Flexible metal hose manufacturers aren’t exactly the type of businesses that spring to mind when you think of stocks with market-crushing potential. However, as a leader in this flexible metal hose niche — primarily corrugated stainless steel tubing (CSST) — Omega Flex (NASDAQ: OFLX) proves that monstrous returns can come from all varieties of stocks.

From the company’s initial public offering (IPO) in 2005 through 2021, Omega Flex produced total returns more than six times higher than those of the S&P 500 index. Even after Omega Flex saw its share price decline 74% in the last few years, mainly due to the cyclicality of its operations and its industry, the company’s returns have roughly equaled those of the S&P 500 index since Omega Flex’s IPO.

As alarming as this sell-off has been, I can’t help but see it as a once-in-a-decade opportunity for investors with the patience to buy and hold for a decade at a time. Here’s what makes Omega Flex an attractive investment.

Omega Flex moves hand-in-hand with the U.S. housing market

Omega Flex’s CSST systems provide several advantages over traditional black iron piping for fuel gases in residential and commercial construction. Unlike black iron or copper pipe, which needs threads and separate fittings attached for each bend necessary during construction, Omega Flex’s flexible tubing can be bent by hand and installed in lengthy, uninterrupted lines throughout a building.

In addition to this simplified installation process, Omega Flex’s CSST performs better than rigid piping during earthquakes and lightning strikes, making it more resistant to damage. Thanks to these advantages, CSST now accounts for roughly 50% of fuel gas piping in new and remodeled housing construction in the U.S. — a niche where Omageflex considers itself a leader.

Continuously iterating upon the proprietary rotary manufacturing process it developed in 1995, the company’s production capabilities are as flexible as the CSST it sells, providing its goods on an as-demanded basis.

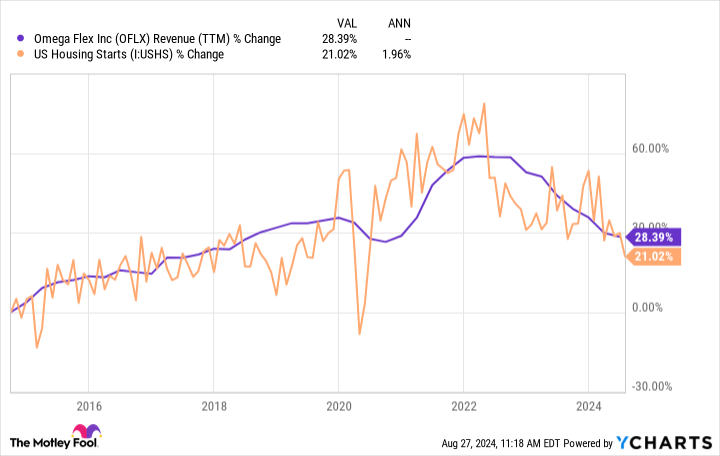

While this leadership position in a growing niche is promising, the vast majority of Omega Flex’s sales correlate to the cyclical housing industry in the United States.

With its sales moving hand-in-hand with U.S. housing starts, Omega Flex has struggled mightily over the last couple of years. As U.S. housing starts continued to slow as the market battled rising interest rates, the after-effects of high inflation, and an uncertain consumer in general, Omega Flex’s sales dropped in tandem.

However, research from Zillow shows that the U.S. housing market remains 4.5 million homes short, and consumers are pining for more affordable housing. Over the longer term, this should rejuvenate growth in the number of U.S. housing starts, but when this change will occur is uncertain.

Ultimately, though, with the Federal Reserve set to cut interest rates in September, the tide might be starting to turn for Omega Flex over the shorter term. Best yet, for investors, the company can currently be purchased at what looks like a once-in-a-decade valuation.

A once-in-a-decade opportunity

Regardless of when the turnaround in the growth of U.S. housing starts occurs, investors buying Omega Flex can take solace in the fact that they are getting a top-tier compounder at an excellent price. Even with the company currently in the trough of its business cycle, Omega Flex currently holds a return on invested capital (ROIC) of 24%.

Measuring the company’s profitability compared to its debt and equity, this resilient ROIC is indicative of a wide moat surrounding Omega Flex’s operations. Historically, companies that generate a higher ROIC than their peers have proven to deliver outperforming stock returns, as this article suggests. In addition to this high ROIC, the company has maintained an 18% net income margin despite the challenging macroeconomic environment.

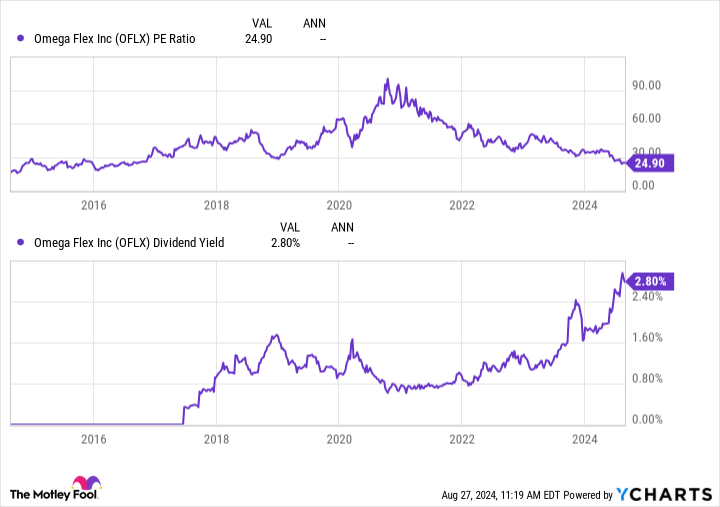

On the valuation side, Omega Flex’s price-to-earnings (P/E) ratio of 25 is near 10-year lows, and its 2.8% dividend yield is at all-time highs.

Despite these large dividend payments amid the challenging operating environment, the company only uses 69% of its net income to fund its payout. Typically distributing the majority of its earnings to shareholders over recent years — including a hefty special dividend in 2019 — management isn’t afraid to return cash to shareholders. With insiders owning 25% of the company’s shares, management is well incentivized to continue growing these dividends — maybe even at an accelerated rate once revenue growth returns.

Ultimately, Omega Flex isn’t the flashiest investment opportunity out there. However, short- and long-term trends are starting to lean in Omega Flex’s favor. With the company’s highly profitable (albeit cyclical) operations available at a once-in-a-decade valuation, I believe it makes for a magnificent dividend stock to buy and hold for decades.

Should you invest $1,000 in Omega Flex right now?

Before you buy stock in Omega Flex, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Omega Flex wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Josh Kohn-Lindquist has positions in Omega Flex and Zillow Group. The Motley Fool has positions in and recommends Zillow Group. The Motley Fool has a disclosure policy.

A Once-in-a-Decade Opportunity: 1 Magnificent Dividend Stock Down 74% to Buy Now and Hold Forever was originally published by The Motley Fool