Despite its massive run-up this year, perhaps no company is quite as divisive among investors at the moment as Palantir Technologies (NYSE: PLTR). The share price for this tech stock, which was just added to the S&P 500, has more than doubled this year and was among the market’s top performers last quarter.

Given that strong performance, it is no surprise that many investors wonder if Palantir stock is a buy, sell, or hold. Let’s look at the cases for each.

The buy case for Palantir

While Nvidia has been the biggest artificial intelligence (AI) beneficiary on the hardware side, Palantir has the opportunity to be among the biggest beneficiaries on the software side. The company already established itself as one of the top analytics providers in the world by helping the U.S. government fight terrorism and track the spread of COVID-19 during the pandemic.

Its new Artificial Intelligence Platform (AIP) expanded the use cases for Palantir’s technologies and is being rapidly adopted by commercial customers. The company is getting wins from clients across various industry verticals, including healthcare, insurance, energy, industrials, restaurants, and retailing. The breadth of the industries Palantir is serving is impressive, as AIP helps customers build AI apps, actions, and agents to solve complex problems. AIP also has out-of-the-box AI solutions as well as starter packs and templates that can be customized if needed.

The company is seeing impressive growth in its U.S. commercial segment, with revenue growing 55% year over year last quarter, as it brings in new customers through its boot camps. These five-day camps help potential customers understand how to apply AI to crucial operations. The strategy is working as U.S. commercial customers grew by 83% year over year in the second quarter.

Moving all these new customers from the prototypes they create in its boot camps to production is Palantir’s biggest opportunity. The company is already seeing solid net dollar retention, up 114% last quarter, but that number does not reflect the new customers it has added in the past year with its boot camps. Palantir said this transition has been very difficult for most companies but that it has been able to do so smoothly, as demonstrated by a recent expansion with Tampa General Hospital.

The “expand” part of Palantir’s land-and-expand strategy is about to really kick in and help accelerate growth in the future.

Meanwhile, Palantir continues to win new U.S. government contracts, which should help reaccelerate growth from its largest client. These include a $99.8 million deal over the next five years for the military to use its AI-powered Maven Smart System to help improve battlefield awareness.

Right now, the company has a lot of opportunities and could just be scratching the surface of its potential.

The sell case for Palantir

For the sell case, investors need look no further than the company’s executives, who are doing just that: selling Palantir stock. Chairman Peter Thiel sold 28.6 million shares between Sept. 24 and Oct. 1. The speed at which Thiel dumped so many shares speaks volumes. He also sold 7 million shares in March and nearly 13 million in May.

CEO Alex Karp also greatly accelerated his stock sales. Between Sept. 13 and 17, he exercised and sold 9 million options at an exercise price of $11.38 that were not set to expire until 2032. Karp has sold shares before, but this was his largest sale by number of shares since he sold at the IPO and a big step up from the 575,000 shares he sold in August and the 729,000 he sold in May.

Other company executives and directors have also picked up their selling, all seemingly triggered by the stock’s rise in price. And that leads to the biggest reason to sell Palantir stock: its valuation.

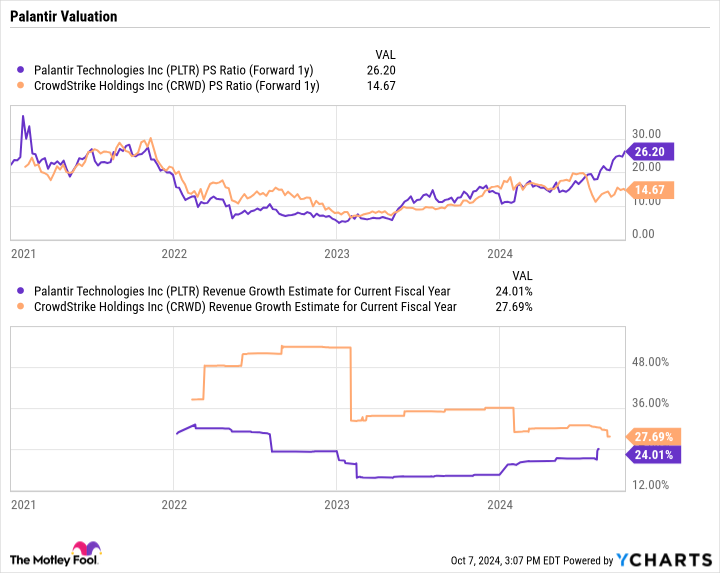

The stock trades at a forward price-to-sales multiple (P/S) of 26 based on next year’s analyst estimates. Very fast-growing, high-margin software-as-a-service (SaaS) companies can command high multiples, but a forward P/S of 26 for a company that grew revenue 27% last quarter is pretty extreme.

For example, CrowdStrike is expected to grow a bit faster than Palantir this year, but its stock trades at a P/S ratio of less than 15.

The hold case for Palantir

The hold case for Palantir simply comes down to thinking the stock can accelerate and grow into its hefty multiple in the next few years.

Palantir could generate sales of about $6 billion in 2027 if it manages 30% revenue growth each of the next three years (a rate higher than its current pace). At a P/S of 15, the same as CrowdStrike, the price would be about $41, close to where it trades today.

At 35% sales growth, it would generate 2027 revenue of $6.8 billion, and at a P/S of 15, it would be a $46 stock. At 40% growth, it would generate 2027 revenue of $7.6 billion, and at a P/S of 17, it would be a $59 stock.

If it grows at 40%, I would expect a higher multiple, which is why I used 17 times in this scenario. In the latter scenario, it would certainly be worth holding the stock, although that type of growth acceleration would be quite extraordinary.

The verdict

At this point, I would follow Palantir management’s lead and at least sell some stock if I owned it. The executives seem to think selling shares when they are above $35 is the right move.

The future for the company is bright, but its valuation is well ahead of itself at this point. Holding or buying the stock is really betting that the company can accelerate its revenue growth closer to 40% or more and sustain it over the next few years. While it’s possible, it wouldn’t be easy. But if Palantir becomes the dominant AI software winner, much like Nvidia did in hardware, the sky is the limit.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $814,364!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CrowdStrike, Nvidia, and Palantir Technologies. The Motley Fool has a disclosure policy.

Palantir Stock: Buy, Sell, or Hold? was originally published by The Motley Fool