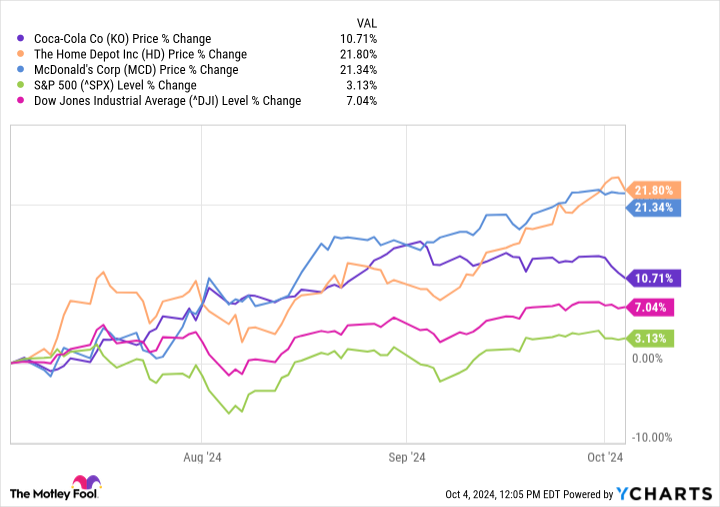

In the beginning of 2024, the broader indexes were being driven higher mostly by mega-cap growth stocks. But the market’s leadership has changed in recent months, with stodgy blue chip dividend and value stocks posting sizable gains.

For example, Nvidia is down 3.1% in the last three months while the S&P 500 is up 3.2% and the Dow Jones Industrial Average has increased 7.1%. Meanwhile, Dow components Coca-Cola (NYSE: KO), Home Depot (NYSE: HD), and McDonald’s (NYSE: MCD) are up even more.

Here’s why these three blue chip dividend stocks could be solid buys in October for folks looking to generate passive income.

Coca-Cola is returning to growth

Coca-Cola is an excellent example of why a stodgy, low-growth company can be a great investment when it exceeds investor exceptions.

Coca-Cola is an established, mature company with a global beverage portfolio. Investors likely gravitate toward buying and holding Coke stock for steady earnings and dividend growth, and because it can deliver results no matter what the economy or the rest of the stock market is doing. For this reason, Coke doesn’t have to provide breakneck double-digit earnings growth to impress investors — it just has to grow its earnings enough to justify reasonable dividend raises while maintaining a solid balance sheet.

Since Coke’s most recent dividend raise was a healthy 5.4% increase and the company is projected to report record earnings this fiscal year, it’s understandable why the stock has been on a tear in recent months.

After its sales nosedived during the pandemic’s height, Coke did an excellent job navigating inflationary pressures. The company’s pricing power has been on full display as it continues to make the most of its growing portfolio of soft drinks, coffee, tea, juice, energy drinks, water, and sparkling water.

The run-up in Coke’s stock price has dropped its yield to 2.7% and pushed its price-to-earnings (P/E) ratio above historical levels. However, Coke is well-positioned to maintain high margins and pass profits to shareholders.

Coke could pull back due to valuation concerns. However, the underlying business is in excellent shape, suggesting Coke is still a good buy for long-term investors looking for reliable dividend stocks.

The worst of Home Depot’s downturn could be nearing an end

Home Depot’s results have been relatively weak in recent years. In the company’s latest report, it lowered its full-year guidance, expecting lower sales and earnings in fiscal 2024 compared to fiscal 2023. Despite the bleak outlook, Home Depot has been one of the hottest stocks in the Dow in recent months, and it just blasted to a new all-time high on Oct. 2.

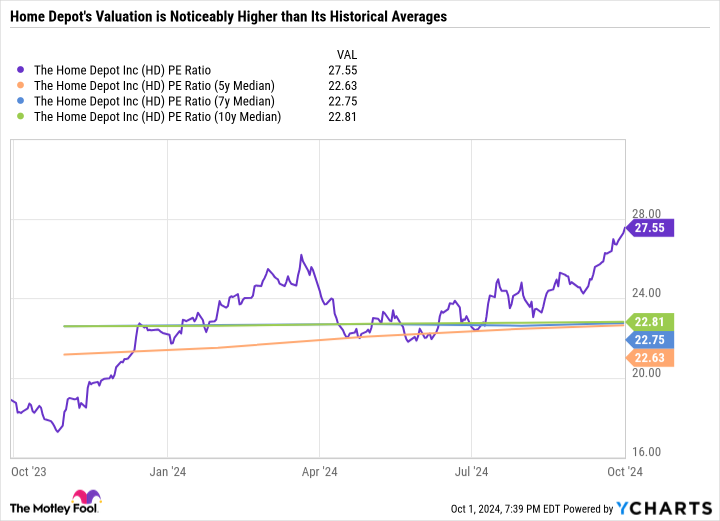

The two biggest factors likely driving Home Depot higher are that it was a cheap blue chip dividend stock in an otherwise expensive market, and that lower interest rates could be a boon for the housing market, and in turn, the home improvement market. As you can see in the following chart, Home Depot’s P/E ratio was right around its five-, seven-, and 10-year median levels, but has since spiked in lockstep with its higher stock price.

Lower mortgage interest rates could spur an uptick in consumer spending, benefiting Home Depot’s forward results. But it’s worth understanding that the run-up in Home Depot stock isn’t based on what the company has done, but rather on what it could do under more favorable economic conditions.

Given the expensive valuation, Home Depot isn’t as compelling a buy anymore. It could still be a good long-term buy-and-hold dividend stock, though.

