We recently compiled a list of the 10 AI News You Shouldn’t Miss. In this article, we are going to take a look at where Advanced Micro Devices, Inc. (NASDAQ:AMD) stands against the other AI stocks you shouldn’t miss.

AI presents significant benefits for investors, primarily through increased efficiency, automation, and the potential for high returns in specific sectors. It leads to higher profitability and efficiency. For example, AI-driven automation enhances efficiency in trading, portfolio management, and operations, helping investors achieve better returns. According to a report by PwC, financial institutions that adopt AI could reduce operational costs by 22% in the short term, which directly improves profitability. Hedge funds, for instance, have seen an increase in efficiency, particularly in areas such as algorithmic trading and risk management. A report by McKinsey suggests that AI-driven trading algorithms can outperform traditional investment strategies by identifying patterns and trends that are hard for human analysts to spot. This advantage could increase returns by 2-3% annually, which can compound into significant gains over time.

Read more about these developments by accessing 33 Most Important AI Companies You Should Pay Attention To and 20 Industrial Stocks Already Riding the AI Wave.

AI tools also provide real-time data analytics and insights, giving investors a competitive edge in making informed decisions. According to a study by Deloitte, 63% of financial executives believe that AI can dramatically improve investment decision-making by providing better market forecasts and risk assessments. AI algorithms can analyze vast amounts of data quickly, allowing investors to capitalize on short-term market movements with greater precision. Similarly, the explosion of generative AI and machine learning has led to a surge in stocks related to AI technology. Several AI-focused exchange traded funds (ETFs) have outperformed the broader market, providing investors with opportunities for growth. For instance, the Global X Robotics and Artificial Intelligence ETF has returned close to 30% in the past year, significantly outperforming traditional tech funds.

Tom Kehoe, a top researcher at Alternative Investment Management Association, an investment firm in the United Kingdom, has emphasized that AI is poised to revolutionize investment management, offering greater efficiency and precision in decision-making. Similarly, Larry Fink, the CEO of investment titan BlackRock, believes that AI will be a transformative force for wealth management, allowing firms to personalize portfolios and scale operations efficiently, which in turn create immediate value for investors. Fink was quoted by Financial Times as saying that the collapse of productivity had been a central issue in the global economy. Per Fink, AI had the huge potential to increase productivity, and transform margins across sectors, as it may be the technology that brought down inflation.

Read more about these developments by accessing Beyond the Tech Giants: 35 Non-Tech AI Opportunities.

Our Methodology

For this article, we selected the latest and most important AI news by combing through news articles, stock analysis, and press releases. These stocks are also popular among hedge funds. The stocks are sorted in ascending order of the number of hedge funds that have stakes in them, as of Q2 2024.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points (see more details here).

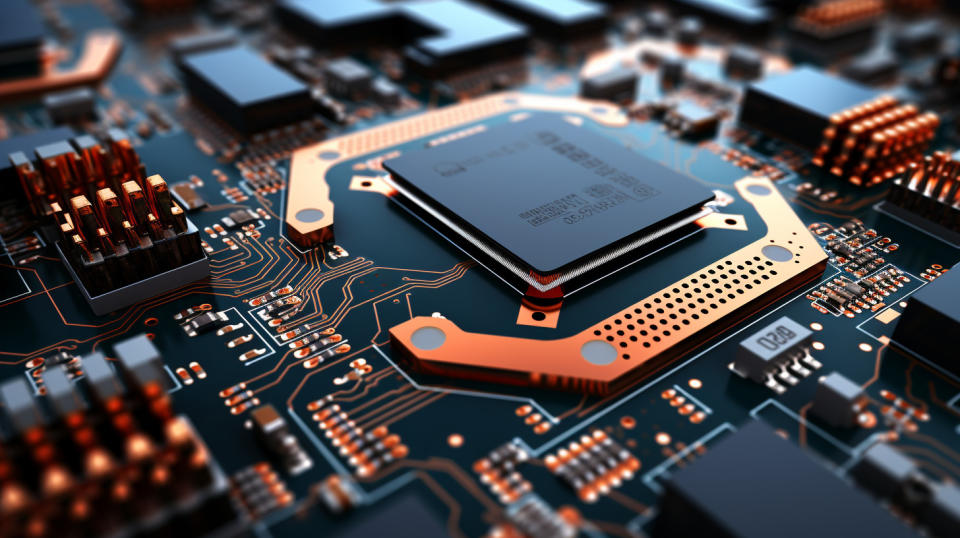

A close up of a complex looking PCB board with several intergrated semiconductor parts.

Advanced Micro Devices, Inc. (NASDAQ:AMD)

Number of Hedge Fund Holders: 108

Advanced Micro Devices, Inc. (NASDAQ:AMD) operates as a semiconductor manufacturer. Lisa Su, the CEO of the firm, recently said that graphic processing units (GPUs) might not be the architecture of choice for companies working on AI within the next five years because they did not offer the level of programmability tech firms wanted. The CEO was contextualizing earlier statements in which she said that GPUs right now were the architecture of choice for large language models, because they were very efficient for parallel processing. Su further noted that the next phase would not be a transition away from GPUs but rather a broadening beyond them. Custom AI chips, tailored to company-specific AI tasks, are already gaining traction in the tech world, highlighting the broadening away from GPUs.

Overall AMD ranks 7th on our list of the AI stocks you shouldn’t miss. While we acknowledge the potential of AMD as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for an AI stock that is more promising than AMD but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: $30 Trillion Opportunity: 15 Best Humanoid Robot Stocks to Buy According to Morgan Stanley and Jim Cramer Says NVIDIA ‘Has Become A Wasteland’.

Disclosure: None. This article is originally published at Insider Monkey.