This week’s Q&A column is written by Darlene Duffett of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Darlene at 703-969-9015 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

This week’s Q&A column is written by Darlene Duffett of McEnearney Associates Realtors®, the leading real estate firm in Alexandria. To learn more about this article and relevant Alexandria market news, contact Darlene at 703-969-9015 or email [email protected]. You may also submit your questions to McEnearney Associates via email for response in future columns.

Question: Should I buy now, or should I wait based on the interest rates?

Answer: The decision to buy a home is a significant milestone, often accompanied by excitement, anticipation, and many questions. A major consideration in today’s real estate market is whether to wait for lower interest rates or to purchase now with the current rates.

Understanding the Interest Rate Landscape

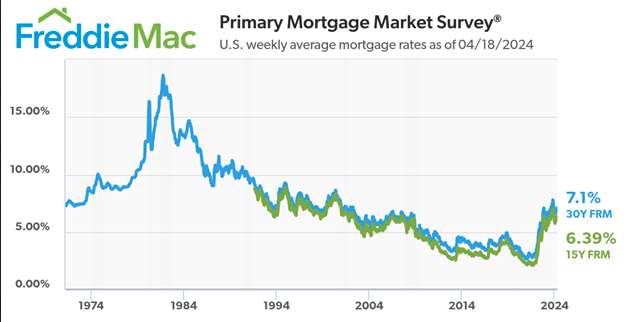

Interest rates are influenced by a complex array of factors, including economic conditions, inflation, government policies, and the Federal Reserve’s actions. The Fed has been raising rates since early 2022 to bring down inflation and over the past year we have seen first-hand that when the Fed funds rate rises, interest and mortgage rates tend to follow. This has led many potential homebuyers to wonder if they should wait for rates to drop further or secure a mortgage at the current rate. Listening to my parents and their friends speak of their rates in the 1970s and 1980s gives me ponder as to how they did it. Historically the average rate on a 30-year mortgage peaked in 1981 to just over 18% and bottomed out in 2021 to just under 3%. In October, rates hit a 23-year high of 7.79% for a 30-year fixed loan, according to Freddie Mac.

The Case for Waiting

Proponents of waiting for lower interest rates argue that patience can lead to significant savings over the life of a mortgage. A lower rate means reduced monthly payments and overall interest costs. For first-time homebuyers or those with tight budgets, even a small reduction in interest rates can make a noticeable difference. It can also impact the amount of home you can afford, allowing you to consider properties in a higher price range.

The Risks of Waiting

However, waiting for lower interest rates carries risks. No one has a crystal ball to know exactly when rates will drop—or if they will drop at all. By waiting, you risk potentially jumping back into the market when everyone else who has been sitting on the side lines jumps back in too, creating a super competitive market where you risk waiving contingencies and might find yourself competing with more buyers, leading to bidding wars and higher prices.

The Case for Securing a Mortgage Now

Securing a mortgage now provides certainty in an uncertain market. It allows you to move forward with your home purchase without worrying about fluctuations in interest rates. This stability can be particularly valuable if you’re planning to stay in your new home for a long time, as it shields you from future rate increases. Additionally, acting now can give you more flexibility in negotiations with a smaller buyer pool. With a pre-approved mortgage, you can make competitive offers, potentially giving you an edge over other buyers who are waiting to speak with a lender.

The Case for a Renter to Step into Home Ownership

I would be remiss to not mention that renting is equivalent to paying 100% interest and investing in another individual’s property. Home ownership provides stability and security as you do not need to worry about rent increases. It provides the potential for appreciation and building equity. There are tax benefits as mortgage interest payments and property taxes may be tax deductible. Studies show that homeowners have a much higher net worth than renters do. (Consult your tax preparer for more information.)

The Case for Buying Down the Interest Rate for the Life of the Mortgage

Buying down the interest rate, often called a mortgage rate buydown, is a strategy used by homebuyers to reduce their long-term interest costs on a loan. This involves making an upfront payment, known as “points” or “discount points” to the lender at the time of closing in exchange for a lower interest rate over the life of the loan. Each point typically costs 1% of the loan amount and can reduce the interest rate by a set fraction, typically 0.25%. While this increases the upfront costs of purchasing a home, it can result in significant savings over the loan’s term. This approach can be particularly beneficial for those who plan to stay in their home for many years, as the reduced interest can lead to considerable long-term savings. However, the decision to buy down an interest rate should be carefully evaluated against other financial goals and priorities.

The Case for a 2-1 Buydown

The 2-1 buydown is a mortgage financing option designed to make the initial years of a loan more affordable for borrowers. In a 2-1 buydown, the interest rate is temporarily reduced by two percentage points in the first year and by one percentage point in the second year. By the third year, the interest rate reverts to the original fixed rate for the remaining term of the loan. The cost of the buydown is typically funded by a lump-sum payment made by the borrower or seller at closing. Some might use this as a tool to purchase now and refinance if mortgage interest rates go down. This option could be a good tool, but buyers should be very cautious as future planning for the higher-cost monthly payment is a serious reality.

Making the Right Decision

Ultimately, the decision to wait or act depends on your personal circumstances. Consider your financial situation, the local real estate market, and your long-term plans. If you’re unsure, give me a call and we can look at all the current numbers and use our cutting-edge tools at McEnearney Associates along with a trusted mortgage professional to provide valuable insights tailored to your unique situation.

Darlene Duffett is a real estate agent with McEnearney Associates Realtors® in Old Town, Alexandria. She is licensed in Virginia and Washington, DC. She has built a reputation of partnering. with her friends and clients through the homebuying process and loves working with first time home buyers. If you would like more information on selling or buying in today’s complex market, contact Darlene at 703-969-9015, [email protected] or visit her website DarleneDuffettRealEstate.com.

If you would like a question answered in our weekly column or to set up an appointment with one of our Associates, please email: [email protected] or call 703-549-9292.

McEnearney Associates Realtors®, 109 S. Pitt Street, Alexandria, VA 22314. www.McEnearney.com Equal Housing Opportunity. #WeAreAlexandria