The price of West Texas Intermediate (WTI) crude oil — the U.S. benchmark — just fell below $70 a barrel, sending ripples throughout the energy sector. Long-term investors may view lower oil prices as an opportunity to scoop up shares of quality energy stocks on sale.

There are plenty of ways to invest in oil and gas, such as an integrated major like ExxonMobil (NYSE: XOM) or exploration and production (E&P) companies like Devon Energy (NYSE: DVN) or Occidental Petroleum (NYSE: OXY).

Here’s what you need to know about these three companies to help you decide which dividend stock is best for you.

The safer play

ExxonMobil is the most valuable U.S.-based energy company. It is one of the largest producers of oil and gas in North America and has a massive downstream business that is bigger from a throughput standpoint than many independent players such as Valero Energy. Exxon makes energy products like gasoline, naphtha, heating oils, kerosene, diesel, aviation fuels, heavy fuels, chemical products, and specialty products.

Exxon generates plenty of excess cash to aggressively buy back its own stock, raise its dividend, and invest in low-carbon opportunities such as carbon capture and storage, hydrogen, and more.

Exxon has paid and raised its dividend every year for 42 consecutive years — a period that includes several industry downturns. Exxon currently yields 3.3% — which is right around the average yield of the energy sector but significantly higher than the S&P 500 yield of 1.2%.

The company has done an excellent job improving its balance sheet by paying down debt, which set the stage for its $60 billion acquisition of Pioneer Natural Resources.

Add it all up, and Exxon is one of the most well-rounded energy stocks to buy now.

Two aggressive E&Ps hovering around 52-week lows

Occidental Petroleum — commonly known as Oxy — and Devon Energy lack Exxon’s downstream assets and diversification. They are also fairly concentrated from a production standpoint, specifically in North American onshore shale plays. These characteristics make both companies more sensitive to the price of oil and gas.

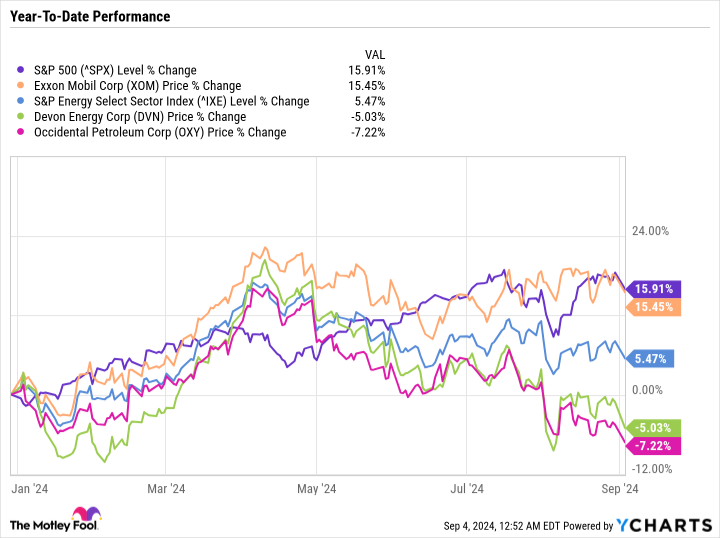

To their credit, Oxy and Devon have built impressive asset portfolios with low production costs and strong margins when oil prices are high. Both stocks will likely outperform Exxon and other integrated majors during expansion periods and underperform the sector during falling oil prices. The following chart shows that Exxon has kept pace with the S&P 500 year to date and has handily beaten the energy sector, whereas Oxy and Devon are now down on the year.

Oxy and Devon pay dividends but aren’t as reliable as Exxon in generating predictable passive income. Oxy slashed its dividend to a penny per share per quarter in 2020 and has since made modest raises to get the dividend back up to $0.22 per share per quarter for a yield of 1.6%.

Devon pays an ordinary dividend and a variable dividend that fluctuates based on its business performance. Since 2019, the annual dividend payments have been as low as $0.35 per share and as high as $5.17 per share in 2022. The following table shows total dividend payments by year for the last five years and the average price of WTI crude oil that year, which provides a rough idea of what to expect in passive income.

|

Metric |

2023 |

2022 |

2021 |

2020 |

2019 |

|---|---|---|---|---|---|

|

Average WTI crude oil spot price |

$77.58 |

$94.9 |

$68.13 |

$39.16 |

$56.99 |

|

Devon Energy dividend payments per share |

$2.87 |

$5.17 |

$1.97 |

$0.68 |

$0.35 |

Data sources: U.S. Energy Information Administration, Devon Energy.

Near-term dividend payments could be lower as Devon works to integrate its $5 billion acquisition of Grayson Mill Energy. Devon’s realized price can also differ from the spot price based on hedging contracts and other factors.

All three stocks are worth buying now

Exxon is a straightforward way to invest in the oil patch and could be the better choice for risk-averse investors, those new to energy stocks, or anyone looking for a stable stream of passive income.

However, a 50/50 split of Oxy and Devon has more upside potential if oil prices do level off, and especially if they go up.

Ultimately, the decision comes down to personal preference, risk tolerance, and the best fit for your portfolio. For some investors, all three stocks could be worth buying now.

Should you invest $1,000 in ExxonMobil right now?

Before you buy stock in ExxonMobil, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ExxonMobil wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

Better Buy in September: ExxonMobil or a 50/50 Split of Devon Energy and Occidental Petroleum? was originally published by The Motley Fool