Rivian Automotive (NASDAQ: RIVN) has done an excellent job making a name for itself. It has stood out from most young electric vehicle (EV) start-ups and placed itself in a group expected to win long-term in the EV industry.

Moreover, the company’s R1S and R1T vehicles have won numerous awards from J.D. Power and Consumer Reports, among others, helping build a strong brand name and reputation of quality.

Now, the company is turning its used vehicles into another revenue stream.

New revenue stream

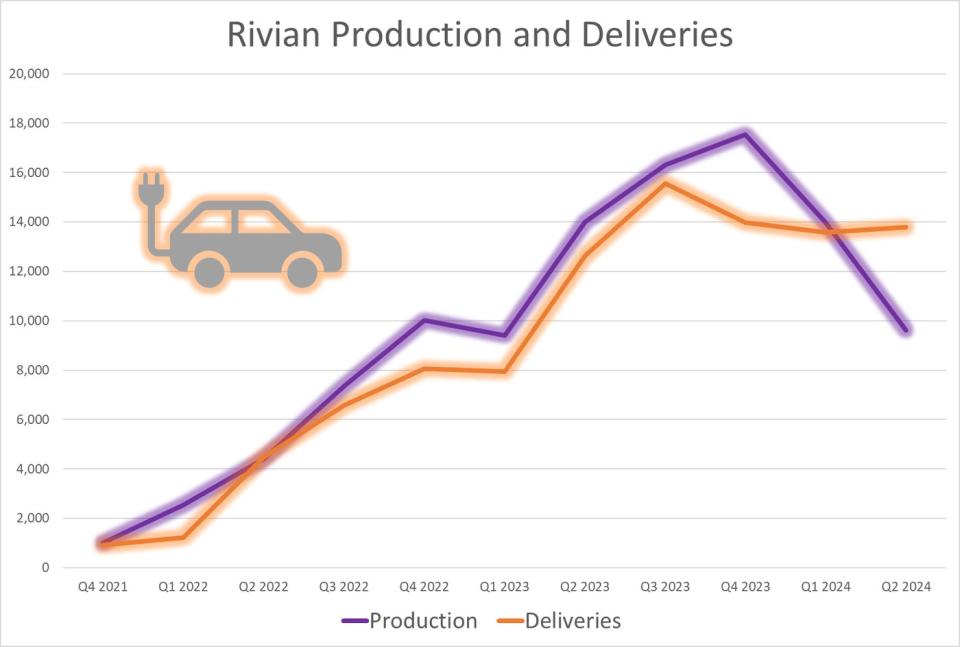

Rivian recently announced it would be launching a pre-owned sales program for its R1T truck and R1S SUV, which will open up a new path for revenue generation. This is especially helpful as the company’s deliveries are expected to remain flat in 2024.

As deliveries stall while the company works through its backlog of orders, current orders, and the launch of its highly anticipated and more affordable R2 crossover, the company needs a way to generate more revenue. Starting a pre-owned lineup is the next logical step.

“It’s almost mandatory if you want to be taken seriously,” said Ivan Drury, a senior analyst at Edmunds, according to Automotive News. “For consumers testing the waters on brands they’ve never had experience with, you want as many things as possible that inspire confidence, and these programs speak to that.”

What the move does

In addition to opening a new stream of revenue, this is a next logical step for a maturing brand, especially considering the company launched its leasing program roughly 10 months ago. As these vehicles come in, the company found a way to turn them back around into more revenue. It’s also a move that Tesla made in 2015 when it began selling pre-owned Model S vehicles.

Price-sensitive customers may appreciate the move. For example, on Rivian’s website, it offers a pre-owned R1T with an original sticker price of $87,000 selling at a pre-owned rate of $62,370. More good news for Rivian is that pre-owned EVs are sought-after considering the depreciation on a new EV is noticeably worse than it is for gasoline-powered or hybrid vehicles.

Further, pre-owned programs are known to boost profits as retailers can lift the price tag of their vehicles above the market in exchange for consumer convenience. Customers are assured of detailed inspections and receive what’s left over of the factory warranty. Drury went as far to say that a “pre-owned program benefits everybody except your competition.”

Used EVs are now selling much faster than they did a year ago, which shows that consumer demand is there at the right price. Unfortunately, the right price is apparently lower than many new EVs can reach currently.

What it all means

This move to launch a pre-owned program is also vital when considering the upcoming R2 crossover, which could lead to many valuable trade-ins of its first-generation R1T and R1S as customers step into the newer vehicle.

It’s just a little good news at a time when deliveries are stalling for Rivian. As it awaits the R2 crossover to help boost sales, it’s finding ways to generate new revenue and take advantage of its strong early branding and leasing program.

Should you invest $1,000 in Rivian Automotive right now?

Before you buy stock in Rivian Automotive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rivian Automotive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Daniel Miller has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

A Little Good News for Rivian Investors was originally published by The Motley Fool