Advanced Micro Devices (NASDAQ: AMD) has a potent role in tech, supplying its chips to companies across the industry. Its hardware powers everything, from video game consoles to cloud platforms, consumer-built personal computers, laptops, and AI models. As a result, AMD formed lucrative partnerships with companies like Microsoft (NASDAQ: MSFT), Sony, and Meta Platforms.

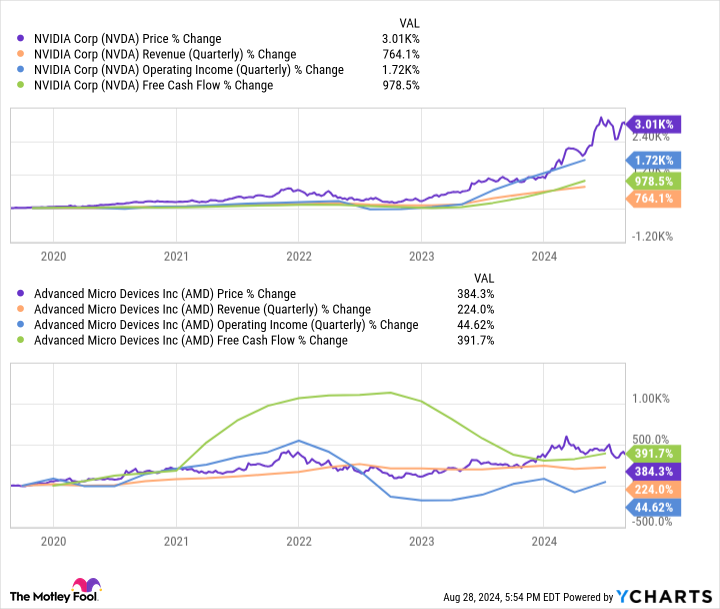

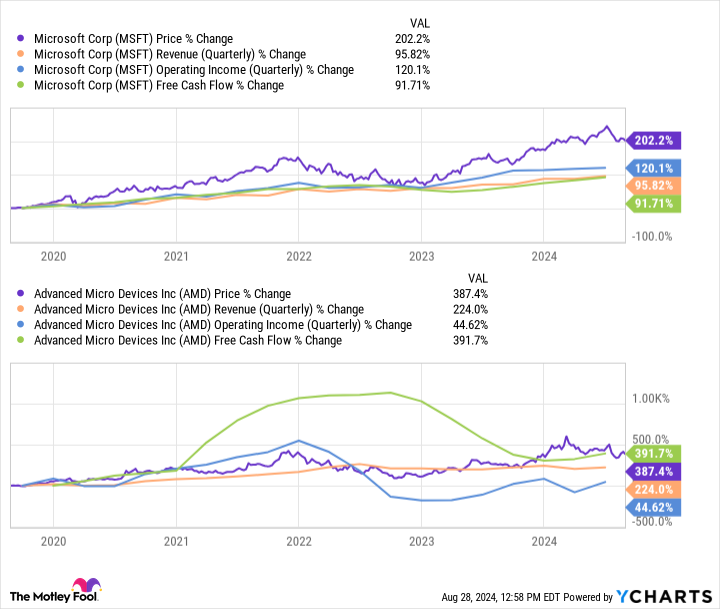

AMD’s success over the years saw its revenue and operating income increase by 224% and 45%, relatively, since 2019. Meanwhile, its stock climbed by 384% in the last five years. The company boasts a long growth history and has a solid outlook as it expands into high-growth sectors like AI.

However, a rally over the last year and a business that has only recently begun seeing returns on its significant investment in AI means its stock isn’t exactly a bargain.

