There’s no way to dispute the dominance of Realty Income (NYSE: O) as a net lease real estate investment trust (REIT). It is roughly four times larger than its next closet rival, W.P. Carey (NYSE: WPC). The interplay between these two REITs, however, is kind of interesting. Right now, W.P. Carey is trying to look more like its larger competitor, but that wasn’t always the case.

What does Realty Income do?

Realty Income owns single-tenant properties for which the occupants are responsible for most property-level operating costs. This is what’s known as a net lease.

Although any single property is high risk, given there’s just one tenant, across a large-enough portfolio the risk of this investment approach is fairly low. Realty Income is the leading net lease REIT, with a market cap of roughly $54 billion and a portfolio that contains more than 15,400 properties.

There are a lot of different property types that can use the net lease approach. Realty Income’s primary focus is on retail assets, which make up about 73% of its rents. The rest is split between non-retail, which is largely industrial, at 17% of rents, and a sizable “other” category, which accounts for the rest. In addition to this diversification within the portfolio, Realty Income also has properties in Europe, which make up 13.5% of rents (spread across property types).

Realty Income benefits from its scale because it provides the investment-grade-rated access to capital markets (on both the debt and equity sides). It also benefits from its diversification, because it has multiple avenues for growth across property type and geography.

Although being so large suggests that future growth will be slow and steady, that’s perfectly fine for Realty Income. The REIT has increased its dividend annually for 29 years at a clip of about 4.3% a year. With a roughly 5% dividend yield today, conservative income investors should probably find it reasonably attractive.

What does W.P. Carey Do?

With a market cap of just under $14 billion and a portfolio of roughly 1,300 properties, W.P. Carey is the second-largest net lease REIT. It is roughly a quarter the size of Realty Income. The REIT’s dividend yield is 5.5%, which is a step up from Realty Income and might interest some yield-focused investors.

Here’s the interesting thing: At one point, Realty Income was trying to look like W.P. Carey. For more than two decades, W.P. Carey has invested in Europe, a region where the net lease model is still fairly new. It wasn’t until a few years ago that Realty Income expanded across the pond, effectively looking to capitalize on a market that W.P. Carey had basically helped to develop.

At that point, Realty Income was mimicking W.P. Carey as the larger REIT looked for more ways to grow. But then Realty Income did something different: It spun off its office properties so it could exit a sector that offered less potential. That’s exactly what W.P. Carey recently did.

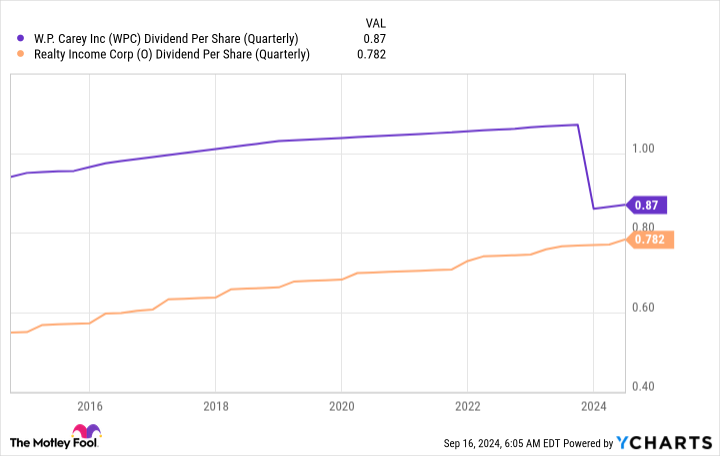

But W.P. Carey didn’t pull off the move in the same way. Realty Income didn’t skip a beat on the dividend front, while W.P. Carey ended up cutting its dividend after the exiting the office sector. Investors were upset. Now W.P. Carey’s portfolio is broken down as 64% industrial, 21% retail, and 15% “other.” Europe accounts for about 35% of the rent roll.

In some ways, the two portfolios are opposites in terms of retail versus industrial exposure, but W.P. Carey has been looking to increase retail of late. So after Realty Income tried to look like W.P. Carey by entering Europe, it now seems W.P. Carey is trying to look like Realty Income by expanding in retail.

Can W.P. Carey be the next Realty Income?

For income investors looking at W.P. Carey’s higher yield, the question here is whether it is worth the risk after the dividend cut. It probably is because the company started raising the dividend again the very next quarter after the cut. That gets the dividend back on its normal cadence of quarterly increases. The dividend cut is probably better thought of as a dividend reset.

That said, W.P. Carey will probably always be heavy on the industrial sector, and it may never catch up to Realty Income in terms of size because the industry giant continues to grow. But the path forward is clearly up, and because of the office exit W.P. Carey has a record level of liquidity that it plans to invest in new properties. And as long as the dividend continues to grow every year, W.P. Carey could be a great compliment to Realty Income or, frankly, a good stand-alone investment. Chasing an industry giant, even if you don’t catch it, can lead to strong shareholder returns.

Should you invest $1,000 in W.P. Carey right now?

Before you buy stock in W.P. Carey, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and W.P. Carey wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Reuben Gregg Brewer has positions in Realty Income and W.P. Carey. The Motley Fool has positions in and recommends Realty Income. The Motley Fool has a disclosure policy.

Could W.P. Carey Become the Next Realty Income? was originally published by The Motley Fool