It can pay to track the investing legends. Billionaire Stanley Druckenmiller put up 30% returns for 30 years when running his hedge fund, and he never had a down year for his investors. Clearly, he is one of the best investors out there, making it worthwhile to track what he is buying and selling.

While you shouldn’t blindly follow the investing legends, it can be a great source of inspiration for potential new stocks to buy.

Luckily for individuals, large investment funds are required to disclose their buys and sells and overall portfolio each quarter. Recently, Druckenmiller’s family office disclosed a new position in growing dividend payer Philip Morris International (NYSE: PM). Even though the stock has posted a total return of 36% year to date, Druckenmiller is indicating that he is still bullish on the stock.

Should you hop on the dividend growth train and buy Philip Morris International stock for your portfolio?

Growing volumes through new-age products

Philip Morris International is categorized as one of the tobacco companies in terminal decline. At the start of this year, the company sported a dividend yield of 5.5%, which is much higher than the average large-cap company. There is a narrative that tobacco is uninvestable due to the heavy usage declines for cigarette smokers.

This narrative began to change in 2024 for Philip Morris International. Why? Because of the undeniable growth of Philip Morris’ new-age nicotine products. These products are led by Iqos heat-not-burn tobacco and Zyn nicotine pouches. There are more than 36 million active users of these smoke-free nicotine products, which has helped Philip Morris stabilize and begin to grow shipment volumes in the last few quarters. Last quarter, smoke-free gross profit grew 22.2% year over year, which led consolidated operating earnings to grow by 12.5%.

No wonder investors like Druckenmiller are excited about Philip Morris. The stock was trading at a sky-high dividend yield even though it had returned to top- and bottom-line growth. This is why the stock is up big this year and the dividend yield is down to 4.1%, one of its lowest levels in years.

Earnings growth equates to dividend growth

In 2024, Philip Morris is expecting to generate at or just under $6 in earnings per share (EPS). This is significant growth from the $5.02 it generated in 2023 and will be an all-time high if it is hit or surpassed. The company is seeing rapid earnings growth as its new-age products get more operating leverage and start contributing more and more to the bottom line.

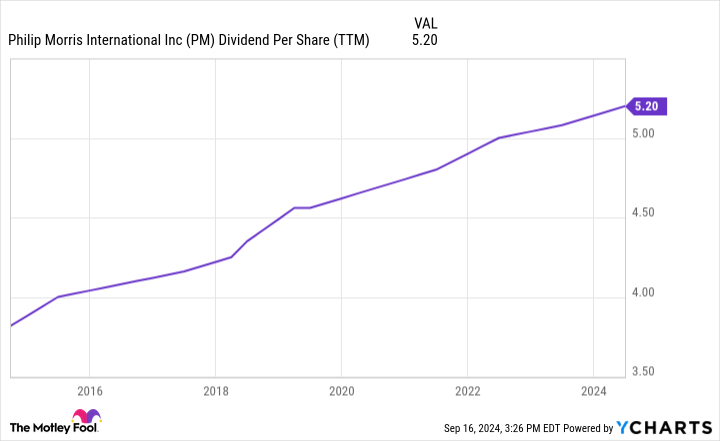

EPS is important to track as it is the lifeblood of Philip Morris’ dividend payout each quarter. Recently, Philip Morris declared an increase in its dividend per share to $1.35 a quarter, which is equivalent to an annual payout of $5.40. This is still well below the company’s guidance of $6 in EPS for the full year. If Philip Morris can keep growing its EPS over the next five to 10 years, it will have plenty of room to keep pushing the dividend per share higher and higher.

The stock is (still) cheap

Philip Morris International’s dividend yield has come down as the stock has gone up. But the stock still looks cheap at these levels. The company’s dividend yield of 4.1% is well above the 10-year U.S. Treasury yield of 3.6% and has plenty of room to grow. Over the next five years, there is room for the company’s EPS to hit $10. Assuming the dividend per share climbs to $9, that is a sky-high forward dividend yield of 7.1% based on the current stock price of $126.

There is a lot of income coming the way of Philip Morris international shareholders. Its dividend should keep growing year after year as more people switch from cigarettes to heat-not-burn and nicotine pouch brands. This makes Philip Morris International stock an easy buy for dividend growth investors today.

Should you invest $1,000 in Philip Morris International right now?

Before you buy stock in Philip Morris International, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Philip Morris International wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $708,348!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool recommends Philip Morris International. The Motley Fool has a disclosure policy.

Billionaire Stanley Druckenmiller Just Added This Hot Dividend Growth Stock to His Portfolio was originally published by The Motley Fool