The company has a proven track record of growing its earnings and dividend at impressive rates and investing through the cycle. Home Depot made a massive $18 billion acquisition earlier this year — one of the largest in its history. It did so with the understanding that the move could take a while to pay off. There aren’t many companies that can make that much of a splash during an industry downturn.

With a 2.2% dividend yield, Home Depot could still be a good buy for investors who like the company’s strategic decisions and believe it could be a coiled spring for a rebound in the housing market.

A healthier consumer would be excellent news for McDonald’s

In July, McDonald’s was knocking on the door of a new 52-week low. Investors grew concerned that the company was losing pricing power and customers were gravitating toward more affordable options. But McDonald’s has roared nearly 20% higher in the last three months, blasting to a new 52-week high.

The move may suggest that McDonald’s has turned the corner. But management isn’t confident about the company’s near-term prospects. People are still being selective with their purchases, and lower interest rates are unlikely to change that behavior overnight.

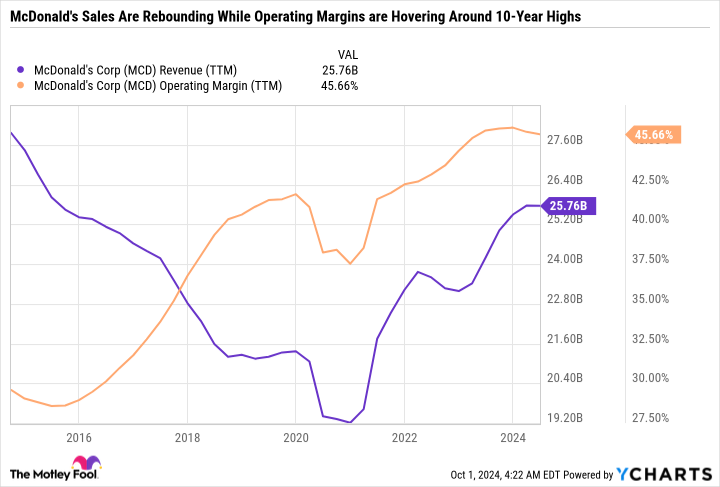

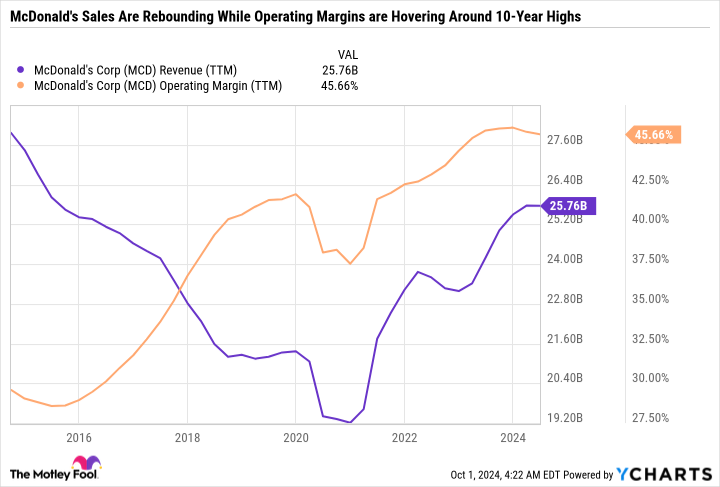

It’s also worth understanding that McDonald’s isn’t a company that should be valued based on traditional metrics like the P/E ratio, because just 5% of stores are company-owned and operated. The franchise business model can result in inconsistent earnings, so it’s better to look at McDonald’s revenue and operating margin over an extended period of time.

As you can see in the chart, McDonald’s sales have rebounded from their pandemic lows, and the company has grown margins, indicating it has plenty of room to lower prices if needed, or extend promotions like its $5 meal deal.

With McDonald’s, it seems that investors are taking an ultra-long-term view on the stock and looking at where the company will be at least a year from now, rather than where it is today.

Another catalyst that could be driving the stock’s move higher is China. China recently announced a stimulus package aimed at driving economic growth and boosting consumer spending. Given its presence in the country, a potentially stronger Chinese economy is great news for McDonald’s.

McDonald’s isn’t the screaming buy it was a few months ago, but it still stands out as a worthwhile dividend stock to buy now. McDonald’s recently raised its dividend by 6% to $1.77 per quarter, or $7.08 per year — representing a forward yield of 2.3%. That’s not a bad passive income source, when you consider that the S&P 500 yields just 1.3%.

3 reasonable buys for long-term investors

Coca-Cola, Home Depot, and McDonald’s are three phenomenal businesses that were bargains but have undergone significant run-ups in their stock prices in a relatively short period. Any time a stock makes a big move based on expectations, it pressures the company to deliver or face a pullback in its stock price.

While all three companies aren’t as good a deal as they were earlier in the year, they aren’t necessarily overpriced for investors looking for blue chip dividend stocks. In fact, they are the exact kind of companies investors can count on to persevere through a recession.

If you’re willing to invest in quality, it might be wise to closely evaluate all three stocks, keeping in mind that the current rally could cool off soon.

Should you invest $1,000 in Coca-Cola right now?

Before you buy stock in Coca-Cola, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Coca-Cola wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Home Depot and Nvidia. The Motley Fool has a disclosure policy.

Coca-Cola and These 2 Red-Hot Dow Dividend Stocks Are Up 10% to 22% in 3 Months, and They Could Still Be Worth Buying in October was originally published by The Motley Fool