The major stock market indexes continue to blast through record highs as 2024 shapes up to be another great year for investors. Since the start of 2023, the S&P 500 is up a mind-numbing 49.5%.

Despite the impressive performance, investors can still scoop up shares of quality companies without paying an exorbitant price relative to earnings. Honeywell (NASDAQ: HON), Phillips 66 (NYSE: PSX), and Delta Air Lines (NYSE: DAL) are three value stocks that pay dividends and are worth buying now.

Honeywell is making an effort to please investors with capital commitments

Daniel Foelber (Honeywell): On Sept. 27, Honeywell increased its dividend by 4.6% from $4.32 per share per year to $4.52. The increase puts Honeywell on track to deliver its 15th consecutive year of higher dividends in 2025 and is part of the company’s plan to boost shareholder value through dividends, acquisitions, capital expenditures, and buybacks.

Honeywell’s growth has been disappointing in recent years as the company has failed to convert opportunities in automation, the industrial Internet of Things, aerospace, and the energy transition into meaningful top- and bottom-line results. But there’s reason to be optimistic going forward.

Honeywell tends to be a stodgy company that is slow to change. But in June 2023, former head of Honeywell Performance Materials and Technologies, Vimal Kapur, took over as Honeywell CEO. In October 2023, Honeywell announced a strategic shift to realign its business to capitalize on its highest-conviction megatrends.

In its July investor presentation, Honeywell said it had already announced $10 billion in mergers and acquisitions (M&A) since 2023 and was on track to reduce its share count by 2% in 2024 through buybacks. The company is targeting $22 billion in share repurchases, M&A, and dividends between 2023 and 2025.

Honeywell remains in prove-it mode, but it has done a good job resetting expectations and setting a clear path toward achieving the steady earnings growth that investors were used to in years past.

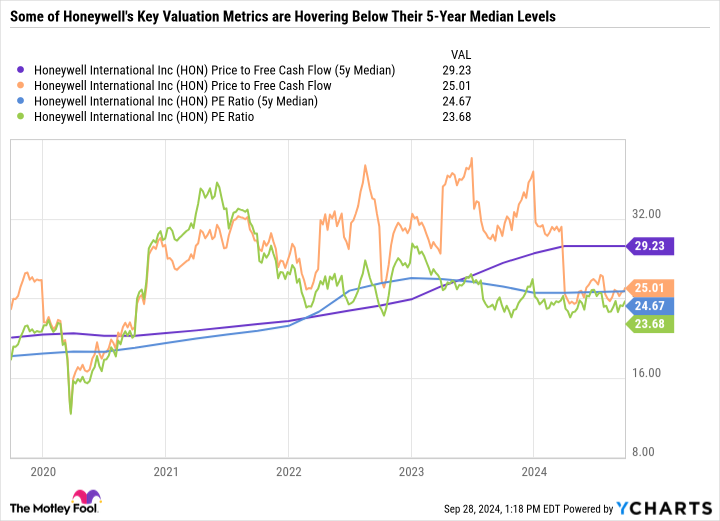

As for Honeywell’s valuation, the stock’s price-to-earnings (P/E) ratio and price-to-free cash flow ratio are both below their five-year median levels, suggesting investors are less optimistic about the company’s future prospects.

Honeywell was a market darling in the 2010s, posting a total return of 499% compared to 257% for the S&P 500. But in the 2020s, Honeywell has been a market underperformer for good reason, considering its underwhelming earnings growth.

It’s too early to say the worst is over for Honeywell, but the stock’s valuation, growing dividend, and potential to accelerate its turnaround make it a worthy value stock to consider buying now.

Forget the brakes, it’s time to step on the gas with Phillips 66 stock

Scott Levine (Phillips 66): You don’t have to be an expert in energy stocks to know that when oil and gas prices decline, energy stocks are likely to also slide. This is certainly the case with Phillips 66 over the past six months. During this time period, oil-price benchmark West Texas Intermediate fell about 12.3%, and shares of Phillips 66 have plunged more than 17%. For forward-looking investors, this sell-off provides a great buying opportunity for the energy stock — along with its juicy 3.5% forward-yielding dividend.

An operator of various midstream and downstream assets, Phillips 66 has reported strong financial results so far in 2024 albeit not as high as in the same period during 2023. Through the first half of 2024, Phillips 66 reported $3.3 billion in operating cash flow, a decrease from the $4.5 billion in cash from operations that it reported during the same period in 2023.

It’s critical to recognize, however, that the inferior performance simply reflects the impact of falling commodity prices. In fact, Phillips 66 achieved $100 million in cost reductions in the first and second quarters of 2024, and in its refining segment, the company reported 98% crude utilization — the highest such rate in over five years.

Although the stock’s slide may be disconcerting for some, it by no means signals that investors should keep it off their buy lists. Energy prices will rise again, and Phillips 66 stock will likely rebound with them. Until then — and even after — investors can rake in a steady stream of passive income as management intends to return 50% of operating cash flow to investors in the form of dividends.

An excellent value stock in the transportation sector

Lee Samaha (Delta Air Lines): The airline trades at just 7.7 times its estimated 2024 earnings and represents an excellent value opportunity for investors looking for exposure to airline stocks. The low valuation is likely a reflection of the perceived risk in the stock coming from its debt profile and its exposure to the cyclical nature of the airline industry.

However, those risks look overstated. Delta Air Lines currently has $19.2 billion in net debt, but management is focused on paying it down — and with $3 billion to $4 billion in free cash flow expected in 2024, it will have resources to do so further this year.

In addition, investors recently received some good news on the “cyclicality” issue. In usual cycles, airlines have tended to build capacity as the market improves, only to overextend themselves and walk into a period of overcapacity when demand growth starts to slow. The result is usually a sharp profit slowdown, as airlines stubbornly maintain unprofitable routes while waiting for an upturn.

Investors were worried about that scenario when overcapacity reared its head in the summer. However, Delta and United Airlines‘ management spoke at a conference recently and confirmed that the industry had acted rationally and cut less-profitable routes. As such, Delta and United are improving their revenue per available seat miles (RASM) metric again, implying that the overcapacity issue has gone.

That’s good news. With interest rates set to move lower, airlines could benefit from improved consumer discretionary spending and corporate travel. As such, Delta Air Lines looks like an excellent value stock.

Should you invest $1,000 in Honeywell International right now?

Before you buy stock in Honeywell International, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Honeywell International wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $716,988!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Daniel Foelber has no position in any of the stocks mentioned. Lee Samaha has no position in any of the stocks mentioned. Scott Levine has no position in any of the stocks mentioned. The Motley Fool recommends Delta Air Lines. The Motley Fool has a disclosure policy.

These 3 Bargain-Bin Dividend Value Stocks Have Become Too Cheap to Ignore was originally published by The Motley Fool