While the midstream energy sector is less vulnerable to fluctuations in oil and gas prices, the outlook for the Zacks Oil and Gas – Production and Pipelines industry remains uncertain. Reduced capital spending by upstream companies and weak global oil demand could negatively impact the utilization of midstream assets held by companies.

Despite the challenges, pipeline players are in a stronger position than upstream and downstream firms, as they benefit from steady, fee-based income through long-term contracts with shippers. Leading companies in the sector include Enbridge Inc. ENB, Kinder Morgan, Inc. KMI, The Williams Companies Inc. WMB and MPLX LP MPLX.

About the Industry

The Zacks Oil and Gas – Production and Pipelines industry comprises companies that own and operate midstream energy infrastructure assets. The properties consist of extensive pipeline networks that transport crude oil, liquids and natural gas. The midstream energy players are also involved in the processing and storing of natural gas. The companies have interests in natural gas distribution utilities, serving millions of retail customers across North America. Some companies are ramping up investments in renewable energy and power transmission businesses. The firms invested in wind farms, solar energy operations, geothermal projects and hydroelectric facilities. Thus, with a diversified portfolio of renewable energy projects, the firms have room to generate extra cash flows in addition to stable fee-based revenues from transportation assets.

What’s Shaping the Future of Oil & Gas – Production & Pipelines Industry?

Bearish Fuel Demand: The global oil demand outlook remains soft, especially in light of China’s economic struggles. China, which is the world’s biggest crude oil importer, is grappling with several significant issues. This is resulting in a contraction in China’s oil consumption, casting a shadow over the broader market sentiment. Lower demand for fuel will, in turn, reduce the need for oil pipeline assets and transportation infrastructure, affecting midstream players.

Shift to Renewables: Energy majors will increasingly face challenges in providing sustainable energy to the world while reducing greenhouse gas emissions. Thus, to address the issues of climate change, there will be a gradual shift from fossil fuel to renewable energy. This will lower the demand for the partnerships’ pipeline and storage networks for oil and natural gas.

Explorers’ Conservative Capital Spending: Oil and gas exploration and production companies are facing heightened pressure from investors to focus on stockholders’ returns rather than production. This is hindering production growth of commodities, thereby denting the demand for pipeline and storage assets.

Zacks Industry Rank Indicates Bleak Prospects

The Zacks Oil and Gas – Production and Pipelines is a nine-stock group within the broader Zacks Oil – Energy sector. The industry currently carries a Zacks Industry Rank #147, which places it in the bottom 41% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is the average of the Zacks Rank of all the member stocks, indicates gloomy near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

Despite the cloudy prospects, we present a few stocks that investors can retain or keep an eye on, given their solid potential. But before that, let us take a look at the industry’s recent stock market performance and its current valuation.

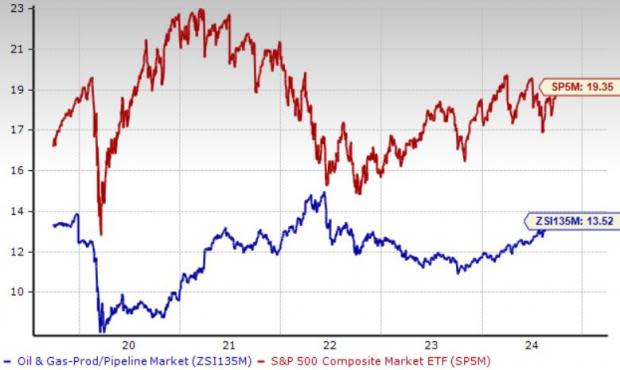

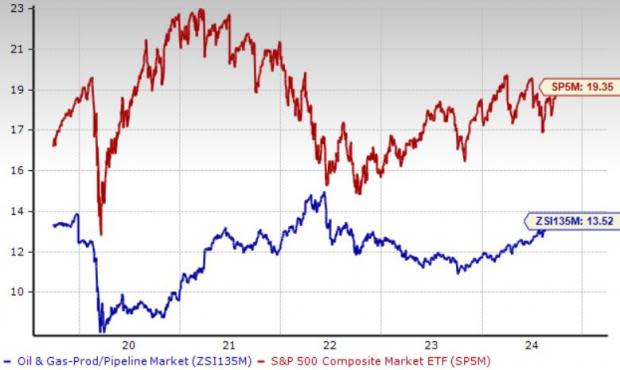

Industry Outperforms S&P 500 & Sector

The Zacks Oil and Gas – Production and Pipelines industry has outperformed the Zacks S&P 500 composite and the broader Zacks Oil – Energy sector over the past year.

The industry has jumped 40.4% over this period compared with the 36.4% rise of the S&P 500 and 5% growth of the broader sector.

