Shares of Nvidia (NASDAQ: NVDA) and Palantir Technologies (NYSE: PLTR) have delivered stunning gains of 152% and 133%, respectively, in 2024, as both companies have been benefiting from the fast-growing adoption of artificial intelligence (AI) hardware and software. That is also why both of them are now trading at expensive valuations.

However, a closer look at their prospects indicates that Nvidia and Palantir’s AI-powered growth is here to stay, as both of them stand to gain from massive end-market opportunities. Here, let’s examine which of these two AI stocks investors should consider buying right now following their stunning gains so far this year.

The case for Nvidia

Nvidia has been delivering robust growth quarter after quarter thanks to its market share of more than 85% in AI chips, which analysts at investment research firm Third Bridge believe is sustainable, thanks to the arrival of the company’s next-generation Blackwell processors.

Nvidia’s revenue in the second quarter of fiscal 2025 (which ended July 28) shot up 122% year over year to $30 billion. More importantly, the company’s pricing power helped it increase its non-GAAP (generally accepted accounting principles) gross margin by 4.5 percentage points last quarter to 75.7%. As a result, the growth in the company’s bottom line outpaced its revenue growth.

Nvidia reported $0.68 per share in earnings in fiscal Q2, an increase of 152% from the year-ago period. And now, analysts at Japanese investment bank Mizuho have raised their sales expectations of Nvidia’s AI graphics cards for 2025. Mizuho is expecting Nvidia to sell 8% to 10% more AI graphics cards next year from its prior guidance issued in July.

The company is expected to sell between 6.5 million to 7 million AI GPUs (graphics processing units) next year, driven by an improving supply chain that is expected to help it manufacture more chips. Given that Nvidia has reportedly priced its upcoming Blackwell processors between $30,000 to $40,000, which is identical to what it charges for its current generation flagship processor — the H200 — there is a solid chance its data center revenue could surge big time next year.

Assuming Nvidia sells even 6 million of its AI GPUs in 2025 at an average selling price (ASP) of $30,000, it could generate a whopping $180 billion in revenue from the data center business next year. Moreover, its data center revenue could exceed $200 billion, at the higher end of Mizuho’s shipment forecast. Given that Nvidia has generated close to $49 billion in revenue from the data center business in the first six months of the current fiscal year, which translates into an annual revenue run rate of $98 billion, investors can hope for another stellar year from this semiconductor giant next year.

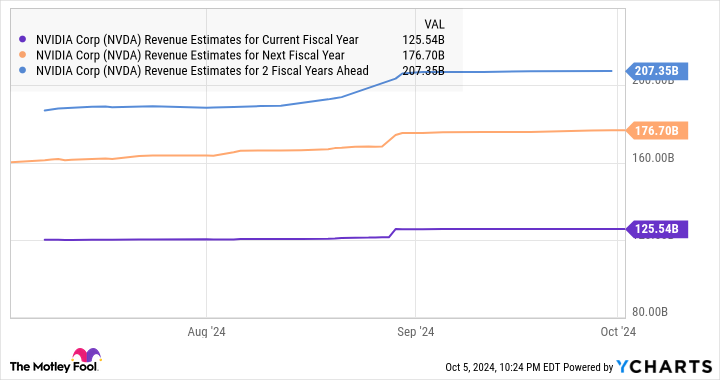

Consensus estimates are projecting Nvidia’s revenue to hit $176 billion in fiscal 2026 (which will begin in January next year) from this year’s level of $125 billion.

However, if Nvidia can indeed manage to ship at least 6 million AI GPUs next year at the ASP discussed, it could very well coast past consensus expectations. As such, Nvidia could remain a top AI stock even after the stellar gains it has recorded in 2024.

The case for Palantir Technologies

Just like Nvidia is the dominant player in the AI hardware market, Palantir has been touted to be the leading provider of AI software platforms by market research firms. Forrester, for instance, recognizes Palantir as a leader in “artificial intelligence and machine learning (AI/ML) software platforms.” Similarly, Dresner Advisory Services says that Palantir is a “top performer” in its AI, data science, and machine learning market study.

With the AI platforms software market forecast to clock an annual growth rate of 40% through 2028, generating $153 billion in annual revenue, Palantir seems to be on the cusp of a major growth opportunity. More importantly, Palantir’s growth rate has started improving as more customers have started deploying its Artificial Intelligence Platform (AIP) to integrate generative AI into their operations.

The company’s revenue in the first six months of 2024 increased by 23% from the same period last year. Its earnings have shot up fivefold over the same period to $0.10 per share. For comparison, Palantir’s revenue in the first six months of 2023 increased at a slower pace of 15% from the year-ago period.

Palantir management made it clear on the company’s August earnings conference call that its AIP is leading to stronger deal activity by attracting new customers, and by also helping it gain more business at existing customers. According to Palantir chief revenue officer Ryan Taylor:

One of the most notable indicators of our delivery is the volume of existing customers who are signing expansion deals, many of which are a direct result of AIP.

The strong traction of Palantir’s AIP has encouraged the company to raise its full-year guidance to just under $2.75 billion from the earlier expectation of $2.68 billion. Analysts, however, are expecting Palantir to deliver $2.76 billion in revenue in 2024, which would be a 24% increase from last year. However, it won’t be surprising to see it post stronger growth than that because of a healthy revenue pipeline that stands at $4.3 billion (its remaining deal value at the end of Q2, a metric that refers to the total value of contracts it is yet to fulfill).

Time to make a choice

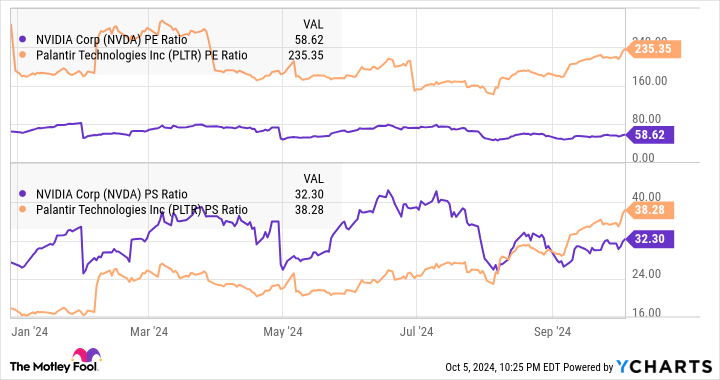

The points discussed indicate that both Palantir and Nvidia are heading into 2025 with sunny prospects, thanks to solid demand for their AI offerings. However, Nvidia is growing at a significantly faster pace than Palantir. Also, a look at the valuation of the two companies, Nvidia turns out to be the relatively cheaper bet.

Investors should also note that Nvidia is possibly straddling Palantir’s territory, as Nvidia has been witnessing solid traction in its software business. So, based on the valuation, the pace of growth, and Nvidia’s moat in AI hardware and its focus on diversifying into the software side, it looks like the better AI investment of the two high-flying companies discussed here.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,363!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $41,938!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $378,539!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.

Better Artificial Intelligence (AI) Stock: Nvidia vs. Palantir Technologies was originally published by The Motley Fool