Billionaire stock portfolios can unearth top investment ideas. Most billionaire investors, after all, have superb track records when picking equities.

Point72, a global asset manager led by billionaire Steven A. Cohen, has been steadily buying shares of gallium nitride (GaN) power integrated circuit specialist Navitas Semiconductor Company (NASDAQ: NVTS) since the first quarter of 2023.

After adding another 4.12 million shares in the second quarter of 2024, Point72 now owns a 2.34% stake in the next-generation semiconductor company. This investment is intriguing for several reasons.

First, Navitas shares trade at a mere $3.02 per share, a price point that typically keeps professional investors on the sidelines. Next, the semiconductor company isn’t in the best financial shape either. More on that in a moment.

Yet Cohen’s aggressive buying over the past year and a half warrants attention by investors on the hunt for the next big growth play. Let’s dig deeper to better understand Navitas’ core value proposition and risk profile.

Navitas: A next-generation semiconductor player

Navitas designs, develops, and markets gallium nitride power integrated circuits, silicon carbide, and associated components used in power conversion and charging. Its products find applications in mobile devices, consumer electronics, data centers, solar inverters, and electric vehicles (EVs). The company operates globally, with its principal executive offices in Torrance, California.

Founded in 2013, Navitas is pioneering the GaN market with a proprietary GaN power IC platform shipping in mass production to tier-1 companies like Samsung, Dell, Lenovo, and Amazon. The company’s solutions offer faster charging, higher power density, and greater energy savings compared to silicon-based power systems.

Core strengths and market opportunities

Navitas’ core strength lies in its industry-leading IP position, including a comprehensive patent portfolio and proprietary process design kit (PDK). The company’s research and development activities, primarily located in the U.S. and China, consumed approximately 90% of its revenue in the first half of 2024.

The company is targeting several high-growth markets. In the Enterprise/AI Data Center segment, Navitas is developing AC-DC power platforms up to 10 kW to meet Nvidia‘s demanding Hopper-Blackwell-Rubin roadmap. The EV/eMobility division is seeing strong growth in its customer pipeline, with over 200 projects in development.

The Appliance/Industrial segment is poised for a revenue ramp in 2025 across diverse applications. In the Solar/Energy Storage market, Navitas is displacing legacy silicon chips with both SiC and GaN technologies, according to its latest 10-Q.

The gallium nitride market: Heating up for future demand

The power gallium nitride device market is projected to grow significantly in the coming years. This market is set to expand from $126 million in 2021 to $2 billion in 2027, representing a compound annual growth rate of 59%, according to market research firm Yole Développement. This parabolic growth is primarily driven by increasing demand in consumer electronics, data centers, and electric vehicles.

However, the robotics revolution could serve as a future catalyst for even more explosive growth in the GaN market. Artificial intelligence (AI) is expected to power advanced robotics from 2025 to 2035, potentially unlocking trillions in economic value. While this isn’t the primary driver of current GaN market growth, it represents a significant future opportunity that could sustain and potentially accelerate the market’s expansion.

Navitas’ technology could play a crucial role in addressing the power consumption challenges that currently hold back the robotics field. As robots become more integrated into daily life, they will require access to rapid recharging systems that can meet their enormous power requirements. Navitas appears to have intellectual property rights to technology that could address this critical need, positioning the company to potentially capitalize on this future demand.

Financial challenges and risks

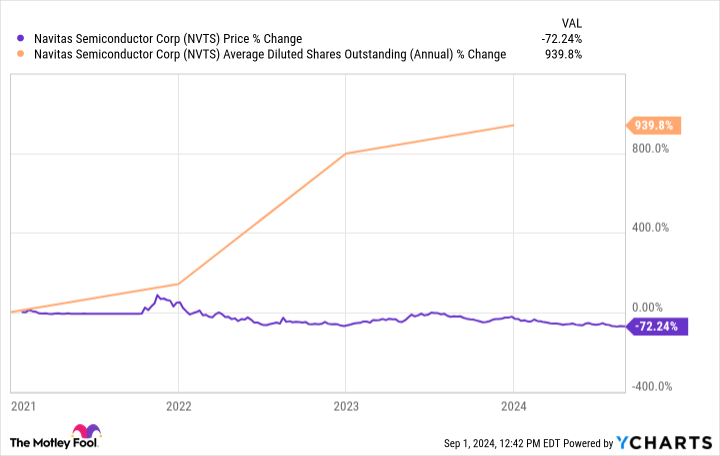

However, Navitas faces significant financial challenges. As of June 30, 2024, the company had $112.0 million in cash and cash equivalents. Its GAAP loss from operations for the most recent quarter was $31.1 million. Over the past five years, Navitas’ number of outstanding shares has also increased substantially due to dilution, while its share price has declined sharply.

Barring a sudden revenue uptick, possibly from its data center business, this trend may continue. While sales are growing by double-digits, Navitas is only expected to generate around $148 million in revenue in 2025, according to Wall Street’s most optimistic forecast. The company is also projected to remain cash flow negative next year, potentially straining its remaining cash reserves.

Is this speculative AI stock a buy?

Steven Cohen’s hedge fund seems to be positioning itself ahead of a potential shift in the semiconductor industry from traditional silicon-based chips to GaN semiconductors. Navitas, as a leader in this niche, could benefit enormously from this trend. Its shares also offer exposure to the coming robotics revolution.

However, investors should carefully weigh the company’s growth potential against its financial risks before following in Cohen’s footsteps. Navitas is far from a slam dunk and serious challenges lie in its path to success.

What’s the bottom line? This AI stock screens as a potential buy for aggressive investors with a high tolerance for risk. That being said, Navitas probably shouldn’t account for more than 1% of your stock portfolio at this early juncture, and investors will want to keep a close eye on the company’s progress.

Should you invest $1,000 in Navitas Semiconductor right now?

Before you buy stock in Navitas Semiconductor, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Navitas Semiconductor wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. George Budwell has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Nvidia. The Motley Fool has a disclosure policy.

A Billionaire-Led Hedge Fund Is Gobbling Up This Speculative Artificial Intelligence Stock. Should You? was originally published by The Motley Fool