One-Year Price Performance

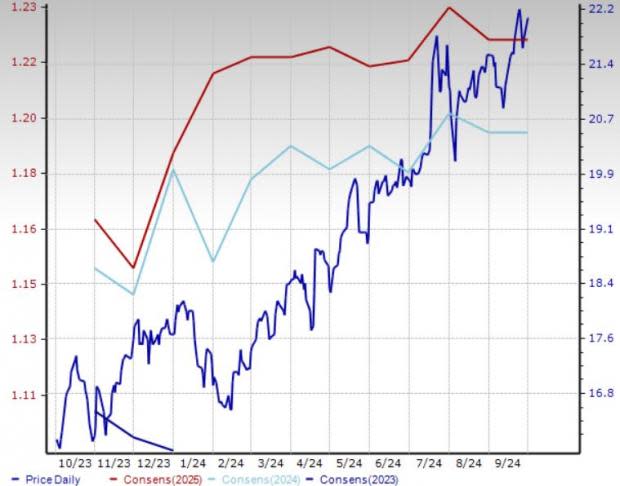

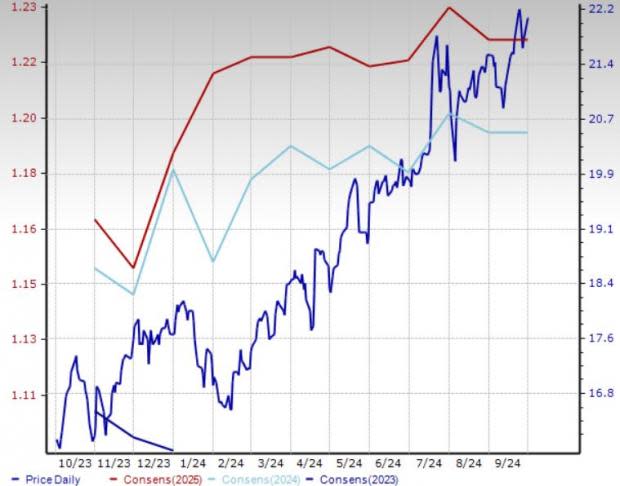

Industry’s Current Valuation

Based on the trailing 12-month enterprise value-to-EBITDA (EV/EBITDA), which is a commonly used multiple for valuing oil and gas production and pipeline stocks, the industry is currently trading at 13.52X, lower than the S&P 500’s 19.35X. It is, however, above the sector’s trailing 12-month EV/EBITDA of 3.10X.

Over the past five years, the industry has traded as high as 14.81X, as low as 8.67X and at a median of 12.39X.

Trailing 12-Month Enterprise Value-to-EBITDA (EV/EBITDA) Ratio

4 Oil & Gas Pipeline Stocks to Keep a Close Eye on

MPLX: The company generates stable cashflows and has lower exposure to commodity price volatility since it is the operator of midstream energy infrastructure and logistics assets. It also generates cashflows from a relatively stable fuel distribution business.

The partnership, currently carrying a Zacks Rank #3 (Hold), has attractive organic growth capital projects and is pursuing low-carbon opportunities. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

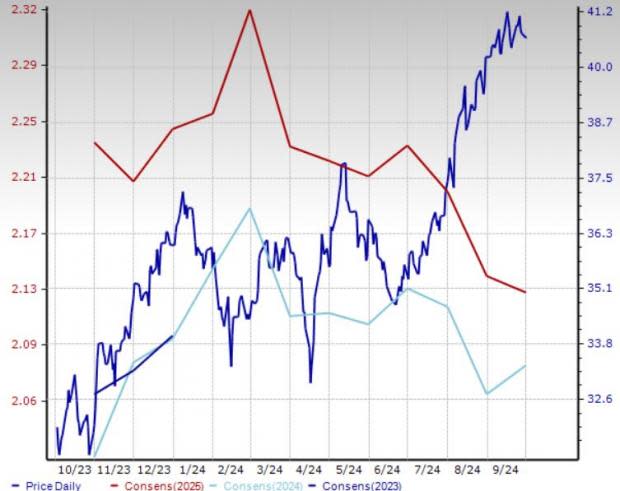

Price and Consensus: MPLX

Kinder Morgan: The company operates an extensive network of pipelines spanning 79,000 miles, transporting natural gas, gasoline, crude oil and carbon dioxide. In addition, it owns 139 terminals that store a variety of products, including renewable fuels, petroleum products, chemicals and vegetable oils.

As a leading midstream service provider, Kinder Morgan’s pipeline and storage assets are secured under long-term take-or-pay contracts. These contracts ensure that shippers pay for the capacity reserved, whether they utilize it or not, which provides a steady revenue stream. This structure allows Kinder Morgan, which currently has a Zacks Rank of 3, to generate stable earnings, primarily insulated from fluctuations in the volume of natural gas transported, thereby offering significant stability to its bottom line.

