Goldman Sachs recently released a report estimating that the global cloud computing market could generate a whopping $2 trillion in revenue in 2030. The report projects this market will see a compound annual growth rate of 22% through the end of the decade, with new catalysts such as artificial intelligence (AI) set to play a central role in its growth.

Plenty of companies are already making the most of the surge in spending by cloud service providers. Chipmakers like Nvidia, Broadcom, and Marvell Technology reported impressive growth in their data center revenue, thanks to the robust demand for their AI accelerators. Memory specialist Micron Technology (NASDAQ: MU) also joined the party as AI servers require faster memory chips and more storage capacity, and a similar trend is unfolding in AI-enabled edge devices such as smartphones and personal computers (PCs).

Another company that seems set to jump on the AI bandwagon thanks to the potentially lucrative growth in the global storage market is Seagate Technology (NASDAQ: STX).

Here are some reasons why Seagate is positioned to benefit long-term from the big AI-fueled surge in the storage market.

Seagate Technology is sitting on a huge addressable market

Fortune Business Insights estimates the data storage market was worth $217 billion in 2022, and it could clock an annual growth rate of 18% through 2030 to generate $778 billion in revenue at the end of the forecast period. Additionally, Micron Technology’s recent results have made it clear that AI’s proliferation is driving growth in data center storage.

More specifically, Micron’s revenue from sales of data center solid-state drives (SSDs) more than tripled in the previous fiscal year. Micron also points out that traditional storage markets such as PCs are set to get a nice boost thanks to AI. As CEO Sanjay Mehrotra remarked on the latest earnings conference call:

As an example, leading PC OEMs have recently announced AI-enabled PCs with a minimum of 16GB of DRAM for the value segment and between 32GB to 64GB for the mid and premium segments, versus an average content across all PCs of around 12GB last year.

Seagate Technology is one of the ways investors can capitalize on this massive opportunity. The company sells hard disk drives (HDDs) and SSDs for data centers and PCs, and its recent results show that it has started benefiting from the growth of the storage market.

Seagate’s revenue in the fourth quarter of fiscal 2024 (which ended on June 28) increased 18% year over year to $1.89 billion. The company’s gross margin improved to 30.9% from 19.5% in the same quarter last year. As a result, Seagate swung to a non-GAAP profit of $1.05 per share, compared to a loss of $0.18 per share in the prior-year period.

Analysts were expecting Seagate to post earnings of $0.76 per share on $1.87 billion in revenue. However, a favorable pricing environment in the memory market worked in Seagate’s favor, and it crushed Wall Street’s earnings expectations. Even better, the company’s guidance for the first quarter of fiscal 2025 points toward a significant acceleration in its growth.

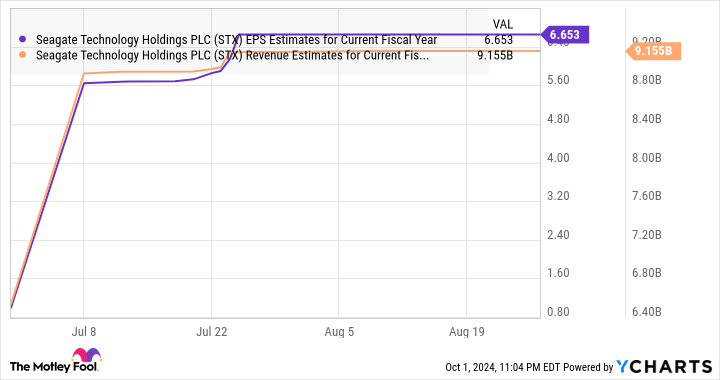

Seagate guided for $2.1 billion in revenue for fiscal Q1, which would be a 45% increase over the year-ago period. Additionally, the company expects to report a profit of $1.40 per share for the quarter, compared to a loss of $0.22 per share in the year-ago quarter. The good part is that Seagate is expected to maintain its outstanding growth throughout fiscal 2025, as per analysts’ estimates.

The top line would be a big improvement from fiscal 2024 levels of $6.5 billion, translating into a potential jump of 40%. For comparison, Seagate’s revenue fell 11% in fiscal 2024, while it reported adjusted earnings of $1.29 per share. So, the company’s earnings are on track to jump 5x in the current fiscal year.

More importantly, Seagate is also likely to sustain its healthy growth levels in the long run, since it has already started benefiting from the AI-driven growth in demand for storage solutions. On its July earnings conference call, Seagate CEO William Mosley remarked:

We’ve also started to see incremental demand for higher-density storage-specific solutions, due in part to enterprises putting storage capacity in place, either on-prem or in private clouds, as they prepare for future AI applications.

As such, it won’t be surprising to see Seagate stock heading higher following the 27% gains it has already had in 2024.

The valuation and the potential stock upside make buying this stock a no-brainer

As already noted, Seagate’s earnings are expected to multiply significantly this year. Analysts forecast that the company’s bottom line will jump another 36% in the next fiscal year, to $9.09 per share. Seagate stock currently trades at 17 times forward earnings, a discount to the Nasdaq-100 index’s price-to-earnings ratio of 32 (using the index as a proxy for tech stocks).

Assuming Seagate trades at 17 times forward earnings after a couple of years and indeed generates $9.09 per share in earnings as analysts expect it to, its stock price could hit $154. That points toward a potential upside of 42% over the next couple of years. This makes Seagate an attractive stock to buy right now to capitalize on the secular growth of the storage market, thanks to catalysts like AI.

Should you invest $1,000 in Seagate Technology Plc right now?

Before you buy stock in Seagate Technology Plc, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Seagate Technology Plc wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Broadcom and Marvell Technology. The Motley Fool has a disclosure policy.

Artificial Intelligence (AI) Is Set to Drive Solid Growth in This Market: 1 No-Brainer Stock to Buy Hand Over Fist Before That Happens was originally published by The Motley Fool