Joining the S&P 500 (SNPINDEX: ^GSPC) is a prestigious achievement for any American company. The index has a strict entry criteria: Companies must have a market capitalization of at least $18 billion, and they must be generating positive earnings. But even then, entry is at the discretion of a special committee that rebalances the index once every quarter.

Then there is the S&P 500 Growth index, which uses an even tighter criteria to reduce the 500 companies from the regular S&P down to its top-performing stocks. It only holds 231 companies as of this writing, and disregards the rest. As a result, the Growth index consistently outperforms the S&P 500 each year.

The Vanguard S&P 500 Growth ETF (NYSEMKT: VOOG) directly tracks the performance of the Growth index by holding similar stocks and maintaining similar portfolio weightings. Here’s why investors with $350 in spare cash can confidently buy the ETF heading into 2025.

Large holdings in the highest-quality stocks

Both the S&P 500 and the S&P 500 Growth indexes are weighted by market capitalization, meaning the largest stocks have a greater influence over their performance than the smallest. Technology is the biggest of 11 different sectors in the S&P 500 with a weighting of 31%.

The Growth index selects stocks based on their momentum and the sales growth of the underlying companies. Since tech giants like Nvidia tend to lead the rest of the market based on those factors, it’s no surprise the Growth index has a much higher weighting toward the tech sector, at 49.9%.

In fact, most of the top 10 holdings in the Vanguard S&P 500 Growth ETF are from the technology industry, and they each have a much higher weighting than they do in the regular S&P 500:

|

Stock |

Vanguard Growth ETF Weighting |

S&P 500 Weighting |

|---|---|---|

|

1. Apple |

12.40% |

6.97% |

|

2. Microsoft |

11.65% |

6.54% |

|

3. Nvidia |

11.03% |

6.20% |

|

4. Meta Platforms |

4.48% |

2.41% |

|

5. Amazon |

4.14% |

3.45% |

|

6. Alphabet Class A |

3.61% |

2.03% |

|

7. Alphabet Class C |

3.03% |

1.70% |

|

8. Eli Lilly |

3.01% |

1.62% |

|

9. Broadcom |

2.78% |

1.50% |

|

10. Tesla |

2.33% |

1.25% |

Data source: Vanguard. Portfolio weightings are accurate as of Aug. 31, 2024, and are subject to change.

Every company in that top 10 is creating value by developing and deploying artificial intelligence (AI) at the moment. Even Eli Lilly — which is a biopharmaceutical company — signed partnerships with start-ups like OpenAI and Genetic Leap earlier this year to help invent different drugs and therapies.

Tesla, which is known as an electric vehicle company, is also developing AI to power its autonomous self-driving software.

Apple, on the other hand, has over 2.2 billion active devices worldwide, so the company could soon become the largest distributor of AI to consumers through its Apple Intelligence software. It’s only available on the latest devices like the M3 MacBooks and the iPhone 16 right now, so the new AI features could drive a powerful upgrade cycle over the next few years.

Microsoft, Amazon, and Alphabet have each created their own AI models, virtual assistants, and chatbots. Plus, they are the top three providers of cloud computing services globally. Those cloud platforms have become distribution channels for AI models and data center computing capacity, which businesses need to develop and deploy AI software.

Nvidia designs the semiconductor industry’s most powerful graphics processors (GPUs) for the data center, which are at the heart of everything I just mentioned. The chips are in demand from OpenAI, Tesla, Microsoft, Amazon, Alphabet, and almost every other tech giant looking to capture the AI opportunity.

The Vanguard ETF could beat the S&P 500 (again) next year

The Vanguard S&P 500 Growth ETF is up 27.6% so far in 2024, beating the 21.5% gain in the S&P 500. Why? The top 10 holdings in the above table have generated an average return of 43.7% this year, so the index that assigns them a higher weighting is naturally going to perform better.

That is a consistent theme for the Vanguard ETF (and the Growth index). It has generated a compound annual return of 16% since its inception in 2010, comfortably beating the 13.7% average annual return in the S&P 500 over the same period.

The ETF rebalances every quarter by replacing its underperforming stocks. In other words, it will almost always outperform the S&P 500 over the long term because it doesn’t have to hold the stocks from that index that aren’t delivering strong results.

The only time the S&P 500 might do better is when dividend stocks experience a period of outperformance relative to growth stocks.

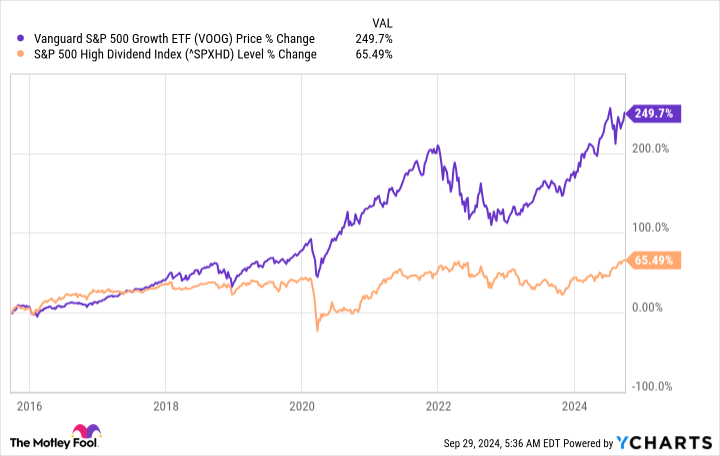

The chart below overlays the Vanguard ETF with the S&P 500 High Dividend index. Growth stocks only lagged dividend stocks for one year out of the last 10, and there is a stark difference in the overall return for that entire period, which makes the Vanguard ETF an obvious choice:

That’s why the Vanguard ETF looks like a great buy heading into 2025. But investors should always take a long-term approach because the difference in returns between the ETF and the S&P 500 can have a significant impact in dollar terms over time, thanks to the effects of compounding:

|

Starting Balance (2010) |

Compound Annual Return |

Balance In 2024 |

|---|---|---|

|

$50,000 |

16% (Vanguard ETF) |

$399,375 |

|

$50,000 |

13.7% (S&P 500) |

$301,728 |

Calculations by author.

Should you invest $1,000 in Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF right now?

Before you buy stock in Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $744,197!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

1 Unstoppable Vanguard ETF to Confidently Buy With $350 Heading Into 2025 was originally published by The Motley Fool