Over the past year, businesses raced to implement artificial intelligence (AI) technologies, and that boosted sales for semiconductor chip makers Nvidia (NASDAQ: NVDA) and Broadcom (NASDAQ: AVGO). Both sell components required to implement AI in data centers designed for cloud computing, the ideal place for AI to satisfy its need for massive computing power.

As a result, Broadcom and Nvidia are positioned to benefit for years as the AI industry expands from 2023’s global market size of $136 billion to an estimated $827 billion by 2030. This is one reason owning shares in both is a great way to invest in the secular trend of AI.

However, if you had to choose just one of these semiconductor giants to invest in, which would make the better AI investment? Here’s a breakdown of each to arrive at an answer.

Broadcom’s AI strategy

Broadcom tackles the AI market with an array of products servicing many tech industries, including data centers, wireless networks, and industrial applications. The company’s AI strategy involves a combination of hardware and software to help customers meet their needs for AI infrastructure.

On the hardware side, Broadcom’s products include AI accelerators, an essential component to speed up AI computer processing. Its business building custom AI accelerators grew year over year by more than 3 times in its fiscal third quarter, ended Aug. 4.

Thanks to demand for its AI-related products, the company’s semiconductor division saw fiscal Q3 sales grow to $7.3 billion, up from $6.9 billion in the previous year.

On the software side, Broadcom acquired VMware toward the end of 2023, which is why its software division’s Q3 revenue zoomed up to $5.8 billion from $1.9 billion in the prior year. The addition of VMware enabled total Q3 revenue to grow 47% year over year to $13.1 billion.

Broadcom is using the VMware Cloud Foundation (VCF) platform to target businesses wanting a private cloud, or a hybrid of private and public clouds, for their AI systems. The strategy is succeeding. VCF represented 80% of VMware’s products booked in Q3.

Broadcom exited its fiscal third quarter with respectable financials, such as free cash flow (FCF) of $4.8 billion. Its balance sheet included total assets of $168 billion, with $10 billion of that in cash and equivalents. Total liabilities were $102.3 billion, with $70 billion of that in debt.

Nvidia’s AI approach

Nvidia’s AI success centers around its graphics processing unit (GPU), which is the heart of an AI system’s ability to execute complex computations. The company also provides a comprehensive suite of software and other services, such as a robotics platform, to help businesses harness AI.

The semiconductor giant pioneered the GPU in 1999, steadily improving it over the years. Now, Nvidia’s chips are the preferred choice for the AI computing industry.

The company continues to evolve its processors, with its new Blackwell GPUs ramping up production this year. According to Nvidia, Blackwell is the world’s largest, most powerful GPU, housing over 200 billion transistors.

Its GPU leadership in AI enabled Nvidia to hit a record $30 billion in revenue during its fiscal second quarter, ended July 28, a 122% increase from a year ago. The company expects sales to keep growing, forecasting fiscal Q3 revenue to reach $32.5 billion, up from the prior year’s $18.1 billion.

Nvidia’s AI strategy includes extending its GPU strength into various industries, such as automotive, to enable self-driving vehicles. In addition, its CEO, Jensen Huang, believes the cloud computing market, worth nearly $600 billion in 2023, will transition existing infrastructure to support AI systems. This would be a massive market opportunity for chipmakers such as Nvidia.

Adding to the company’s investment appeal, Nvidia’s financials are excellent. Its fiscal Q2 FCF was $13.5 billion. Its Q2 balance sheet included $85.2 billion in total assets, with $34.8 billion of that in cash, cash equivalents, and marketable securities. Total liabilities were $27.1 billion, with $8.5 billion in debt.

Deciding between Broadcom and Nvidia stocks

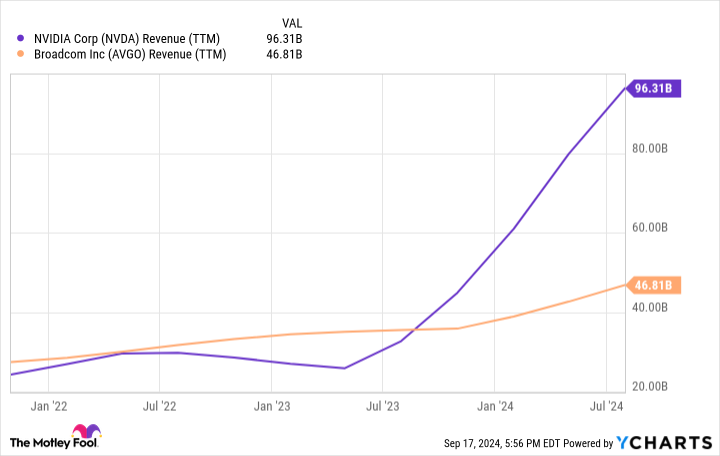

Because the AI market is large and growing, both Broadcom and Nvidia should continue to see rising sales. But between the two, Nvidia experienced the largest revenue growth this past year as AI took off, illustrating the customer demand for its products.

Another factor to consider with each stock is their price-to-earnings ratio (P/E ratio), a widely used metric to assess valuation. Broadcom’s P/E multiple of 141 is far higher than the 54 for Nvidia shares at the time of this writing, indicating Nvidia is the better value.

Currently, both Broadcom and Nvidia shares are below their 52-week highs. But Nvidia’s market leadership in AI chips, strong financials, and superior valuation compared to Broadcom make it the better long-term investment between these two semiconductor titans.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Robert Izquierdo has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Better Artificial Intelligence Stock: Nvidia vs. Broadcom was originally published by The Motley Fool