Stock splits are seeing a renaissance. During the last 15 years, we have been in the midst of a raging bull market with minimal interruptions, leading to big winning stocks trading at sky-high prices. To make it easier to gift stock options to employees and for small-time investors to buy shares, companies have started to implement more stock splits. Amazon, Nvidia, and Chipotle are recent stock split examples, but there are many others out there.

Investors have built up a narrative that stock splits drive value. There is an idea that by making a stock trade at a lower price but with a larger total amount of shares outstanding, the stock is somehow cheaper. Does this narrative hold up in reality? Let’s take a look at a stock split candidate — Costco (NASDAQ: COST) — to investigate this phenomenon and whether you should buy ahead of a potential stock split announcement.

Costco’s upcoming one-comma milestone

Costco stock is up around 650% in the last five years and recently surpassed $900 a share. If it goes up by a little more than 10%, it will reach the $1,000 milestone. A true testament to the durable growth of the low-price membership retail model, Costco is now one of the largest companies in the United States with a market cap of $400 billion.

The stock has posted a 150,000% total return since going public over 40 years ago (total returns include dividend reinvestment), making it one of the best-performing stocks ever. For any investor who has held since the early days, a $1,000 investment would be worth $1.5 million now.

Along the way, Costco has implemented two stock splits due to its rising stock price. One in 1993, and one in 2000. With its price closing in on four digits, investors are likely expecting Costco to implement another stock split sometime soon. When a stock price gets over $1,000 a share, management teams will generally look to split the stock to make it more affordable for investors with small sums of money and to have more flexibility to gift employees smaller slices of stock as a form of income.

Examples of recent stock splits around $1,000 or higher include Chipotle, Nvidia, and Broadcom. If you look at its history, Costco may be overdue for a stock split right now.

A thriving business at a premium valuation

Let’s forget about stock splits for a second. How is Costco’s business doing? Well, just fine and dandy, thank you for asking. Last quarter that ended in May, revenue grew 9.1% year-over-year to $57.4 billion. Growth was strong across the board but especially internationally, where same-store sales grew 8.5% year-over-year when adjusted for gasoline prices. E-commerce growth has also been solid, up 21% in the quarter.

The international runway for growth looks strong. For example, a Costco recently opened in Okinawa Japan, and saw a five-hour wait to enter the door on its first day. Costco has a fantastic brand overseas, perhaps even stronger than the United States where it competes more heavily with Amazon and Walmart. Management just raised prices on its membership fees as well. The premium membership now costs $130 a year vs. $120 previously.

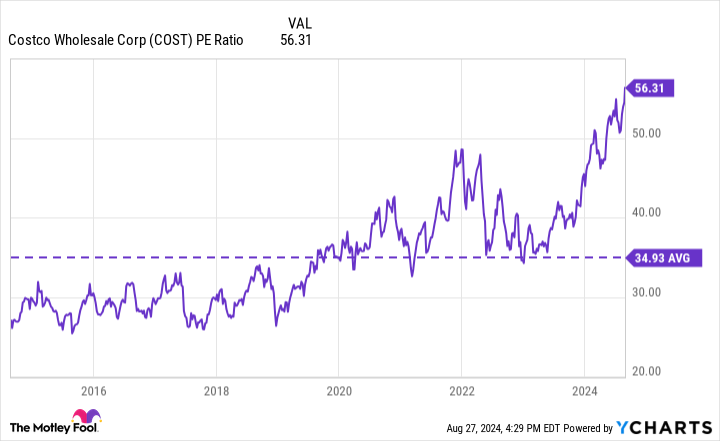

While all this is great, the stock trades at quite a premium valuation. Compared to its last twelve months earnings, the stock has a price-to-earnings ratio (P/E) of 56. The stock’s average over the last 10 years is 35, and this P/E is close to an all-time high. Remember too that Costco was a much smaller company 10 years ago.

COST PE Ratio data by YCharts

Does a stock split mean you should buy the stock?

Let me cut to the chase: Nobody except Costco’s employees (who can get more flexible options packages) should care about a potential stock split. For investors today, the stock split is meaningless, even if it means you can buy a higher number of shares. This is especially true when considering the rise of fractional trading, where brokerages allow you to buy less than one share at a time when the price is sky-high like with Costco.

A stock split is meaningless because it does not change the underlying business operations. If I give you an entire pizza and call it “one” piece, is there magically more pizza when I cut it into 12 slices? No, and the same logic applies to a stock split. Don’t buy Costco for any potential stock split, even if one could be forthcoming.

Instead, investors should focus on the business and the stock’s valuation based on its earnings power. Costco is a great business, there’s no denying that. But it trades at an extended P/E and will only grow at a slow rate over the next 10-20 years due to its huge revenue base. For this reason, investors should avoid buying the stock at today’s price.

Should you invest $1,000 in Costco Wholesale right now?

Before you buy stock in Costco Wholesale, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Costco Wholesale wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Chipotle Mexican Grill, Costco Wholesale, Nvidia, and Walmart. The Motley Fool recommends the following options: short September 2024 $52 puts on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

After Chipotle and Nvidia, Is Costco the Next Big Stock-Split Stock? (And Should You Care?) was originally published by The Motley Fool