Spending on artificial intelligence (AI) infrastructure has been solid in 2024, which is evident from the terrific demand for data center chips and server solutions that has been driving impressive growth in revenue and earnings for several companies.

The good news for companies benefiting from the AI boom is that infrastructure spending in this area is set to keep growing in 2025 as well. According to Barclays, hyperscale cloud companies are on track to increase their 2024 capital expenditures by 41%, followed by an estimated increase of 15% next year. However, the investment bank added that the increase in capex next year could be much larger than 15%, thanks to higher spending on graphics processing units (GPUs) and custom AI chips being deployed in AI servers.

What’s more, market research firm Dell’Oro Group estimates spending on data center infrastructure is on track to increase at a compound annual growth rate (CAGR) of 24% through 2028.

All this explains why investors would do well to buy shares of Broadcom (NASDAQ: AVGO) and Dell Technologies (NYSE: DELL), two companies that are direct beneficiaries of the surge in AI-focused data center spending.

Let’s look at the reasons why buying these two names right now could turn out to be a profitable move for 2025 and beyond.

1. Broadcom

Broadcom makes application-specific integrated circuits (ASICs), which are custom chips designed for performing specific tasks. While GPUs are currently being deployed in huge numbers to train large language models (LLMs) thanks to their massive parallel computing power, McKinsey estimates that ASICs will be used for performing the majority of AI workloads by 2030.

That’s not surprising, as ASICs are purpose-built chips that are more energy efficient when compared to general-purpose computing chips such as GPUs. And because they are designed to perform specific tasks, ASICs carry a speed and performance advantage over general-purpose chips. This explains why JPMorgan estimates that the market for ASICs, which is currently worth $20 billion to $30 billion, could grow at an annual rate of more than 20% in the long run.

JPMorgan adds that Broadcom is the dominant player in ASICs, with an estimated market share of 55% to 60%. The company is set to generate $12 billion in revenue in the current fiscal year from sales of its custom AI accelerators and Ethernet networking chips deployed in AI servers. That would be nearly triple the $4.2 billion revenue Broadcom generated from selling AI chips last year.

The company expects to finish the ongoing fiscal year 2024 (which will end in early November) with $51.5 billion, which means that AI will account for 23% of its top line. That would be a nice improvement from last year, when AI accounted for 14% of its revenue.

Broadcom’s AI revenue is growing at a much faster pace than the market for custom AI chips, as stated by JPMorgan earlier. That’s because Broadcom’s networking chips are also witnessing healthy demand. The company’s networking revenue increased an impressive 43% year over year in the previous quarter.

Broadcom management said on the September earnings conference call that sales of its Ethernet switches jumped 4x from the year-ago period thanks to demand from hyperscale customers. Investors should note that the data center switching market is getting a nice boost because of AI, with Dell’Oro predicting that it could double in size over the next five years and generate $80 billion in annual revenue.

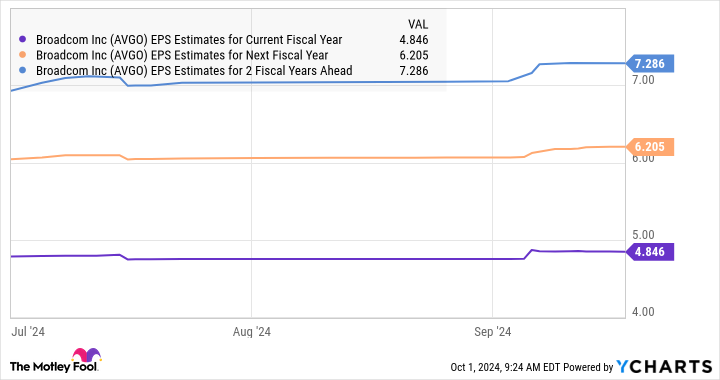

As such, Broadcom seems capable of maintaining an impressive pace of growth in the long run. Analysts are expecting the company’s bottom line to increase at an annual rate of 20% over the next five years. However, they have been increasing their expectations of late.

So, there is a chance that Broadcom’s earnings growth could outpace Wall Street’s expectations in the future, which is why it would be a good idea for investors to buy this AI stock before it jumps higher following impressive gains of 60% in 2024.

2. Dell Technologies

Dell is another company that has witnessed an improvement in its growth thanks to the increased spending on AI infrastructure. More specifically, increasing demand for AI servers has been a tailwind for Dell, driving impressive growth in the company’s infrastructure solutions group (ISG) through which it sells server and storage products.

The company’s revenue in the second quarter of fiscal 2025 (which ended on Aug. 2) increased 9% year over year to $25 billion. However, the company’s ISG business grew at a much faster pace of 38% and delivered a record revenue of $11.6 billion. Within the ISG business, Dell said its servers and networking products witnessed a terrific year-over-year increase of 80% to $7.7 billion.

The company shipped $3.1 billion worth of AI servers last quarter, and received $3.2 billion worth of new orders from cloud service providers (CSPs). More importantly, Dell said its “AI server pipeline expanded across both tier 2 CSPs and Enterprise customers again in Q2 and now has grown to several multiples of our backlog.”

That’s not surprising, as the AI server market is witnessing outstanding growth. This market could clock annual revenue growth of 18% through 2032, generating an annual revenue of $183 billion at the end of the forecast period. Not surprisingly, Dell said it is in the early innings of the AI opportunity, which is why there is a solid chance that the robust growth of its ISG business will start driving the needle in a more meaningful way for the company in the future.

Dell’s fiscal 2025 revenue guidance of $97 billion would be a 10% improvement from the previous year. For comparison, the company’s revenue was down 14% in fiscal 2024. So AI has already started driving an improvement in Dell’s fortunes, and that trend is expected to continue in the future thanks to the additional AI-related opportunity in the form of the personal computer (PC) market.

All this explains why Dell’s earnings are expected to increase at an annual rate of almost 11% over the next five years. That would be a big improvement over the 1.5% annual earnings erosion the company has witnessed in the past five years.

Finally, Dell’s forward earnings multiple of just 15 makes buying the stock a no-brainer right now, as it represents a discount to the Nasdaq-100 index’s forward earnings multiple of 29 (using the index as a proxy for tech stocks). Dell stock has recorded impressive gains of 55% in 2024, and it has the potential to fly higher thanks to the AI-driven turnaround in its business.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase. The Motley Fool recommends Barclays Plc and Broadcom. The Motley Fool has a disclosure policy.

2 Top Artificial Intelligence (AI) Stocks to Buy Before 2025 was originally published by The Motley Fool