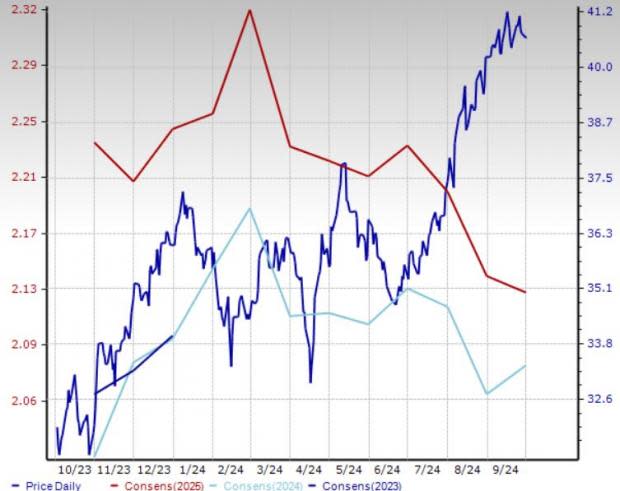

Price and Consensus: KMI

Enbridge: The company is a leading midstream energy player in North America, operating an extensive crude oil and liquids transportation network spanning 18,085 miles — the world’s longest and most complex system. ENB’s gas transportation pipeline network spans 71,308 miles, covering 31 U.S. states, four Canada provinces and offshore areas in the Gulf of Mexico. The company generates stable, fee-based revenues from these midstream assets, as they are booked by shippers on a long-term basis, minimizing commodity price volatility and volume risks.

With a Zacks Rank of 3 at present, the midstream energy major secures incremental cash flows from its C$24-billion backlog of secured capital projects, which include liquid pipelines, gas transmission, gas distribution and storage, and renewables, with the maximum in-service date of 2028.

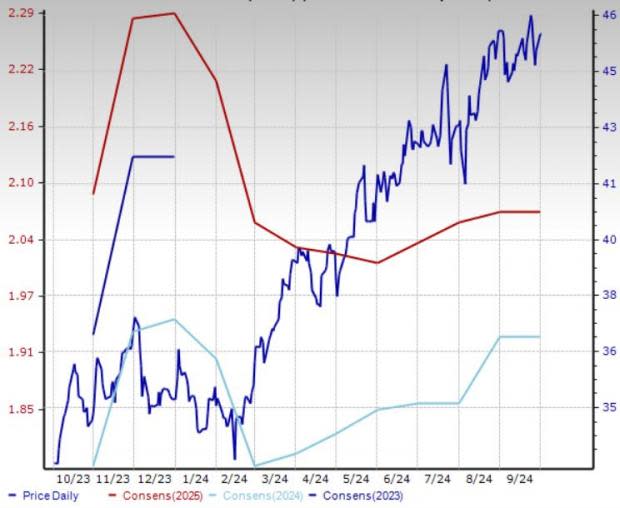

Price and Consensus: ENB

The Williams Companies: The company is well-poised to capitalize on the mounting demand for clean energy since it is engaged in transporting, storing, gathering, and processing natural gas and natural gas liquids.

With its pipeline networks spread across more than 30,000 miles, The Williams Companies connects premium basins in the United States to the key market. With a Zacks Rank of 3 at present, WMB’s assets can meet 30% of the nation’s natural gas consumption, utilized for heating purposes and clean-energy generation.

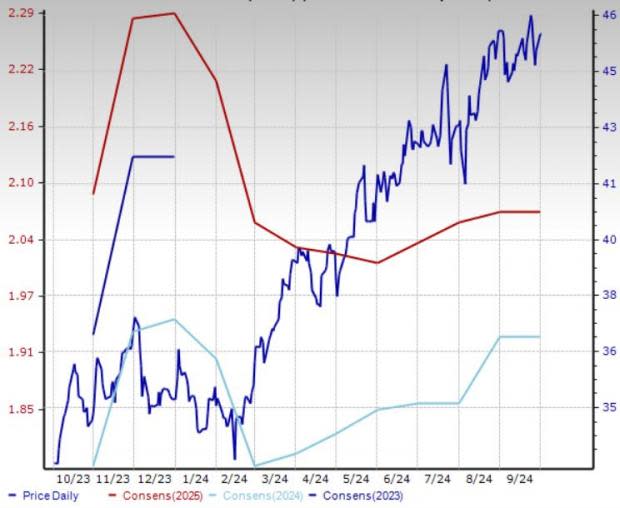

Price and Consensus: WMB

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Enbridge Inc (ENB) : Free Stock Analysis Report

Williams Companies, Inc. (The) (WMB) : Free Stock Analysis Report

Kinder Morgan, Inc. (KMI) : Free Stock Analysis Report

MPLX LP (MPLX) : Free Stock Analysis Report