A lot of eyes were on CrowdStrike (NASDAQ: CRWD) when the cybersecurity company reported its fiscal second-quarter results, as investors looked to get a better sense of what the fallout would be from its well-covered outage this summer.

Despite losing more than a quarter of its value since the beginning of July, the stock has nearly doubled over the past year.

Let’s take a closer look at the company’s most recent results and whether the worst appears to be behind the stock.

Lowered guidance

With the outage coming late in the quarter, the incident had little impact on CrowdStrike’s financial results. For the second quarter, the company grew its revenue 32% to $963.9 million. That was ahead of its earlier forecast for revenue of between $958.3 million to $961.2 million. Subscription revenue jumped 33% to $918.3 million.

Its annual recurring revenue (ARR), which is the annualized value of its customer subscription contracts, increased 32% to $3.86 billion. Net new ARR in the quarter was $217.6 million.

The company’s adjusted earnings per share (EPS) jumped from $0.74 a year ago to $1.04. Its prior guidance was for adjusted EPS of between $0.98 to $0.99.

It generated operating cash flow of $326.6 million, while free cash flow was $272.2 million. The company ended the quarter with about $3 billion in net cash and short-term investments.

Among its modules seeing strong growth were cloud security, up more than 80% to an ARR of more than $515 million; Identity Security, up over 70% to an ARR of over $350 million; and LogScale Next-Gen SIEM, which saw its ARR surge more than 140% to over $220 million.

More than 65% of CrowdStrike’s customers have five or more modules, while 29% have seven or more. Meanwhile, the number of deals with eight or more modules jumped by 48%.

Looking ahead, CrowdStrike forecasts Q3 revenue between $979.2 million and $984.7 million, with adjusted EPS between $0.80 and $0.81.

The company’s management lowered its fiscal year guidance, as displayed in the table below.

|

Full Fiscal Year Metrics |

||

|---|---|---|

|

Revenue |

$3.98 billion to $4.01 billion |

$3.89 billion to $3.90 billion |

|

Adjusted EPS |

$3.93 to $4.03 |

$3.61 to $3.65 |

Table by Author. Data Source: CrowdStrike filings.

CrowdStrike said the outage toward the end of its quarter caused many deals to be delayed, as it typically closes deals in the last two weeks of the quarter. However, it added that the “vast majority” were still in its pipeline. The company highlighted two large post-outage wins but said it has more than $60 million in deals that it has a line of sight on in the quarter that remain open. It expects them to close in future quarters.

However, the company expects to see extended sales cycles and more deal scrutiny moving forward. It is also looking to get customers to commit to its Falcon platform for longer periods of time, which it thinks will lead to less upselling in the near term and some higher levels of contraction. It thinks this will impact ARR and subscription revenue by about $60 million. It will also shift some planned sales and marketing expenses to R&D, quality assurance, and customer support.

Overall, it is looking for these headwinds to last about a year.

Is it time to buy the dip?

Before the outage, CrowdStrike was widely considered to be the best of breed in cybersecurity, but with the outage, its reputation has taken a hit. Not surprisingly, potential customers are taking more time to decide whether to adopt the company’s platform, while current customers are putting more thought into adding modules.

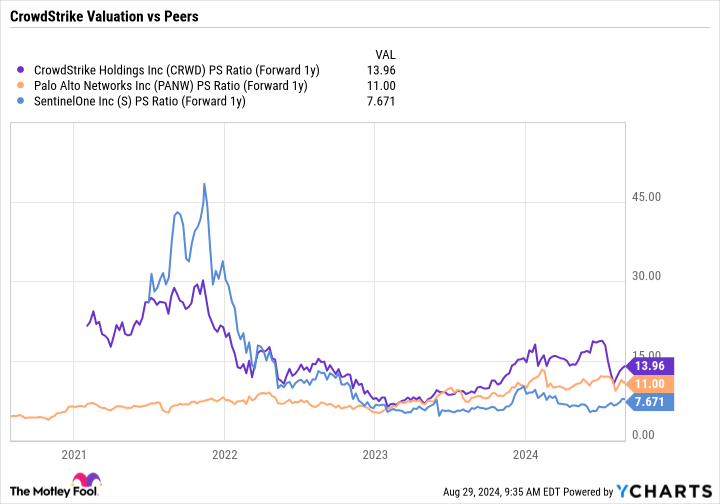

Overall, the fallout from the outage appears manageable, and the lasting impact should fade if there are no more incidents. That said, the stock still trades at a pretty large premium to the cybersecurity group with a forward price-to-sales (P/S) multiple of about 14 times next year’s analyst estimates. Those estimates also likely haven’t been fully adjusted lower to take into consideration its latest guidance.

Thus, while the stock and its valuation multiples are much lower than a few months ago, the stock is by no means cheap. In the longer term, CrowdStrike’s story likely doesn’t change much because of this hiccup, and the worst could indeed be over for the stock. However, investors do need to weigh the stock’s valuation against its long-term prospects, and that appears to be in balance at the moment.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $20,104!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,321!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $378,232!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of August 26, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CrowdStrike and Palo Alto Networks. The Motley Fool has a disclosure policy.

CrowdStrike Lowers Guidance Due to Outage Impact. Is The Worst Over for the Stock? was originally published by The Motley Fool