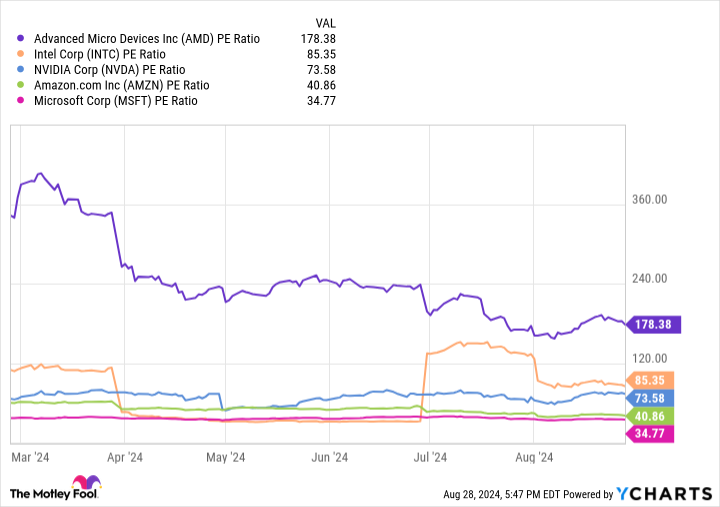

When you consider the price-to-earnings (P/E) ratios of some of the most prominent names in AI, including three chipmakers and two leading cloud providers, AMD has the highest P/E among these companies, indicating its stock offers the least value.

AMD’s P/E might prove inconsequential over the long term, as the company’s stock will likely continue rising as the tech industry expands. However, for anyone looking for bargains, it might be best to avoid AMD for now.

So, forget AMD this month and consider buying these two tech stocks instead.

1. Nvidia

Nvidia (NASDAQ: NVDA) isn’t a screaming value with a P/E of 74. However, its stock remains a compelling option with a lower P/E than its rivals, AMD and Intel, and a majority market share in AI.

Chip stocks are one of the best ways to invest in tech, with their hardware crucial to the industry’s development. Advances in chip technology bolstered countless markets over the last decade, encouraging innovation in cloud computing, virtual/augmented reality, data centers, consumer tech, gaming, and more. As a result, chip demand has skyrocketed in recent years.

As leading chipmakers, Nvidia and AMD enjoyed solid gains over the last half-decade thanks to increased chip sales. While both companies have delivered stellar growth, it’s hard to ignore how much higher Nvidia’s earnings and share price have risen compared to AMD’s. Nvidia’s has also proven to be more reliable, with its earnings and stock steadily trending up, while AMD experienced more volatility.

Nvidia’s success is mainly due to its dominance in graphics processing units (GPUs), which are high-performance chips capable of completing multiple tasks simultaneously. GPUs are critical for training AI models and powering data centers. Consequently, the AI chip market is projected to hit $71 billion this year, with Nvidia’s hardware accounting for an estimated 90% of the industry.

Nvidia has a solid role in tech, and its business will likely continue expanding as demand for its chips rises. This year, the company reached $39 billion in free cash flow, significantly outperforming AMD’s just over $1 billion. Nvidia has the financial resources to continue investing in AI and maintain its lead. Meanwhile, its better-valued stock makes it a no-brainer right now.

2. Microsoft

When investing in tech, it’s a good idea to diversify your holdings in software and hardware. While Nvidia is an excellent option for securing a position in the hardware side of the industry, Microsoft has years of experience dominating software. Home-grown products like Windows, Office, Xbox, Azure, and LinkedIn have helped the company build a massive user base and a powerful role in tech.

Since 2019, Microsoft delivered less earnings and share price growth than AMD. However, like Nvidia, Microsoft has been far more consistent, making it a less risky investment. As a result, the company’s stock is potentially a better long-term hold.

Microsoft’s reliability is mainly due to its thoroughly diverse business model. The company has leading positions in multiple tech areas, from productivity software to operating systems, video games, social media, cloud computing, and digital advertising.

Moreover, Microsoft is never still for long, consistently reinvesting in its business and seeking out new growth markets. The company’s commitment to innovation saw it become an early investor in AI, sinking $1 billion into ChatGPT developer OpenAI in 2019. That figure has since risen to about $13 billion, with the powerful partnership giving Microsoft access to some of the most advanced AI software.

Meanwhile, Microsoft has already begun seeing earnings boosts from AI, thanks to recently launched AI solutions on its cloud platform, Azure, and paid-for features in Office. In fiscal 2024 (ending in June), Microsoft’s revenue increased by 16% year over year, while operating income soared 24%. The period benefited from a 20% rise in cloud sales and a 12% increase in its productivity and business processes segment, with both divisions expanding their AI offerings.

Microsoft’s diverse business provides it with countless ways to monetize its AI venture. Alongside $74 billion in free cash flow and a better-valued stock, it’s worth picking up Microsoft over AMD this August.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $720,542!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Forget AMD: 2 Tech Stocks to Buy Instead was originally published by The Motley Fool