With its stock trading at multiyear lows that have led to a nearly 12% dividend yield, Walgreens Boots Alliance (NASDAQ: WBA) has likely popped up on the radar of some value investors. As a result, some of them may be considering investing in the stock at these levels.

Before making any decision on Walgreens, investors might want to look at five things regarding this company that could affect their choice.

1. The stock is trading down 85% over the past decade

The stock has lost roughly two-thirds of its value so far in 2024, but Walgreens’ woes extend well beyond this year. The stock has lost 85% of its value in the past decade and finds itself trading at the same level as it did back in 1996.

Walgreens stock hit an all-time high of $96.68 back in August 2015, but it has been all downhill since then. Its peak came after it bought the remaining 55% stake in British pharmacy Alliance Boots right before the end of 2014.

2. Reimbursement pressures have been the company’s biggest issue

The biggest issue facing Walgreens has been consistent prescription drug reimbursement pressure, which it has called out since at least the start of 2016. Drug reimbursement prices have been pushed down by pharmacy benefit management companies (PBMs), which historically were hired to negotiate prices and lower costs for their health insurance provider customers.

However, the industry today is controlled by three PBMs, all of which are now owned by companies that also own health insurance businesses. Together they control nearly 80% of the market and have relentlessly pushed down reimbursement rates to pharmacies, to the point where in some cases pharmacies lose money by filling certain scripts. For its part, Walgreens has said it loses more each script it fills for popular GLP-1 drugs, such as Ozempic.

The reimbursement pressures can be seen in Walgreens’ gross margins over time. Over the past decade, its gross margins have gone from 28.2% in its fiscal year 2014 to 19.5% last fiscal year, which ended in August 2023. The company will report its fiscal 2024 results next month.

This has not only hurt Walgreens, but also smaller independent pharmacies. CVS Health has done better than most, but that is because it not only owns a pharmacy, but it also owns the biggest PBM with Express Scripts, as well as health insurance provider Aetna.

At this point, the reimbursement model is broken and is destroying the pharmacy industry. For its part, current Walgreens CEO Tim Wentworth is hoping to transition reimbursements to a cost-plus model, where pharmacies would be paid for the part they play in helping reduce inflationary pressures on drug prices and the services they provide. Wentworth was previously CEO of Express Scripts, so he knows the PBM business and their relationship with pharmacies as well as anyone.

It does not seem like it would be beneficial for PBMs to just completely run pharmacies into bankruptcy, but change does take time. Meanwhile, government regulators have largely stood still watching this happen, seemingly more concerned about fighting antitrust battles with big tech companies.

3. Walgreens made a poor investment in VillageMD

In a bid to expand beyond pharmacies struggling with reimbursement pressures, prior Walgreens management also made a very poor investment when it bought a controlling stake in VillageMD, an owner of primary care medical clinics that was itself scooping up other competitors in a bid to expand. The plan was for Walgreens to create a network where it could control the continuum of care, from the doctor to the pharmacy and places in between.

However, expansion for VillageMD beyond its initial markets proved unprofitable, and the company began to close clinics as losses began to pile up. To make matters worse, this summer, Walgreens revealed that VillageMD was in default of a $2.25 billion secured loan it had provided to the company. Meanwhile, Walgreens management said the company would consider selling part or its entire stake in VillageMD.

4. The company plans to close unprofitable locations

As part of Walgreens’ turnaround strategy, the company plans to close a significant number of its store locations over the next few years. It indicated that nearly 25% of its locations are unprofitable and that it will look to close stores that are too close together, unprofitable, and/or are dealing with too many theft issues.

Closing unprofitable stores should result in addition by subtraction and also lead to an increase in same-store sales reports, as some sales move to nearby stores. With lower fixed costs from fewer stores, this should lead to improved profitability over time.

Meanwhile, the pharmacy industry as whole is shrinking its store base, with CVS having closed stores in recent years and Rite Aid set to close up to 500 locations after filing for Chapter 11 bankruptcy protection last year. More sales across fewer stores should ultimately help the pharmacy industry and Walgreens.

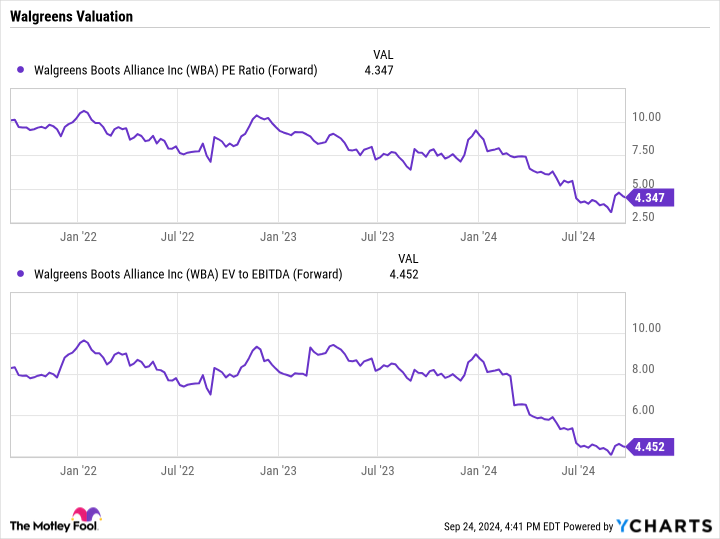

5. The stock looks incredibly cheap

Walgreens’ struggles have put the stock in the deep discount aisle. It trades at a forward P/E of less than 4.5 times earnings based on this fiscal year’s analyst estimates and a similar enterprise value-to-EBITDA (earnings before interest, taxes, depreciation, and amortization) multiple. Enterprise value takes into consideration its net debt.

Given its valuation, I think investors can win if the company is just able to get rid of the negative parts of its business, such as VillageMD and unprofitable stores. Meanwhile, if anyone can help change the reimbursement model, it should be Wentworth, given his PBM experience.

This is no easy fix, and the company could very well cut its dividend again to save cash, but it still has levers to pull to help the stock price and get the company on better financial footing, including the sale of its nonpharmacy businesses or even selling Alliance Boots in the U.K. As such, I’d view the stock as a speculative buy for investors who are OK with some short-term volatility.

Should you invest $1,000 in Walgreens Boots Alliance right now?

Before you buy stock in Walgreens Boots Alliance, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Walgreens Boots Alliance wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $756,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool recommends CVS Health. The Motley Fool has a disclosure policy.

5 Things You Need to Know If You Buy Walgreens Today was originally published by The Motley Fool