A good stock is an even better buy at a low price. It doesn’t necessarily follow, however, that all discounted stocks are great investments. After all, the company in question must first be worth owning at any price.

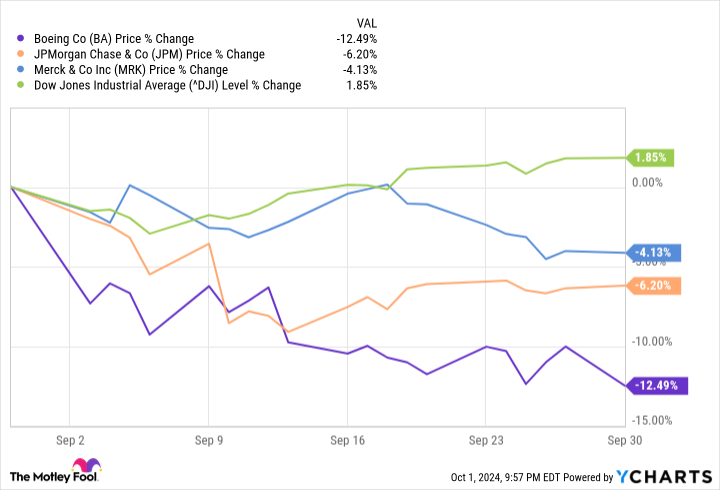

This truism presents something of a conundrum for investors right now. Several blue chip stocks found in the Dow Jones Industrial Average (DJINDICES: ^DJI) tumbled last month even though the Dow itself made forward progress. Are these setbacks buying opportunities? Or are they omens of what’s to come?

What went wrong

September’s three worst-performing Dow stocks are Merck (NYSE: MRK), JPMorgan Chase (NYSE: JPM), and Boeing (NYSE: BA), down 4.1%, 6.2%, and 12.5%, respectively. For comparison, the Dow Jones Industrial Average gained nearly 2% last month.

What went wrong?

For Merck, much of last month’s weakness is an extension of selling that first started in August following a lackluster second-quarter report, which forced the drugmaker to lower its earnings guidance for the full year. Much of September’s lethargy also stems from news that a cancer treatment from pharmaceutical outfit Summit Therapeutics shows promise as an alternative to Merck’s flagship oncology drug Keytruda. It’s not necessarily disastrous for Merck, but it is a concern.

JPMorgan Chase also warned last month that net interest income would likely fade in the coming fiscal year. That was before the Federal Reserve cut the fed funds rate by 50 basis points, and then added that a more gradual pace of rate cuts is in the cards at least through 2026.

In other words, JPMorgan was correct to suggest caution.

Boeing’s woes are far better documented. In addition to its Starliner spacecraft returning from the International Space Station without its two intended astronauts, labor woes and yet another apparent manufacturing flaw — rudders on the 737 MAX, this time — took their clear toll.

Are any or all of these pullbacks buying opportunities? It depends.

Weighing the past, present, and future

Sure, last month’s pullbacks are opportunities to step into well-established blue chip names at a discounted price. Each company may be facing clear challenges right now, but that’s nothing unusual. All companies experience occasional turbulence.

From a stock picker’s strategic perspective, though, the philosophical point of view oversimplifies the art. Choosing stocks is best done on a case-by-case basis.

Yes, Merck’s vulnerable. Cancer-fighting Keytruda accounts for nearly half of Merck’s top line. Even if Summit’s Ivonescimab appears to be a more effective lung cancer therapy, however, Keytruda is used as a treatment for a wide range of cancers, with more on the way. Indeed, while the drugmaker’s profits may be crimped for the remainder of the year, this is arguably already reflected by the stock’s pullback that’s pumped the well-protected dividend’s yield up to 2.7%.

In other words, if you were interested in Merck before, nothing meaningful has changed in the meantime except the stock’s price, which is nearly 20% below analysts’ consensus target, by the way. The vast majority of these analysts also rate Merck shares as a strong buy.

JPMorgan’s story is different enough to matter. While it will survive shrinking net interest income, the headwind will also take an oversized toll on the company’s bottom line. See, net interest income accounts for more than half of the bank’s profits. Although this profit center isn’t simply going away, it is apt to be disappointing for a couple of years. Should the global economy remain lethargic, the rest of JPMorgan Chase’s business could be lackluster, too. Given that this stock is still just off of record highs reached in August despite the recent lull, there’s not enough potential upside here to justify the risk.

As for Boeing, it’s certainly the trickiest ticker of the three to weigh right now. On balance though, there’s simply too much uncertainty here to bother with it when there are so many other investment options worth owning.

Don’t misread the message. Despite the worry, Boeing’s Starliner spacecraft ended up returning to Earth safely. And, in spite of seemingly never-ending issues with its newest passenger jets, there’s nothing wildly unusual about this latest round of potential problems. Investors’ sensitivity to them is simply heightened, largely thanks to expectations that its newly designed 737 MAX and 787 Dreamliner planes would be practically perfect when they first began rolling off the assembly line. That was never a fair expectation, though. Moreover, dented reputation or not, the air travel industry’s impending growth means the world simply needs Boeing’s aircraft. Its own outlook suggests airlines will collectively be purchasing nearly 44,000 new jets — from somewhere — between now and 2043, for perspective.

This is a long-term matter, though, with a few too many potential pitfalls on the near-term horizon. Boeing may be more headache than it’s worth right now.

Take (most of) the hint

This mindset won’t always be the case. In some months (often the worst months for the stock market) the Dow’s biggest losers are buy candidates largely because their sell-offs are overblown.

That’s not the case here, however. All three of the aforementioned pullbacks were dished out in defiance of the Dow Jones Industrial Average’s respectable gain. That means investors made a reasoned choice to send these stocks lower. While Merck is arguably an exception, for Boeing and JPMorgan, take the hint given by last month’s weakness. Now’s not the time to wade in. Shop around for something else.

Should you invest $1,000 in Boeing right now?

Before you buy stock in Boeing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Boeing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Merck and Summit Therapeutics. The Motley Fool has a disclosure policy.

Is It Time to Buy September’s Worst-Performing Dow Jones Stocks? was originally published by The Motley Fool