The City minister called for a national insurance raid on landlords in a speech before taking power, it can be disclosed, as ministers were urged to impose the tax on rental income for the first time.

Before taking office Tulip Siddiq said that she would be in favour of taxing “unearned income” such as rent on buy to let properties in a fashion more in line with wages.

Her comments, from a speech in 2022, are likely to fuel further speculation of a crackdown on buy-to-let.

Economists at the Resolution Foundation think tank are urging Rachel Reeves, the Chancellor, to hit landlords with National Insurance, which is currently charged at 8pc on wages.

A Treasury spokesman refused to comment on the proposal. However, the recommendation is in line with suggestions in Ms Siddiq’s speech when she backed raiding investment income as part of a commitment to “unlocking capital”.

At the time she said: “We want to make sure unearned income is taxed properly and we don’t feel that it is at the moment.”

The biggest difference between tax on rental income and employee income is that national insurance is not levied on landlords.

The Government is preparing to increase taxes after granting a raft of inflation-busting public sector pay rises.

However, experts warned that landlords are already struggling under a heavy tax burden and additional raids would only drive up rents and make the housing crisis worse.

Adam Corlett, principal economist at the Resolution Foundation, said: “Landlords don’t pay any National Insurance on rental income at the moment and face tax rates that are quite a lot lower than for other sources of income and especially what employees face.

“We think income tax rates for rental income – 20pc, 40pc and 45pc – should be supplemented by a new class of National Insurance.”

Ms Reeves will receive the first projections from the Office for Budget Responsibility ahead of the Budget in October.

She has warned of a £22bn black hole in the public finances after discovering higher than budgeted asylum spending and agreeing to large pay rises for public servants, prompting speculation of a flurry of tax rises.

Sir Keir Starmer this week made clear that the better-off would be likely to finance this shortfall, saying: “Those with the broadest shoulders should bear the heavier burden.”

Mr Corlett said that Labour should seek to reform the tax system to ensure more consistent rates “across different types of income”.

This would ideally entail adopting similar tax rates for capital gains that exceed the rate of inflation, self-employment and rental income, he said.

However these measures also work on their own to help Labour shore up public finances, according to the think tank.

Mr Corlett suggested the Treasury should go even further than simply applying the employee rate of National Insurance.

He said: “If they are looking for some revenue, raising tax rates for landlords would be reasonable.

“You would end up with a rate of maybe 37pc as the basic rate for rental income, compared to a 20pc tax rate at the moment. But you shouldn’t just go from 20pc to 37pc overnight. An increase should be smaller or phased in over time.”

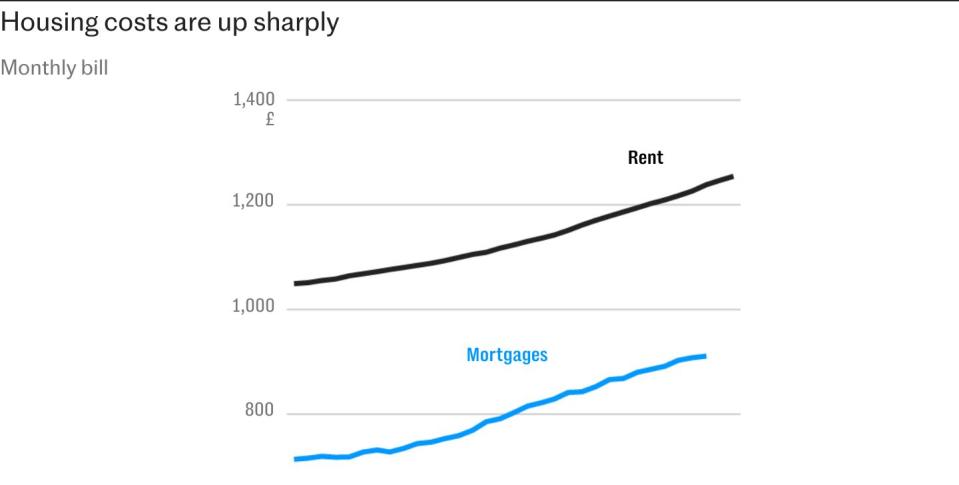

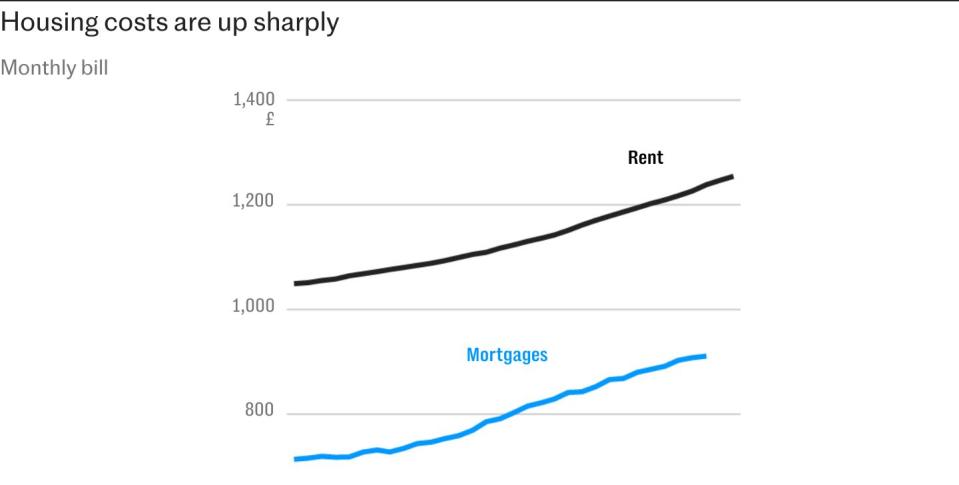

Other experts warned that raising taxation on landlords further would risk intensifying pressure on rents that are still rising at a near-record pace of 8.6pc.

Many landlords have retired in the past few years, blaming tax changes and high interest rates in a move that squeezed supply while demand soared.

National Insurance, often described as a tax on work, is paid by employees and employers to help fund benefits and pensions. Levying it on property income would be a substantial departure from current rules and would also leave pensioners who let out property paying it for the first time.

Tim Stovold, partner and head of tax at the accountant Moore Kingston Smith, said charging landlords national insurance on their rental income would “would go against quite a lot of theory around tax and National Insurance”.

However, there are examples of past governments making up a new tax that is effectively National Insurance in all but name, such as the apprenticeship levy, he said.

Mr Stovold warned that any move to ramp up taxes on landlords further would need to be “very finely balanced” as it could easily backfire on already struggling renters.

He said: “The rental sector has been hammered with various things so far, along the lines of non-deductible mortgage interest. Whenever you increase the tax burden on a landlord, the first thing they think about is how much they can put their rent up by.”

The Resolution Foundation – which until recently was led by Torsten Bell, who is now a Labour MP – rejected the claim that another tax raid on landlords would damage the rental market.

Mr Corlett said rents have soared as a result of high nominal wage growth in recent years, rather than because of landlords passing on costs.

He said: “It’s true that lots of costs have gone up for landlords with the changes to tax relief that have already happened and interest rates going up. But we’re generally sceptical that these things get passed on to renters. That is not how it should work in theory, but it may well mean that the size of a rental sector shrinks and that home ownership rises. But that is a good thing.”

A Treasury spokesman said: “Following the spending audit, the Chancellor has been clear that difficult decisions lie ahead on spending, welfare and tax to fix the foundations of our economy and address the £22bn hole in the public finances left by the last government. Decisions on how to do that will be taken at the Budget in the round.”