If you’re an investor looking for stocks that can produce giant streams of passive income, you may have noticed a couple of well-established dividend payers have been beaten down a long way over the past 12 months.

The past year has been a lousy time for holding shares of Walgreens Boots Alliance (NASDAQ: WBA) and Western Union (NYSE: WU). Both of these dividend payers have been beaten down to near 52-week lows. At their beaten-down prices, it’s only natural for everyday investors to wonder if they could be a bargain.

Here’s a closer look at why these stocks are under pressure to see if they could be bargains now.

1. Walgreens Boots Alliance

Shares of Walgreens Boots Alliance are down by about 62% over the past 12 months. Investors reacted harshly to a dividend reduction the company announced in January from $0.48 per share down to $0.25 per share, and the stock hasn’t stopped falling since.

The stock has fallen so low that its reduced quarter dividend payout can produce an eye-popping 11.5% yield for investors who buy at recent prices. With such a high yield, long-term investors could realize market-beating gains if the company can just maintain its payout at its present level.

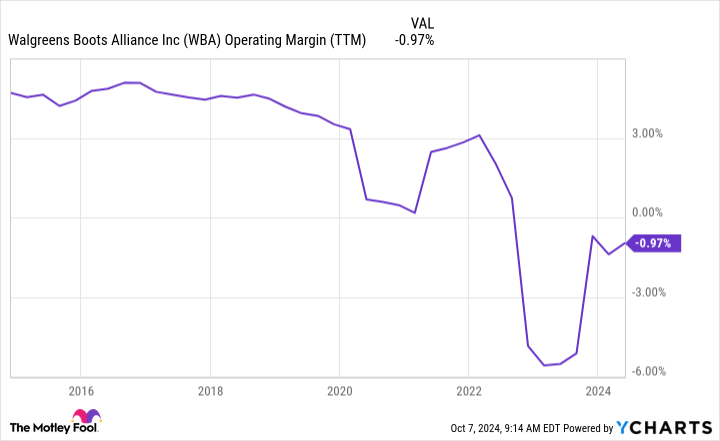

With more than 8,700 retail locations, Walgreens is one of the world’s largest purchasers of prescription drugs. Economies of scale gave the company a strong advantage, but it isn’t enough anymore to produce strong profits. Over the past few years, Walgreens Boots Alliance’s operating margin has dwindled from reliably positive to disturbingly negative.

These days, pharmacy benefit managers (PBMs) run by just three companies, CVS Health, UnitedHealth Group, and Cigna, process nearly 80% of all U.S. prescriptions. These three PBMs are vertically integrated with their own retail, specialty, and mail order pharmacies. Without a big PBM of its own, Walgreens’ pharmacy operation is unlikely to become a reliable source of profits again.

A declining retail pharmacy business isn’t Walgreens’ only problem. An attempt to become a leading provider of primary care services has been a disaster. Earlier this year, the company’s joint venture with Cigna, VillageMD, recorded a $12.4 billion impairment charge.

Walgreens stock might seem like a bargain at a recent price of about 4.6 times forward-looking earnings expectations. Without a clear plan to combat the powerful PBM industry, though, earnings and its dividend payout will likely continue declining. It’s probably best to avoid this falling knife until it has a plan to address challenges facing all retail pharmacies not integrated with the big three PBMs.

2. Western Union

Shares of Western Union have lost more than half their value since reaching an all-time high in 2020. The beaten-down provider of remittance services started to recover this spring, but disappointing quarterly results have pushed it back down to near a 52-week low. At recent prices, the stock offers an 8% yield.

With roots that go back to 1851, Western Union is arguably the world’s most recognized provider of international remittance services. Unfortunately, brand recognition hasn’t prevented a slew of competing remittance providers from gaining market share.

In the first half of 2024, Western Union reported revenue that declined by 4% year over year. The company isn’t necessarily lowering prices, but it had to improve the exchange rates it offers to compete with upstarts that don’t mind racing the 173-year-old company to the bottom.

Remitly (NASDAQ: RELY) is a 13-year-old provider of remittance services that is beating the pants off of Western Union. Revenue in the first half is up 31% year over year, and it isn’t the only remittance service gaining market share. Wise (LSE: WISE) reported total sales that grew 24% during its fiscal year that ended March 31.

Remitly is still losing money, but Wise can easily apply even more pressure to Western Union’s profit margins if it wants to. The British company generated about $636 million in free cash flow in fiscal 2024. That was an impressive 46% of total revenue.

Western Union hasn’t raised its quarterly dividend payout since 2021. It’s hard to imagine the company increasing dividend payments while its share of the international remittance market is shrinking.

Western Union shares have been trading for about 6.7 times forward-looking earnings expectations. While this is an extremely low valuation, competing with Wise and Remitly will probably get more difficult as customers become more familiar with the younger services. It’s probably best to watch this stock from a safe distance.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,006!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,905!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $388,128!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Cory Renauer has positions in CVS Health. The Motley Fool has positions in and recommends Wise Plc. The Motley Fool recommends CVS Health and UnitedHealth Group. The Motley Fool has a disclosure policy.

2 Ultra-High-Yield Dividend Stocks Are Near 52-Week Lows. Is It Time to Buy the Dips? was originally published by The Motley Fool