In late 2010, billionaire investor David Tepper made a big splash on CNBC. He predicted that the Federal Reserve’s zero interest rate environment and quantitative easing policies at the time would bolster almost every investment in the U.S. Following this appearance, the broader benchmark S&P 500 index would rip 45% higher over the next 2-1/2 years in a run now referred to as the “Tepper Rally.”

Yesterday, Tepper made a similar call on CNBC although this time he was talking about Chinese stocks after the Chinese government recently issued sweeping stimulus measures and began cutting interest rates. “Everything,” Tepper said when asked what Chinese stocks to buy. “Everything… ETFs, I would do futures, everything.”

It’s a big call, but Tepper and his fund’s track record of 28% annualized returns speaks for itself. And Tepper has made a lot of his money with a simple strategy: “Don’t fight the Fed.” In this case, it would be the Chinese government and central bank. Here are Tepper’s three largest Chinese equity positions.

Alibaba: 12% of portfolio

E-commerce giant Alibaba (NYSE: BABA) is the largest position in Tepper’s Appaloosa Holdings. The position is worth roughly 12% of the nearly $6.2 billion portfolio and was valued at $756 million at the end of the second quarter of 2024.

Alibaba is considered the Amazon of China, which makes sense considering Amazon is Appaloosa’s second-largest position. Alibaba runs several massive businesses including the world’s largest retail e-commerce business based on gross merchandise value. It also operates the world’s fourth-largest cloud business and Asia Pacific’s largest infrastructure-as-a-service provider. Additionally, like most big tech stocks, Alibaba has recently made a big push into artificial intelligence (AI).

In early 2023, Alibaba announced plans to split the company into six separate businesses, all with their own CEO and board of directors and the ability to raise capital, potentially leading to several initial public offerings (IPOs). Analysts at the time seemed to like the idea because it would allow the company to realize more of its potential on a sum-of-the-parts valuation and reduce regulatory risk.

But earlier this year, the company paused plans for two public offerings, citing difficult market conditions for IPOs. Still, you’ve got a company with a clear moat and strong growth prospects trading at 12 times forward earnings. In comparison, Amazon trades at 40 times forward earnings. If Chinese stimulus can awaken consumer demand, Alibaba is a clear beneficiary.

PDD Holdings: 4% of portfolio

Tepper seems to have a thing for e-commerce, because Appaloosa’s next largest Chinese position is another multinational commerce company called PDD Holdings (NASDAQ: PDD). PDD has several businesses including the online platform Pinduoduo, which is known for its wide range of product offerings at low prices. The platform has a “team purchase” concept in which consumers can invite others to group deals for discounted prices.

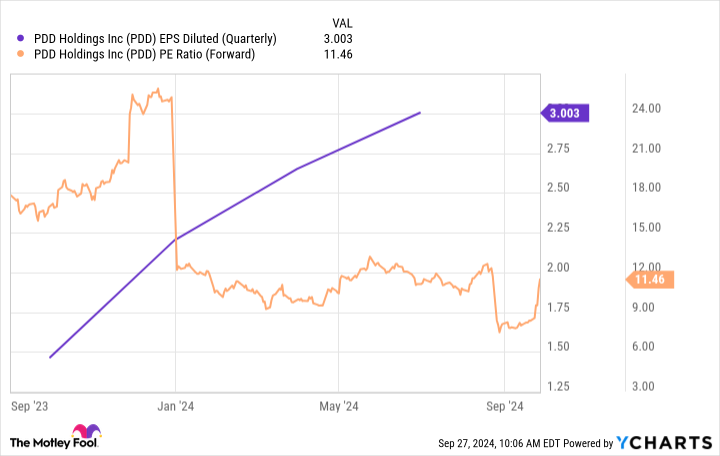

Other businesses owned by PDD include the next-day grocery delivery service Duo Duo and the growing U.S. brand Temu, another online retailer known for its low prices. PDD only trades at 11.5 times forward earnings and has seen earnings double over the last year. This is part of Tepper’s thesis in which you can buy Chinese stocks trading at cheap earnings multiples today that can generate double-digit growth.

Baidu: 2.3% of portfolio

Given Tepper and Appaloosa’s concentration in tech and chip stocks, Baidu (NASDAQ: BIDU) is a logical company to be in the mix. If there is a U.S. comp to Baidu it would probably be Alphabet. Baidu is the dominant search engine in China. The company is also a big player in the artificial intelligence space.

In 2023, Baidu released its ChatGPT-like assistant known as Ernie. Baidu’s developer network, PaddlePaddle, has 10.7 million users who have created 860,000 different models. The company can also create and manufacture its own chips.

Baidu’s roughly 37.5 billion market capitalization pales in comparison to Alphabet’s $2-plus trillion. Now, the Chinese economy is in a very different place from the U.S. and has been hit hard by deflationary pressure, a housing downturn, and weak consumer demand.

Chinese AI companies may also run into obstacles with the government’s AI rules and laws. But given the size of China’s economy, there is tremendous potential. Baidu has seen good earnings growth over the last two years, while its price-to-earnings multiple has fallen to below 14.

Should you invest $1,000 in Alibaba Group right now?

Before you buy stock in Alibaba Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alibaba Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $744,197!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, and Baidu. The Motley Fool recommends Alibaba Group. The Motley Fool has a disclosure policy.

Billionaire Investor David Tepper Just Said to Buy “Everything” in China. Here Are His 3 Largest Positions. was originally published by The Motley Fool