial Properties, Planet Fitness, Realty Income, and Walmart. The Motley Fool recommends T-Mobile US and Verizon Communications. The Motley Fool has a disclosure policy.

3 Dividend Stocks to Double Up on Right Now was originally published by The Motley Fool