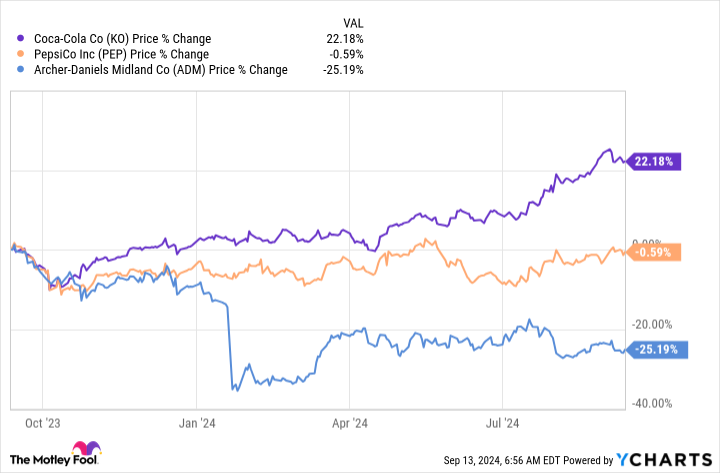

Coca-Cola (NYSE: KO) is a great company, but the stock has risen more than 20% over the past 12 months. Some investors might see that quick rise and pass the stock by, looking for cheaper alternatives. That’s understandable, but what stocks should you be looking at if you have chosen to forget about Coca-Cola?

How about PepsiCo (NASDAQ: PEP) or Archer-Daniels-Midland (NYSE: ADM)? Here’s why both of these stocks might be good choices for investors now.

What’s so special about Coca-Cola?

Coca-Cola has some very loyal fans on Wall Street, including Berkshire Hathaway CEO Warren Buffett. Buffett has owned the stock for decades, and for good reason. Coca-Cola owns one of the best-known brands in the world. It is a strong marketer, has a robust distribution network, and has the size and scale to buy upstart competitors to expand its own portfolio.

One big proof point of the company’s success is its status as a Dividend King, with over six decades of annual dividend increases behind it. You don’t become a Dividend King by accident. It takes strong performance in both good times and bad to achieve that elite status.

That said, Coca-Cola has been doing pretty well of late, too. Revenue has grown around 7.5% a year, annualized, over the past five years. Annualized earnings growth over that span was a bit over 10%. So there are good reasons why investors like the stock today. So the 20% stock price advance over the past 12 months isn’t exactly shocking.

Still, at this point, Coca-Cola looks a little on the expensive side, with its price-to-sales (P/S) and price-to-earnings (P/E) ratios both slightly above their five-year averages. If you don’t mind paying full fare, or perhaps a little bit more, for a great company, Coca-Cola would be a perfectly fine stock to own. But if you have a value bias, you’ll probably want to look elsewhere.

PepsiCo is similar to Coca-Cola in many ways

If you know the Coke brand, you almost certainly know the Pepsi brand, too. It plays second fiddle to Coke in the soda space, but don’t take that as a sign that PepsiCo is a bad company. Far from it. Not only is it a strong No. 2 player in the beverage space, but it is No. 1 in salty snacks with its Frito-Lay division. PepsiCo also makes packaged food items in its Quaker Oats business. If you are a fan of business diversification, you’ll probably like PepsiCo more than Coca-Cola!

Perhaps it doesn’t need to be said, but PepsiCo is every bit as strong as Coca-Cola on the distribution, marketing, and business scale fronts. Like Coca-Cola, PepsiCo is a valued partner to retailers around the world. And, like Coca-Cola, PepsiCo is a highly elite Dividend King.

What PepsiCo isn’t doing right now, however, is performing as well financially. Its earnings are actually lower over the past five years. Investors have reacted by avoiding PepsiCo stock, which is basically flat over the past 12 months. But that’s opening up an opportunity for long-term income investors.

PepsiCo’s dividend yield is 3% compared to Coca-Cola’s 2.7%. And PepsiCo’s P/S and P/E ratios are both below their five-year averages. In other words, it’s a similarly strong company, but it’s cheaper today because it isn’t hitting on all cylinders.

But given the long-term success the company has achieved, highlighted by over 50 years of annual dividend increases, it seems highly likely that PepsiCo will muddle through this rough patch in stride — and pay you well to wait while it figures out how to get back on track.

Archer-Daniels-Midland is almost a Dividend King

Archer-Daniels-Midland’s dividend yield is 3.3%, better than Coca-Cola’s and PepsiCo’s.While it isn’t a Dividend King just yet, it is right on the cusp with 49 annual dividend increases under its belt. That said, Archer-Daniels-Midland is a very different kind of consumer staples company. Unlike Coca-Cola and PepsiCo, Archer-Daniels-Midland is a supplier to other companies that make food products, selling things like oilseeds, corn, and wheat.

The stock has fallen around 25% over the past year. Financial results of late have been pretty rough since the top and bottom lines are both in a downtrend. To be fair, however, commodities are a big part of the business, so revenue and earnings can be a little volatile here. This weak patch really isn’t all that shocking after the inflation spike not too long ago.

Still, investors are reacting and, if you are a long-term dividend investor, you might want to step aboard while others are fearful. Archer-Daniels-Midlands’ P/S and P/E ratios are both below their five-year averages.

The key here is that, given the long history of annual dividend increases, Archer-Daniels-Midland clearly knows how to survive through commodity cycles while continuing to pay investors well. If you can stomach a little near-term uncertainty, this stock offers a much more attractive dividend yield than Coca-Cola.

Watch Coca-Cola, but consider buying PepsiCo and Archer-Daniels-Midland

There’s nothing wrong with Coca-Cola as a business. The problem is simply that the stock is a bit expensive today. If you aren’t willing to pay up for a great company, then you should consider two similarly strong dividend stocks in PepsiCo and Archer-Daniels-Midland.

Neither is performing as well as Coca-Cola is today, financially speaking, but their strong dividend histories suggest that they will figure out how to get their businesses back on track eventually. You’ll be paid well to wait while they do that.

Should you invest $1,000 in PepsiCo right now?

Before you buy stock in PepsiCo, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and PepsiCo wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $708,348!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

Forget Coca-Cola: These Unstoppable Dividend Stocks Are Better Buys was originally published by The Motley Fool