The biggest winners in the stock market over the last two years have all been great companies fueling the biggest innovations in artificial intelligence (AI).

Nvidia is the poster child of big AI stock winners. Its GPUs are essential equipment for training and running large language models. It has seen its stock climb 865% over the last 24 months, leading to a 10-for-1 stock split in June.

Nvidia was far from the only AI-fueled stock to split shares this year. It was joined by Broadcom, Super Micro Computer, and Lam Research, which all executed splits.

A stock split isn’t necessarily a catalyst for a stock to zoom higher. The fundamental value of a company doesn’t change when management decides to split its shares. And in today’s age of fractional shares, it only has a minor impact on making the stock more accessible to small investors.

But a stock split is a sign of confidence from management that shares will continue to climb, and few people have more insights into the future of a company and its stock than management.

So, investors are rightly interested in what could be the next stock to undergo a split. One company essential to the supply of AI semiconductors looks like a great candidate: ASML Holding (NASDAQ: ASML). And at today’s share price, investors should be looking to buy the stock before it announces a split.

An essential part of the supply chain

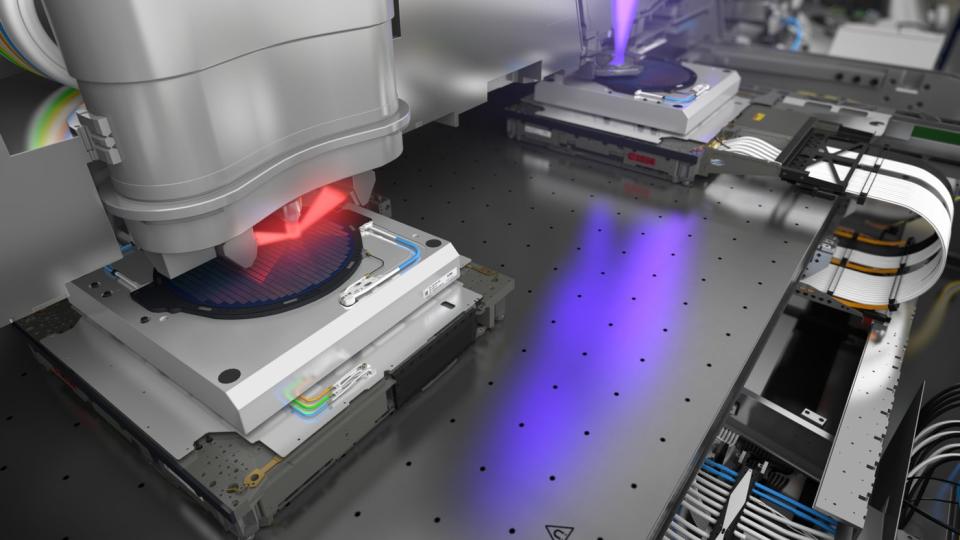

ASML builds and services photolithography machines, which semiconductor manufacturing companies use to produce the chips designed by companies like Nvidia. Basically, without ASML’s machines, there are no AI chips.

It’s the only supplier of extreme ultraviolet lithography (EUV) machinery, a necessary technology for printing the most advanced chips, such as those used in AI data centers for training and running large language models. If a manufacturer is printing a high-end semiconductor, it’s using ASML’s machines.

Customers include Taiwan Semiconductor Manufacturing, Intel, and Samsung. All three revamped their foundries about a decade ago to accommodate ASML’s machinery.

But the company isn’t reliant on selling more machines every year to fuel revenue growth. It receives ongoing revenue from servicing machines already in use and selling replacement parts. The recurring revenue from servicing should grow as more machines are installed in chipmakers’ foundries.

ASML’s revenue from its installed base has grown significantly faster than its system sales over the last 15 years as foundries add more of its equipment to their operations while maintaining and updating old equipment. And given the long lifespans of ASML’s machines (25 to 30 years), that’s a steady and growing source of high-margin revenue.

Newer machines using the latest EUV technology will go into service next year. And the increased complexity of the high-end machines could result in even greater revenue from service and replacement parts relative to older machines.

The future looks bright

ASML referred to 2024 as a transition year. It doesn’t expect any revenue growth, and it forecasts gross margin contraction this year as it gears up to sell its latest EUV machines.

That stands in stark contrast to a company like Nvidia, which has seen revenue and profits continue to soar in 2024. So it’s no wonder investors haven’t been nearly as excited about ASML as they are about big-name chipmakers.

But that could be an opportunity for patient long-term investors. ASML expects 2025 to be a big year. Management’s outlook calls for between 30 billion and 40 billion euros ($33.17 billion to $44.2 billion) in revenue next year as foundry openings using its newest machines go into service. At its midpoint, that represents a 27% increase from 2023.

At its investor day in 2022, management provided an outlook for sales in 2030 of between $48.65 billion and $66.34 billion. Considering that was before the AI boom really took off, it’s a good bet that revenue will come in on the high end. Management might update that outlook to a higher or narrower range at its next investor day in November.

Along with sales growth, management expects strong margin expansion. It sees gross margins between 54% and 56% in 2025 and 56% and 60% by 2030. And while it hasn’t explicitly forecast operating margin expansion, it should see good operating leverage from its research-and-development and selling, general, and administrative expenses as its revenue scales up toward the $66 billion mark.

All of that should translate into very strong profit growth. And considering the technology lead and relationships ASML already has with the largest foundries in the world, there shouldn’t be much standing in the way of achieving those numbers.

Will this be the next big stock split?

ASML currently trades around $835 per share. While that’s well off its all-time high of around $1,100, it’s still quite a lofty price. Stocks have split with far lower prices.

The company last executed forward splits in the late 1990s and the year 2000 amid the dot-com boom. With a strong outlook based on the ongoing spending to build the next generation of AI chips, ASML could be motivated to split its shares in the near future as it sees significant growth ahead.

Even without a stock split, you should consider adding shares to your portfolio. The stock currently trades around 26 times forward earnings expectations. Given the potential for strong and predictable revenue increases and margin expansion for years to come, the company should be able to produce earnings growth that more than justifies that slight premium to the overall S&P 500. And when you compare ASML’s price to other AI stocks, it’s an absolute bargain.

Should you invest $1,000 in ASML right now?

Before you buy stock in ASML, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ASML wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Adam Levy has positions in Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends ASML, Lam Research, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

This Could Be the Next Big Artificial Intelligence (AI) Stock Split. Here’s Why You Should Buy It Before It Happens. was originally published by The Motley Fool